Dollar Stays Bid as U.S. & Israel Threaten Iran with "Severe Consequences"

- Written by: Gary Howes

UK Foreign Secretary David Lammy says a regional war in the Middle East would have significant implications for the global economy. File image by Ben Dance / FCDO.

Safe haven demand for the Dollar spiked after Iran launched a ballistic missile attack on Israel and the U.S. promised "severe consequences" for the attack.

Demand for gold, oil and dollars rose on news reports that the U.S. had warned Israel late on Tuesday that Iran was preparing to carry out a ballistic missile attack on Israel.

The security intelligence was correct, and between 180 and 200 Iranian missiles were fired overnight, with Israel committing to exact revenge on Iran as a consequence.

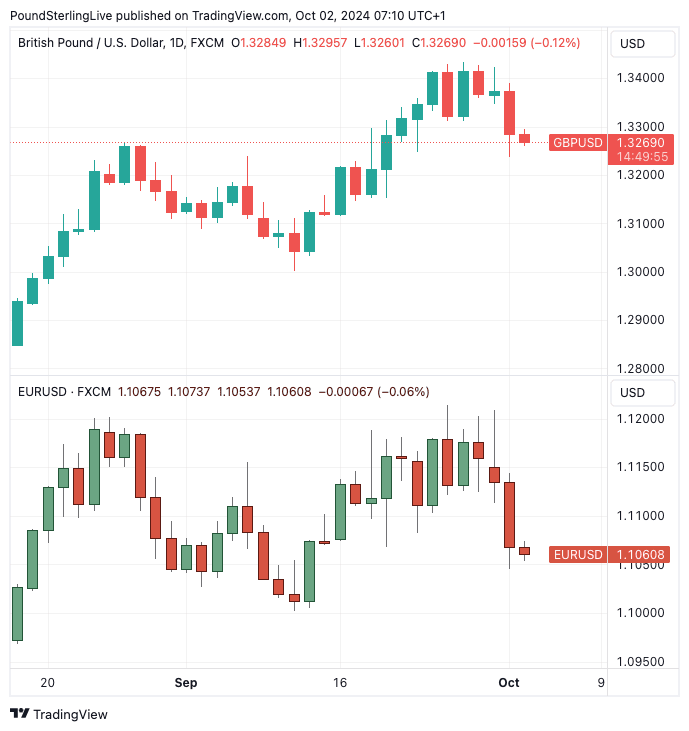

Global equity markets fell amidst heightened investor nerves. In FX, the Pound to Dollar exchange rate registered a 0.66% decline on Tuesday to reach 1.3284. The Euro to Dollar pair fell 0.6% to close at 1.1067.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Dollar strength extends into the midweek session, however, the scale of the selling has eased at the time of writing Wednesday.

For markets, there are two possibilities to consider:

1) Markets reverse losses and the Dollar relinquishes gains as Middle East tensions have tended to have little lasting market impact. "Iran's missile strike on Israel increased safe-haven demand, boosting the USD and pushing oil and gold prices higher. The move faded somewhat towards the end of the session as reported damages were seemingly limited," says Jesper Fjärstedt, Senior Analyst for FX Strategy at Danske Bank.

2) This time is different as this is a sizeable direct attack by Iran on a key ally of the U.S.

Under scenario two, the Dollar can extend its recent recovery.

Above: GBP/USD (top) and EUR/USD at daily intervals.

U.S. authorities said the Iranian missile barrage was intended to cause harm and involved twice as many ballistic missiles as a previous attack on Israel conducted in April.

Escalation risks are elevated with Jake Sullivan, the White House national security adviser, saying: "We have made clear that there will be consequences, severe consequences, for this attack, and we will work with Israel to make that the case."

The underlying fear is that the conflict between Iran and Israel will evolve and impact global trade. "None of us want to see a regional war, the price would be huge for the Middle East and it would have a significant effect on the global economy," said David Lammy, the UK's Foreign Secretary.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Benjamin Netanyahu, Israel's prime minister, has indicated Israel will strike back against Iran.

"Iran made a big mistake tonight and will pay for it. Whoever attacks us, we attack them,” he said as he gathered his security cabinet for a meeting late Tuesday.

Escalation in the Middle East follows a series of targeted strikes by Israel on Iranian proxy, Hizbollah, culminating in a ground invasion of southern Lebanon on Monday.

Israel has dealt a significant blow to the Iranian militia, killing Hizbollah's leader and other senior leaders in a series of airstrikes conducted last week.

Dollar Rebound

Ahead of the latest Middle East escalation, the Dollar was already well bid, responding to Federal Reserve Chair Jerome Powell's latest guidance on interest rates.

Powell indicated on Monday that the Fed expects to implement two more interest rate cuts by the end of 2024, which is less than the market is currently expecting.

The guidance helped U.S. Treasury yields and the Dollar higher, which is a typical market reaction to any fading of rate cut expectations.

"The US dollar reacted positively to Powell’s comments, gaining ground across the board," says Achilleas Georgolopoulos, Investment Analyst at XM.com.

Ahead of Powell, the market was priced for up to 70 basis points of rate cuts over the remainder of the year, which would entail at least one more 50bp cut and another 25bp move.

However, this new guidance from the Chair would suggest markets would be better positioned expecting two further 25bp moves.

"Powell explicitly pushed back against a 50bp rate cut by year-end," says Francesco Pesole, FX strategist at ING.