Pound Sterling repelled at 1.2 level by EUR; GBP/USD stuck in neutral: 21/11 Live Coverage

The British pound sterling (GBP) powered above the 1.2 level against the euro yesterday on talk that the ECB would not be shy in cutting rates below 0%. The aggressive notion caught markets off guard and the EUR suffered as a result. However, this morning 1.2 has been rejected once more.

As the above suggests, drivers to sterling at present are external in nature with pressures on the EUR and focus on the US Fed being of utmost importance. Thus, today we need to keep an eye on sterling's momentum and find where the technical resistance and support levels lie.

Latest currency rates:

- The pound to euro exchange rate is 0.03 pct up on last night at 1.1991.

- The pound to US dollar rate is 0.2 pct higher at 1.6137.

- The pound to Australian dollar rate is 0.93 pct higher at 1.7416.

- The pound to New Zealand dollar rate is 0.93 pct up at 1.9650.

Please note that all quotes here are taken from the inter-bank markets. Your bank will levy a discretionary spread when delivering you forex. However, an independent currency specialist will seek to undercut your bank's offer, thus delivering up to 5% more FX. Please learn more here.

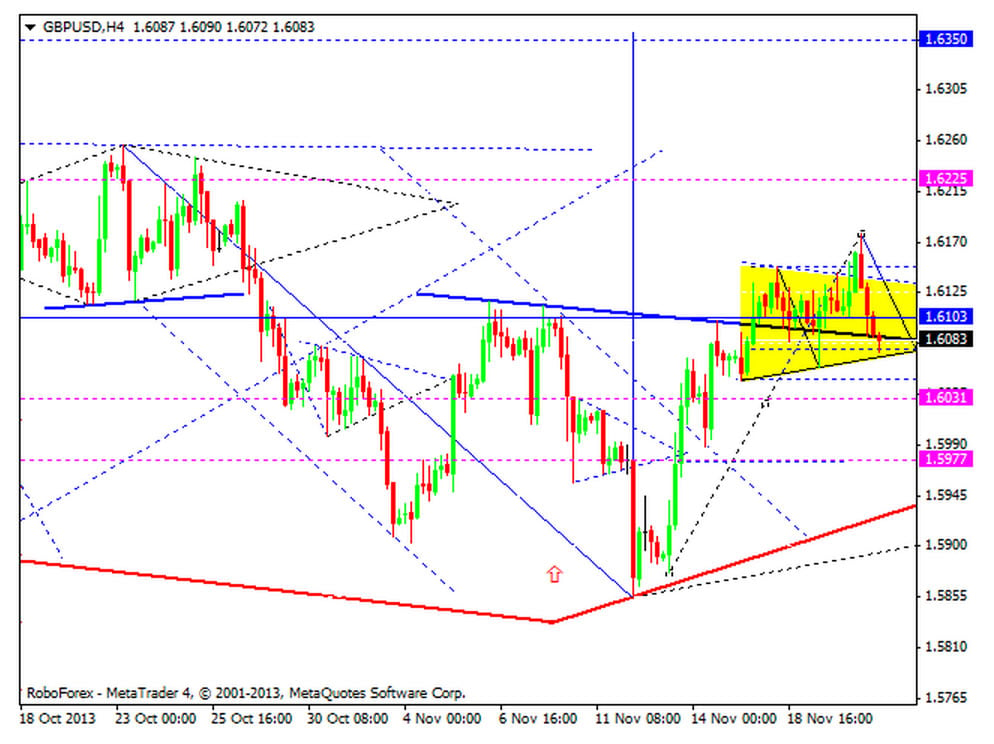

16:53: GBP/USD could still ascend to 1.6350

Analysts at RoboForex remain convinced that the technical setup behind Cable offer the chance of a decent move higher:

"The Pound is still consolidating inside narrow triangle pattern. We think, today price may continue forming ascending structure towards 1.6350. Alternative scenario implies that pair may start correction to reach 1.5970 and then start moving upwards."

16:02: GBP/CAD on target for 1.72

We keep an eye on that bullish GBP/CAD pairing and note it is on target for new highs. Shaun Osborne at TD Securities says:

We keep an eye on that bullish GBP/CAD pairing and note it is on target for new highs. Shaun Osborne at TD Securities says:

"We have been and remain bullish GBP/CAD. We noted previously that the primary trend here is higher and that despite the sideways range trade in the GBP over the past few weeks, short-term trend momentum remained bullish and in alignment with the bullish trend studies over the longer-term timeframes.

"The push to new highs this morning (highest levels since early 2010) has been a question of when rather than if and we continue to target 1.72 near-term. We think the longer-term picture is technically bullish."

15:42: GBP/USD to hit 1.6175 today?

