GBP/CAD Forecast: Asymmetric Bank of Canada Reactions

- Written by: Gary Howes

The Bank of Canada, Ottawa. Image reproduced under CC licensing conditions.

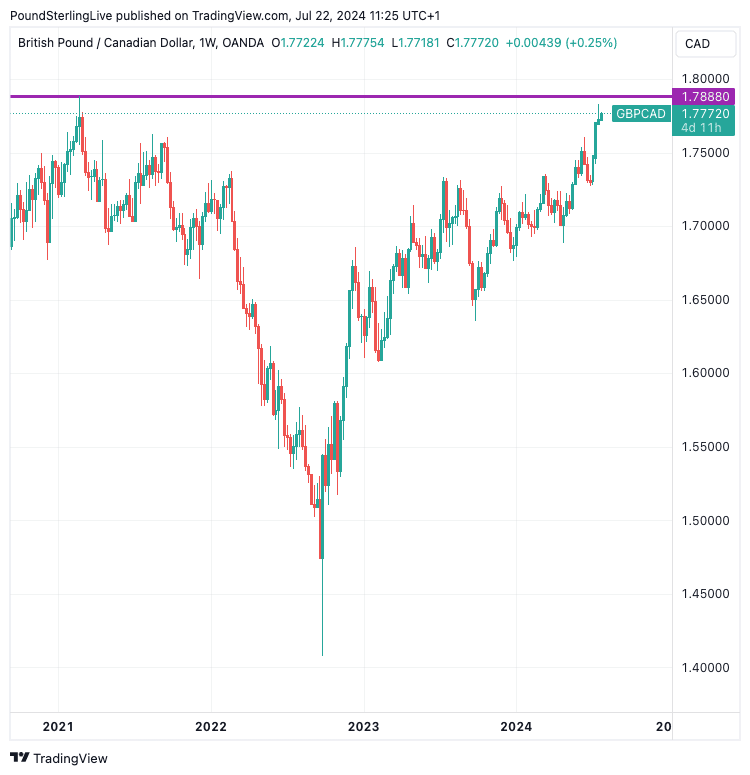

The Pound to Canadian Dollar exchange rate is close to three-and-a-half-year highs as the Bank of Canada looks to cut interest rates again this week.

GBP/CAD is in a strong uptrend and peaked at 1.7827 last week before fading gains to 1.7768 as of writing. There is some caution creeping into the exchange rate as it became overbought last week, signalled by the RSI reaching 70.

Some of the caution will reflect Wednesday's policy decision, and should the Bank of Canada keep rates unchanged on Wednesday, GBP/CAD can retreat further to 1.76.

Above: GBP/CAD at daily intervals. Track GBP/CAD with your custom alerts; find out more here

Elevated downside risks reflected non-binary risks as the market is largely 'priced' for a rate cut.

Analysts think the central bank will go ahead with a second consecutive rate cut in sympathy with Canada's soft inflation, retail sales and rising unemployment, as reported in the past month.

"The decision will coincide with updated macro revisions, so if the judgement is positive on inflation returning to target, the loonie could struggle to ward off further depreciation," says Kenneth Broux, Strategist at Société Générale.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

GBP/CAD will test and potentially move above 1.7880 if the Bank cuts rates and signals it is willing to go further in the coming months.

"We don't think a July BoC cut will do CAD any favours but don't see any major discrepancies to positioning or short-term valuation that would generate a big response," says Mark McCormick, Global Head of FX and EM Strategy at TD Securities.

TD - one of Canada's largest banks - says the Bank of Canada to deliver back to back cuts and bring the overnight rate to 4.50%.

"The BoC has a well-established history of consecutive moves to start a cycle, and we believe recent data has cleared the threshold for easing," says Robert Both, Senior Macro Strategist at TD Securities.

Foreign exchange markets are highly responsive to global interest rate settings at present, which is why the Pound and U.S. Dollar are amongst the top performers of 2024. With the Bank of England and U.S. Federal Reserve presiding over elevated exchange rates, while the Bank of Canada has already cut, creates downside for CAD.

"A second cut would widen the spread vs Fed funds to 75bp (measured off the upper target). Hedge funds last week ramped up short CAD positions to 47.2% of open interest, the most bearish in eight years," says Broux.

The same dynamics apply to GBP, which is backed by the Bank of England's 5.25% base rate. Although the Bank could cut on August 01, analysts say it will likely pursue a slow cutting cycle, which should limit GBP downside.

Indeed, with improved sentiment towards the UK, and the potential for inflation-busting pay increases for the state sector, GBP can remain supported against CAD going forward.