Canadian Dollar: Rate Cut Hopes Boosted on GDP Disappointment

- Written by: Gary Howes

Image © Adobe Images

The Canadian Dollar will remain under pressure against a host of its G10 rivals as a slowing economy invites a mid-year interest rate cut at the Bank of Canada.

The Pound to Canadian Dollar exchange rate advanced to 1.7191 (+0.20% d/d) after Statistics Canada said its preliminary GDP estimate for March was a flat 0% month-on-month, disappointing against expectations for growth of 0.2%.

The February print was revised lower to 0.2%, again disappointing against expectations for 0.3%.

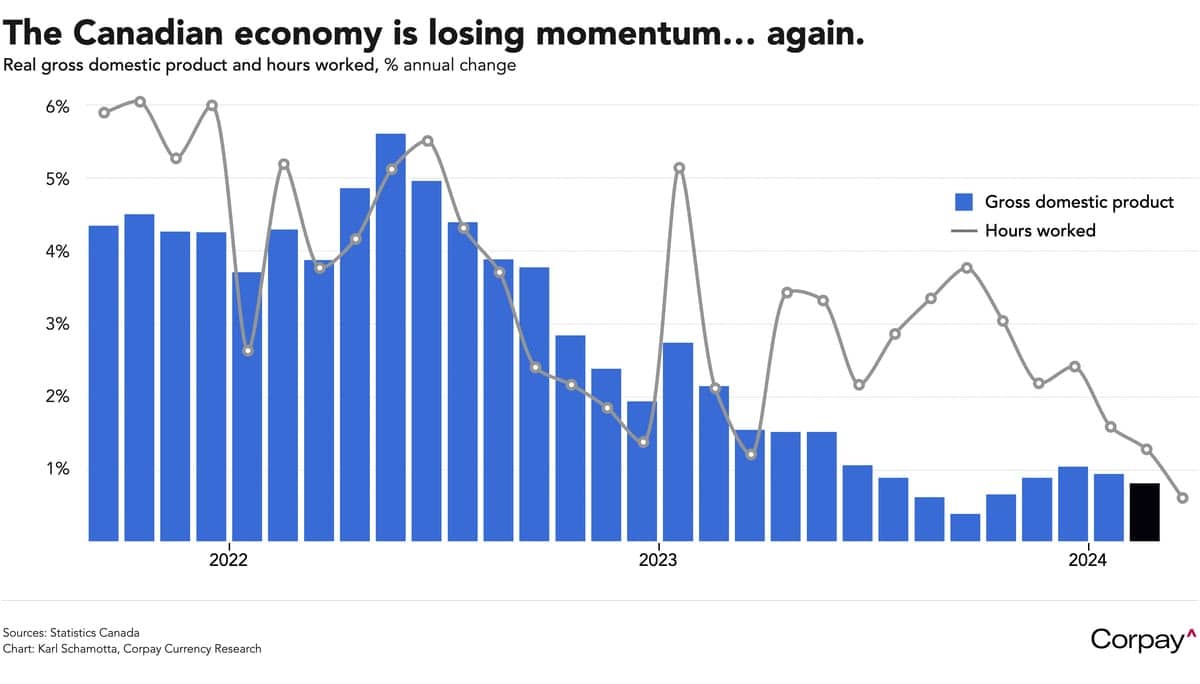

"The Canadian economy ran out of momentum toward the end of the first quarter, helping bolster market-implied odds on an imminent pivot to easing by the Bank of Canada," says Karl Schamotta, Chief Market Strategist at Corpay.

The first quarter started in strong fashion but it has become clear that momentum waned into the second quarter.

Image courtesy of Corpay.

"Momentum in the Canadian economy appears to have faded quickly as the first quarter progressed," says Andrew Grantham, an economist at CIBC.

Looking at the drivers of growth, the services sector expanded again in March but was unable to fully compensate for a further slowdown in goods production. Only 12 of Canada's 20 economic sectors reported positive growth last month. First-quarter growth is running at a 2.5% annualised expansion, undershooting the Bank of Canada's 2.8% forecast.

Compare GBP to CAD Exchange Rates

Find out how much you could save on your pound to Canadian dollar transfer

Potential saving vs high street banks:

C$4,450.00

Free • No obligation • Takes 2 minutes

"The Canadian dollar is tumbling as growth expectations fall relative to the United States - and as traders bet on a more aggressive easing cycle from the Bank of Canada," says Schamotta.

He explains that tracking the "hours worked" measure of labour market demand suggests that the economy could lose more steam in the months ahead, "confounding our own hopes for a “dead cat bounce” in the Canadian economy - and helping bolster the case for rate cuts beginning in June".

"The weak end to the quarter could mean downside risk for the Bank's expectation for 1.5% annualized growth in Q2. We always suspected that strength at the start of the year largely reflected an easing of previous supply constraints and the effects of better than normal winter weather, and that the economy could stall again thereafter," says CIBC's Grantham.

The Bank of Canada is facing slowing growth momentum and fading inflationary pressures. Mid-month, the Canadian Dollar came under pressure after it was reported inflation rose 2.9% on a year-over-year basis in March, following a 0.6% month-on-month gain that underwhelmed against expectations for a rise of 0.7%.

"The Bank of Canada said that it was looking for more evidence of downward momentum, and that is exactly what it got," said Kyle Chapman, FX Markets Analyst at Ballinger Group, following the inflation print.