Pound-Canadian Dollar: Head and Shoulders Developing

- Written by: Gary Howes

Image © Adobe Images

The Pound to Canadian Dollar exchange rate's near-term technical outlook is "shaping up positively", according to a new analysis.

Shaun Osborne, Chief Currency Analyst at Canada's Scotiabank, says recent GBP/CAD price action also reflects the flattish, non-directional trend in the CAD crosses. However, "April/ May price action may be shaping up positively for the pound".

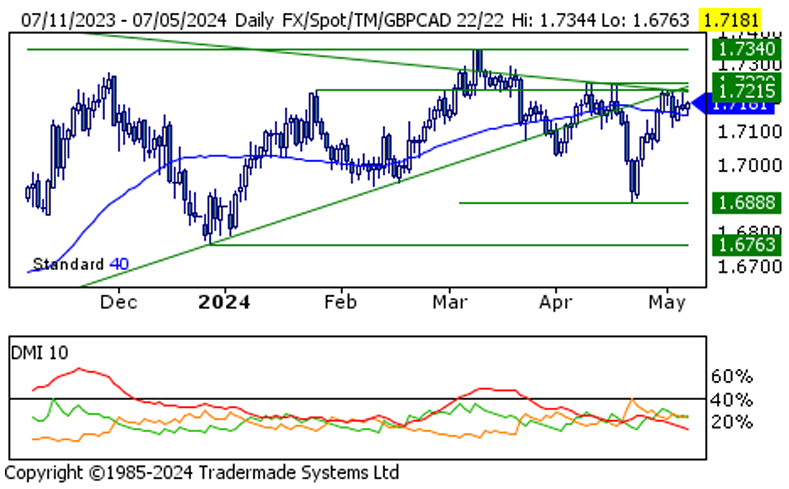

"A potential inverse Head and Shoulders is developing on the daily chart. So far, this pattern looks to be evolving as we should expect. There is a strong degree of symmetry in the formation of the shoulders — which is something I look for as confirmation for these signals," he adds.

The Canadian Dollar has underperformed most of its G10 peers in the course of the past two weeks as investors raise expectations for a Bank of Canada interest rate cut in June. These bets grew following the release of a softer-than-forecast GDP estimate for March, which was a flat 0% month-on-month, disappointing against expectations for growth of 0.2%.

Image courtesy of Scotiabank.

The Pound is another underperformer in the G10 space as investors see increased odds of the Bank of England also cutting in June. But, Sterling has kept pace with its Canadian counterpart, and the Pound-Canadian Dollar exchange rate has retained a constructive technical setup.

Osborne says a bullish break higher targets a GBP move up to the low/mid-1.75 zone.

"But there are caveats," he cautions. "Firstly, there is evidence of strong GBP selling pressure in the low 1.72 zone (note the neckline trigger sits at 1.7215). Secondly, flat range trading has robbed the cross of any sense of momentum on the daily and weekly charts. A GBP breakout is possible but the bar to a significant move up looks quite high at this point."

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes