Canadian Dollar Unlikely to Hold "Petro Currency" Status Gains

- Written by: Gary Howes

Image © Adobe Stock

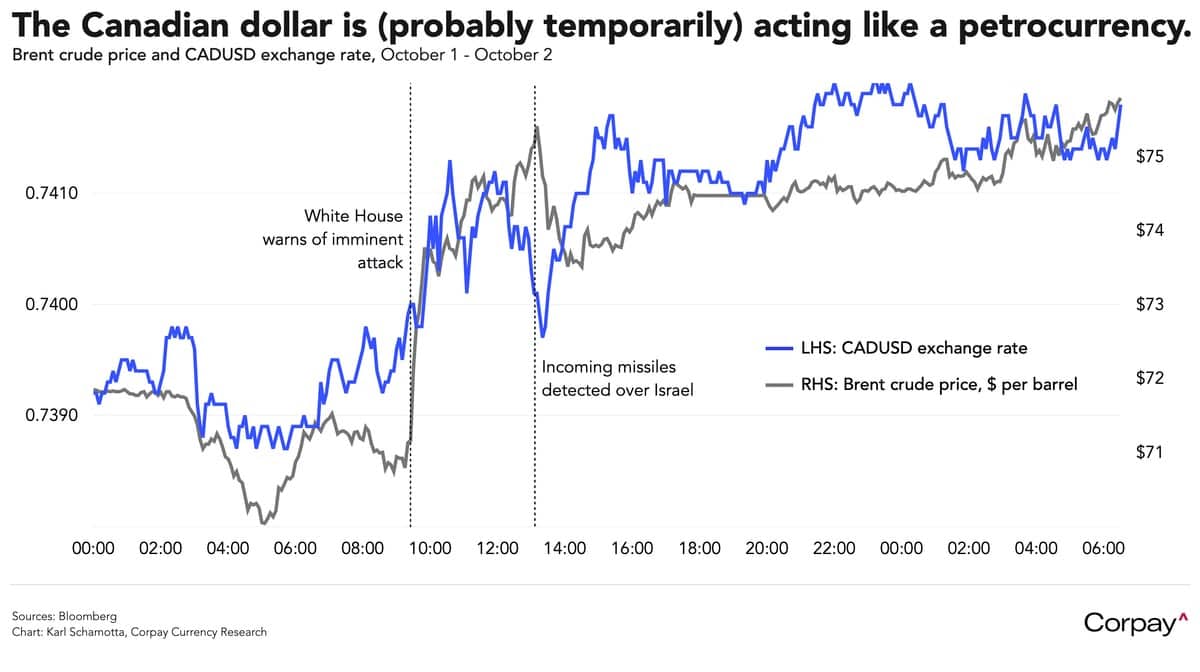

"The Canadian dollar is acting like a petrocurrency once again, but we don’t think this will last," says Karl Schamotta, Chief Market Strategist at Corpay.

The call comes amidst a rally in the value of the Canadian Dollar that is linked to rising oil prices that follow a significant escalation in the war between Israel and Iran (directly, and via the Iranian proxies of Hizbollah and Hamas).

CAD upside reflects a view amongst traders that Canada has strong linkages to oil owing to it's significant oil sector. However, the linkages have weakened over recent years, and CAD's status as a petro currency has faded.

But it appears to be tracking oil again and is being described as a petro currency once more in the wake of recent events.

"The Canadian dollar is acting like a petrocurrency once again, but we don’t think this will last," says Schamotta.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

Schamotta explains CAD price action in response to oil's rise fits a long-standing pattern in which oil price shocks are translated into currency market reactions through a muscle-memory process on trading floors, but doesn’t reflect a changed fundamental backdrop.

"The U.S. is itself now a major energy producer, meaning that the greenback no longer exhibits a negative correlation with oil prices, the Canadian energy sector is no longer the recipient of massive inward investment, and Canada’s economic fundamentals remain consistent with a monetary easing trajectory that matches - and even exceeds - the Federal Reserve's," says Schamotta.

"Gravity might soon reassert itself," he warns.

The Canadian Dollar has also acted as a proxy for the U.S. Dollar for much of 2024, forming a 'North American bloc' with its southern neighbour.

That the two are moving in tandem can be explained by the tight fiscal and economic ties that underpin CAD and USD, and a belief amongst markets that central bank policy will be closely aligned as a result.

The Dollar has rallied amidst the recent geopolitical upheaval, as we would expect this 'safe haven' currency to do.

It could simply be that CAD is hitching a ride on the USD's coattails and is not seeing its petrocurrency status restored.