Pound to Canadian Dollar Forecast for the Week Ahead: Onwards

- Written by: Gary Howes

Image © Adobe Images

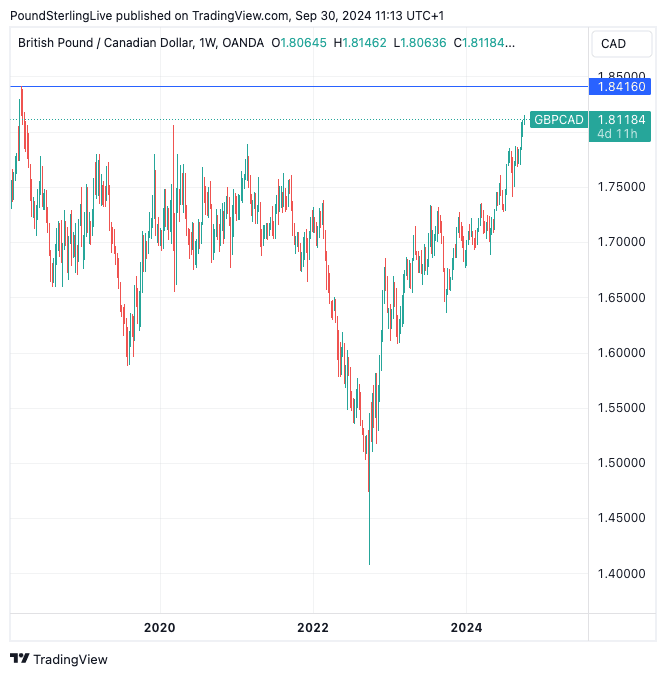

The Pound continues its march higher against the Canadian Dollar and our Week Ahead Forecast model won't fight the trend.

The Pound to Canadian Dollar exchange rate (GBP/CAD) trades at its highest level in seven years at 1.8119 on Monday morning, underpinned by ongoing weakness in the North American currency bloc.

The GBP/CAD rally now targets the March 2018 high at 1.8416; above here the market returns to pre-Brexit trading levels.

Technical indicators are all in the green and we are looking at strong daily and weekly momentum on the charts that leave us with little by way of contrarian indicators that would suggest it is time to fade the rally.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

The coming week is devoid of domestic data releases in either Canada or the UK that could potentially spoil Sterling's ascent.

When pullbacks emerge in the coming days we would view then as being of a limited timeframe that will ultimately be bought into ahead of the next leg higher.

The CAD would potentially find some support if the U.S. Dollar rebounds later in the week, owing to the CAD's penchant for tracking its North American neighbour.

The running assumption is the Federal Reserve has entered a period of consecutive interest rate cuts, that will bolster investor sentiment, boost equity markets and weigh on the U.S. Dollar.

With the Fed entering an interest rate cutting cycle, the market feels the Bank of Canada can now step up the pace of its own cuts, given the Canadian economy has slowed down markedly.

The clear risk to this assumption is that Fed rate cut expectations take a hit in the wake of stronger-than-expected data and signalling from members of the Fed's Open Market Committee (FOMC).

📈 Q2 Investment Bank Forecasts for GBP vs. CAD. See the Median, Highest and Lowest Targets for the Coming Months. Request your copy now.

Analysts at Crédit Agricole think the market is too aggressively priced for Fed rate cuts. Re-pricing would likely weigh on GBP more than it would on the CAD, sending GBP/CAD lower.

U.S. PMI manufacturing survey data is due on Tuesday, as are speeches from FOMC members Cook, Collins, Barkin and Bostic. Bowman and Barkin speak on Wednesday, making this a significant week for direct messaging from the Fed.

There are more U.S. PMI figures incoming on Thursday, this time covering the services sector, which will keep markets entertained ahead of the week's highlight, which is Friday's non-farm payroll release.

Here, a headline of 144k is expected. The rule of thumb is that anything slightly below would signal the need for more cuts at the Fed and keep the mood music supportive of global risk and the Pound.

But any big downside miss could also backfire as it would suggest maybe the economy is slipping into recession.

If the figures give a significant upside surprise, markets will almost certainly fall as investors race to bet the Federal Reserve will slow down the pace of cuts.