Pound to Dollar Rate Eyeing 1.25 Next Says City Index

- Written by: Fawad Razaqzada, analyst at City Index

Image © Adobe Images

City Index analyst Fawad Razaqzada says a drop to $1.25 looks increasingly likely for the Pound to Dollar exchange rate (GBP/USD).

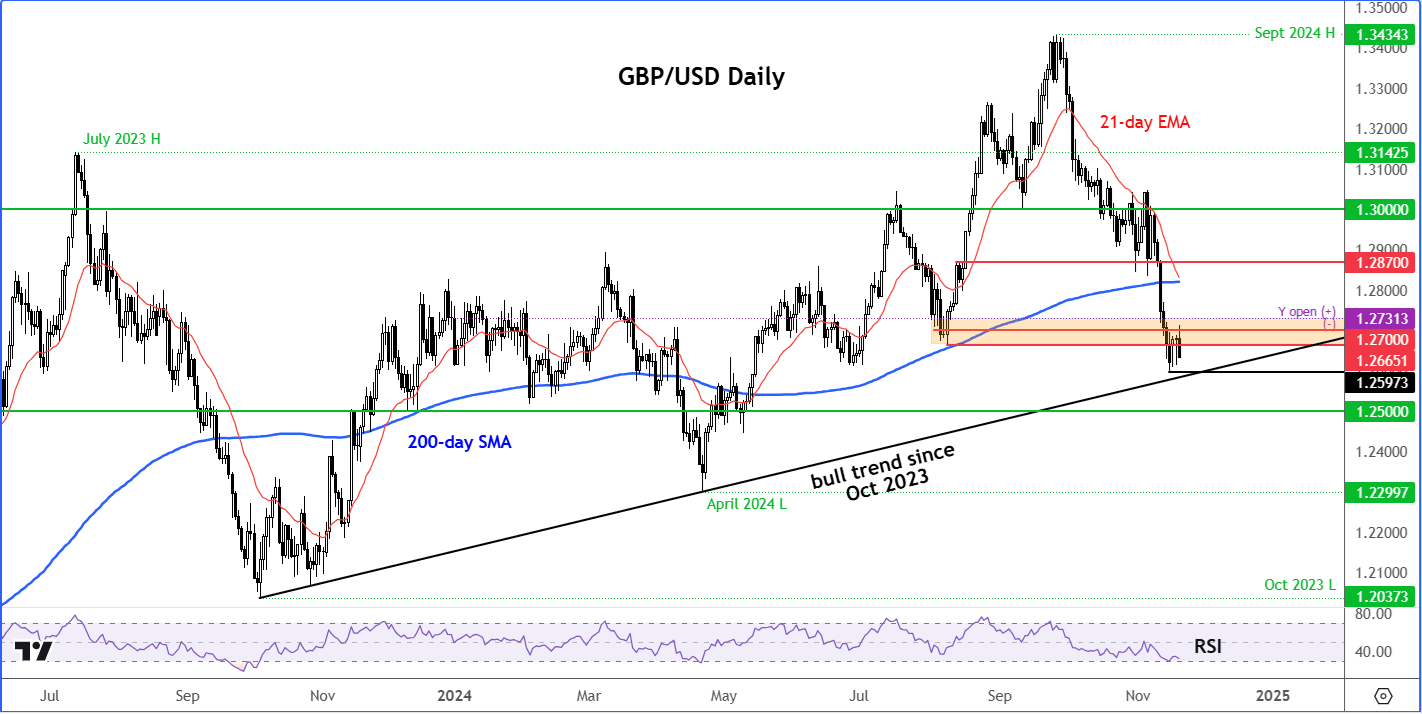

At the time of writing, the GBP/USD forecast from a technical perspective looked bearish, given the shape of the candle that it was printing on its daily time frame.

Resistance between 1.2665 to 1.2731 was tested and held firm. A break above this zone is needed to tip the balance in the bulls’ favour.

GBP to USD Transfer Savings Calculator

How much are you sending from pounds to dollars?

Your potential USD savings on this GBP transfer:

$1,702

By using specialist providers vs high street banks

Support is seen around 1.2580 to 1.2600 area, give or two a few pips, where the trend line going back to October 2023 comes into play. A breach of this trend line could pave the way for a drop to 1.25 handle.

It is worth keeping an eye on the RSI as it gets near oversold levels of 30.0. This on its own does not mean we will see a bounce back, but it does increase the odds of it happening, nonetheless.

For now, it looks like GBP/USD’s path remains tied to the US dollar more than the GBP.

Given the prevailing bullish trend for the USD, there is little scope for significant near-term gains in the GBP/USD, even if it does appear poised for a short-term rebound amid oversold conditions.

But the dollar rally was largely left unscathed after markets were jolted yesterday by Ukraine’s use of US-supplied long-range missiles on Russian territory, with Moscow threatening a nuclear response.

Despite this, the FX market has remained relatively restrained, with the USD/JPY rising and resuming higher against other currencies.

🎯 GBP/USD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Markets seem cautiously optimistic, but any further escalation in the conflict could shake this complacency, particularly the euro and to a lesser degree the pound.

The pound was in focus yesterday after UK CPI data came in hotter than expected for October, rising to 2.3% from 1.7% against expectations of +2.2% y/y. Core CPI was even hotter at 3.3%.

But traders sold the initial GBP/USD rally, knowing full well that the Bank of England is more focused on services inflation, where a modest rise to 5.0% y/y still aligns with their forecasts.

Still, after the latest CPI data, it is difficult to see the BoE taking action again in December. But more easing could follow in early 2025, potentially in February, as the economy warrants looser policy.

I think that the market’s pricing of UK interest rates is far too hawkish given the state of the economy. A drop to $1.25 looks increasingly likely.