"The GBP/USD also fell in yesterday’s North American trading session, through rates are recovering in today’s early European trade. The pair just completed a Bullish Marubozu Candle on the 4hr chart, showing a strong shift to buying pressure. In its case, the GBP/USD may be preparing for a possible run up to yesterday’s highs near 1.6175 next." - Matt Weller at GFT.

15:14: Euro volatility best expressed through EUR/USD as opposed to EUR/GBP

The below chart, supplied by FX Market Alerts is telling:

Accompanying the chart is this observation:

"That the EUR rate is uncomfortably high is now well documented, but once again, a prime opportunity to 'address' this issue is discarded.

"Speaking at a conference in Berlin, it was (Draghi's) comments 'not to infer negative deposit rates' which seems to have set off the short tem/algo community, with stop loss buying generating added momentum to 1.3475. Given that negative rates are on the table, and indeed have been discussed, we fail to see the benefit in discounting market expectations in this respect.

"It is perhaps even more questionable, given the fact that rising implied rates in the long end seem to be the bane of almost every central banker at the present time. Alluding to the uneven and fractious recovery within the Euro zone at present, as exemplified by this morning's PMI stats in France and Germany, allowing the single currency to 'adjust' should be high on the priority list."

14:09: Laying the groundwork for AUD and EUR losses

Stephen Gallo at BMO Capital says it is now clear that the ECB and RBA want their currencies lower. The question is how effective will they be in delivering this downside:

"Looking at the ECB and the RBA together, if there is one dominant theme at the moment and for the week, it would appear to be that these central banks are laying groundwork for a downward, directional bias in their currencies as the initial Fed QE3 ‘taper’ approaches.

"The key question, then, is how significant this downward bias is likely to become? Policy divergence will support the USD during 1H 2014, but the slow pace of reform in China and the developing market space should still support flows related to USD diversification within the G10 space as well, since alternatives to the USD will still remain very limited in number for the foreseeable future. Even using language such as ‘intervention’ won’t trigger a full dissipation of these flows.

"AUD trading lower after RBA Governor Steven’s comments. 0.9250 looks like critical support on AUD/USD."

13:05: An interesting forex snippet!

Deutsche Bank is the largest forex dealer in the world with a market share of around 20%.

Deutsche Bank is the largest forex dealer in the world with a market share of around 20%.

And so it should be - Deutsche is merely sticking to its time-honoured remit:

Deutsche Bank was founded in Berlin in 1870 as a specialist bank for foreign trade.

The bank's statute was adopted on 22 January 1870, and on 10 March 1870 the Prussian government granted it a banking license.* The statute laid great stress on foreign business:

"The object of the company is to transact banking business of all kinds, in particular to promote and facilitate trade relations between Germany, other European countries and overseas markets."

* Lothar Gall (et al.), The Deutsche Bank 1870–1995, London (Weidenfeld & Nicolson) 1995.

12:22: GBP pushes higher

The GBP is really hammering the AUD, NZD and is advancing in strong fashion against the CAD and ZAR.

Driving this is the good news at 09:30 on the borrowing front, the strong CBI Industrial Trends data (See below).

On the other side of the coin, the AUD and NZD are struggling after last night's FOMC minutes which showed the US Federal Reserve is on course to start the tapering programme.

Note the EUR just won't budge - we continue to believe the incredibly strong resistance at 1.2 is playing its part in this.

12:13: GBP trades higher on back of good manufacturing news

Today's second-tier data has helped give the GBP a lift.

Today's second-tier data has helped give the GBP a lift.

Britain's manufacturing sector grows at fastest pace in 18 years, the CBI says.

The CBI reported the strongest rate of growth in manufacturing output and the highest level of new orders since 1995 in November.

The results from the CBI industrial trends survey were better than expected, with export order books also above average, supporting the government's aspirations for a future UK economy dominated by overseas trade and not spending.

12:08: Questions hanging over the euro should keep GBP-EUR supported

The big fall in the EUR yesterday afternoon serves as a reminder of the uncertainties surrounding the ECB's next move.

The big fall in the EUR yesterday afternoon serves as a reminder of the uncertainties surrounding the ECB's next move.

"We do not think the ECB is close to concluding its internal debates on the next steps. For now, continuing to publicly signal a willingness to act should suffice, leaving the Governing Council time to monitor further the data flow. Indeed, the choice of the instrument for further accommodation depends on how the ECB identifies the sources of weakness in the Euro area economy." - Gilles Moec at Deutsche Bank.

In this environment we would favour the GBP over the EUR. However, we certainly wouldn't call for a clear break of 1.2 at this stage!

11:48: Still trading within a horizontal range

Luc Luyet at MIG Bank comments on the horizontal trap the GBP/USD remains contained within:

"GBP/USD made a bearish intraday reversal yesterday, suggesting a weakening buying interest. Monitor the support at 1.6048 (15/11/2013 low), as a break would invalidate the short-term supportive technical structure. Another support can be found at 1.5989 (14/11/2013 low). A resistance now stands at 1.6178.

