Canadian Dollar in Play as Israel Threatens Iranian Oil

- Written by: Gary Howes

Image © Adobe Stock

The Canadian Dollar could strengthen if the conflict in the Middle East intensifies.

Israel could hit Iran's oil infrastructure in retaliation to Iran's overnight ballistic missile attack.

Such a development would send crude oil prices significantly higher and bolster oil-linked assets such as CAD.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Israeli officials told Axios they were considering a "significant retaliation" to Tuesday's massive missile attack within days that could target oil production facilities inside Iran and other strategic sites.

Oil prices pushed higher, with Brent crude tipping back above $75 a barrel amid concerns the fighting would disrupt supplies.

"The rapid escalation in Middle East tensions sent oil higher and high-beta currencies lower against USD and CAD," says Francesco Pesole, FX Strategist at ING Bank.

CAD has already shown itself to be a beneficiary of the sharp market reaction to Tuesday's reports that Iran was preparing to fire a salvo of ballistic missiles and drones on Israel.

📈 Q2 Investment Bank Forecasts for GBP vs. CAD. See the Median, Highest and Lowest Targets for the Coming Months. Request your copy now.

The reports were correct, and Iran fired up to 200 missiles on Tuesday night, sending oil prices and the Dollar higher as investors feared they were witnessing a notable escalation in the Middle East.

The Canadian Dollar is not often considered a traditional 'safe-haven' to geopolitical tensions, but we do note that it has tended to track the fortunes of its North American cousin against the Pound, Euro and others in 2024.

For instance, the Pound to Canadian Dollar (GBP/CAD) is at its highest level since 2018, with bouts of strength tracking GBP/USD strength. The Dollar's safe-haven bid on rising geopolitical tensions could, therefore, be acting to bolster CAD and reverse recent gains.

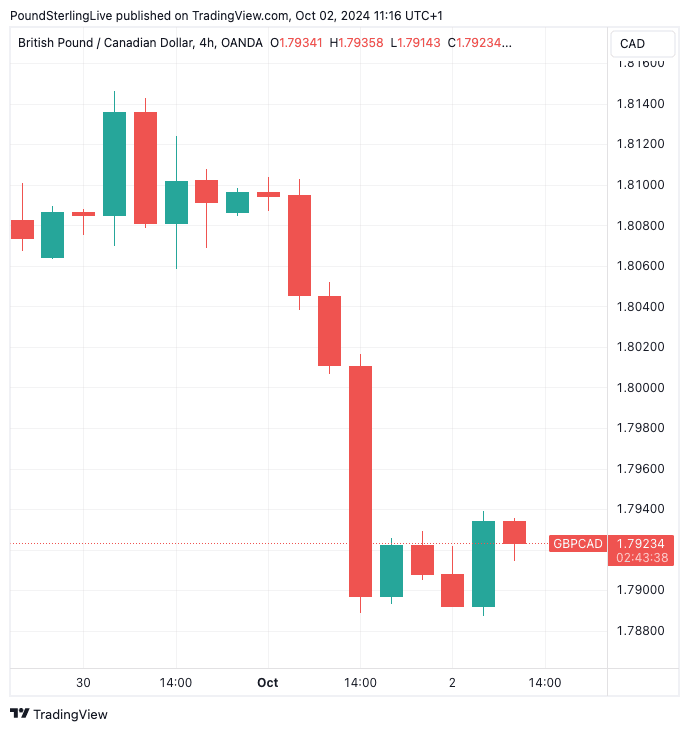

Above: GBP/CAD at four-hour intervals.

ING's Pesole says oil prices are also playing a direct role in driving CAD demand.

"The dollar strengthened on the back of rising geopolitical tensions, with the Canadian dollar also rallying thanks to the oil price jump and a rotation away from more geographically exposed or simply higher-beta currencies like SEK and NZD," he explains.

Escalation in the Middle East conflict could, therefore, open a window to a period of short-term oil price strength and CAD outperformance.

Looking ahead, there are two possible ways forward from here:

1) Markets reverse losses and the Dollar relinquishes gains as Middle East tensions have tended to have little lasting market impact.

"Iran's missile strike on Israel increased safe-haven demand, boosting the USD and pushing oil and gold prices higher. The move faded somewhat towards the end of the session as reported damages were seemingly limited," says Jesper Fjärstedt, Senior Analyst for FX Strategy at Danske Bank.

2) This time is different as this is a sizeable direct attack by Iran on a key ally of the U.S.

Escalation risks are elevated with Jake Sullivan, the White House national security adviser, saying: "We have made clear that there will be consequences, severe consequences, for this attack, and we will work with Israel to make that the case."

Benjamin Netanyahu, Israel's prime minister, has indicated Israel will strike back against Iran.

"Iran made a big mistake tonight and will pay for it. Whoever attacks us, we attack them,” he said as he gathered his security cabinet for a meeting late Tuesday.

With tensions set to remain high over the coming days, the CAD could find itself better supported.