"In the medium-term, prices are moving within the horizontal range defined by the support at

1.5894/1.5855 and the resistance at 1.6260 (01/10/2013 high)."

Click to enlarge, pic courtesy of MIG Bank:

11:36: Key support and resistance levels for GBP/USD

Ipek Ozkardeskaya at Swissquote Research notes the key levels to watch out for regarding the pound to US dollar:

Ipek Ozkardeskaya at Swissquote Research notes the key levels to watch out for regarding the pound to US dollar:

"GBPUSD is having a hard time holding gained ground. The pair rallied to 1.6178 before reversing lower to 1.6073. This choppy trading is something GBP traders are now accustom to. MACD is now stabilizing above the zeroline and should provide renewed strength.

"On the downside the 21-DMA at 1.6077 should provide support to the current sell-off. Watch for next resistance to come into play at 1.6125 (old uptrend floor), 1.6270 (1st Oct high) then 1.6343 (2013 high). The support levels from here are 1.6075 (21- DMA), 1.6045 (downtrend top), 1.5884 (13th Sep high), 1.5759 (17th June high), 1.5708 (fibo 61.8% on Jul-Oct rally), 1.5600 (resistance turned support) then 1.5429 (28th Aug low)."

10:53: 1.2 remains a step too far for GBP/EUR

Sash Nugent at Caxton FX confirms GBP just doesn't have the oomph to break above the 1.2 level:

"Last session there were talks of the ECB considering negative deposit rates. This helped to drive the GBPEUR towards 1.20 again, after the BoE minutes released earlier supported a firmer pound.

The eurozone PMI numbers haven’t been impressive but have done enough to limit sterling gains. It may be another struggle for sterling to breach and maintain 1.20."

10:21: GBP/USD to remain submerged below 1.61?

Emmanuel Ng at OCBC Bank gives his forecast for GBP/USD:

Emmanuel Ng at OCBC Bank gives his forecast for GBP/USD:

"The BOE MPC minutes released on Wednesday demonstrated no new impetus to tighten monetary policy, noting that interest rates may not be raised immediately even if the 7% unemployment threshold is reached. Coupled with a firmer dollar, the GBP-USD may attempt to stay submerged below 1.6100 and seek out the 55-day MA (1.6033) once again."

10:19: Huge resistance for GBP/JPY ahead

Sean Lee at FXWW warns on GBP/JPY: "Huge level looming large for GBP/JPY at 163.00. Normally these levels hold on the first test but watch out if it breaks." Chart here.

09:30: Government revenues outstrip spending, but UK still borrows more than expected

Further signs that the UK's mammoth debt problem could, perhaps one day, ease up a little.

The ONS reports UK government revenue was up 3.2% year-on-year last month, spending was also up at 1.2%.

But - the amount borrowed was in excess of expectations - Public Sector Net Borrowing (Oct) came in at £6.383 BN versus expectations for a reading of £4 BN.

09:06: Breaks put on British pound (GBP) strength?

Lloyds Bank Research question where the impetus required by GBP to push on will be found:

"EUR/GBP broke below the big 0.8330 support yesterday on the reports that the ECB were considering a deposit rate cut to -0.1%, but has so far been unable to hold below it. UK PSNB data and the CBI industrial trends survey are not typically big market movers, so we suspect it will still be a struggle to extend GBP strength from here unless there is some more concrete UK news."

08:50: GBP/USD neutral, EUR/GBP bullish

According to UBS analyst Geoffrey Yu support for GBP/USD is seen at 1.6016, a break below which would extend the weakness to 1.5855. Resistance is at 1.6178 ahead of the critical 1.6260.

According to UBS analyst Geoffrey Yu support for GBP/USD is seen at 1.6016, a break below which would extend the weakness to 1.5855. Resistance is at 1.6178 ahead of the critical 1.6260.

Regarding the EUR/GBP, Yu says he is bearish on the pair with momentum tools confirmed crossing lower reinforcing the bearish theme, "opening the doors to the critical support area at 0.8301 and 0.8285. Resistance

is at 0.8415."

08:45: The US Fed dominates FX market sentiment, USD index well supported

The FOMC minutes last night didn’t really change the mildly dovish policy impression conveyed by the recent Bernanke and Yellen speeches, but yesterday’s EUR sell off has ensured that the USD index now looks to be well supported for now.

The focus will be mainly on the Eurozone today, but there will be some interest in the Philadelphia Fed survey for November, with the Empire survey having disappointed.

"80.50 should now be very good support for the USD index, and the focus today should be on the USD upside, but it will require something more positive form the US for the USD index to breach the 81.10/20 area," say Lloyds Bank.