GBP rockets higher against the Euro towards 1.2 on ECB rumour mill: Wednesday's Live Coverage

The British pound (GBP) faces little by way of economic newsflow today but we do get to hear from the all-powerful Bank of England Monetary Policy Committee.

The minutes of November's MPC meeting is released today - we saw how the Committee sent sterling higher with their inflation report. Any chance of something similar today?

Latest forex rates:

- The pound sterling to euro exchange rate is 0.66 pct up on last night at 1.1990.

- The pound sterling to US dollar rate is 0.15 pct higher at 1.6145.

- The pound to Australian dollar rate is 0.57 pct higher at 1.7187.

- The pound to New Zealand dollar rate is 0.53 pct up at 1.9367.

Be Aware that all quotes here are taken from the inter-bank markets. Your bank will levy a discretionary spread when delivering you forex. However, an independent currency specialist will seek to undercut your bank's offer, thus delivering up to 5% more FX. Please learn more here.

16:33: Will this break the camels back?

Even after an ECB interest rate cut this November the cheeky Euro continued to hold onto strength. So will today's talk of another ECB cut break recent ranges?

"This spurred an unwind of euro long positions and sent the GBPEUR rate back to 1.20, while slamming the EURUSD rate below 1.35 once again. Evidence for short euro positions is building, especially against sterling where UK fundamentals are more impressive. Having said that, every time we believe it is time for the euro to continue to weaken, it finds some hidden strength and proves us all wrong. It may take more than negative deposit rates ensure the GBPEUR rate remains above 1.20," says Sasha Nugent at Caxton FX.

15:40: ECB Said to Consider Mini Deposit-Rate Cut If Needed

Why has the pound rocketed higher against the euro? This from Bloomberg: "The European Central Bank is considering a smaller-than-normal cut in the deposit rate if officials decide to take it negative for the first time, according to two people with knowledge of the debate." Check out the piece here.

15:24: Massive spike in GBP/EUR

Alert - the pound to euro exchange rate has smashed through 1.1990 in the past couple of minutes.

It would appear that the pressure is being exerted by the ECB - rumours are doing the rounds that a negative interest rate is being considered - investors are beginning to realise just how agressive the Eurozone's central bank will be in an era of plummeting inflation.

14:40: Are we about to open the door on a fresh GBP/USD rally?

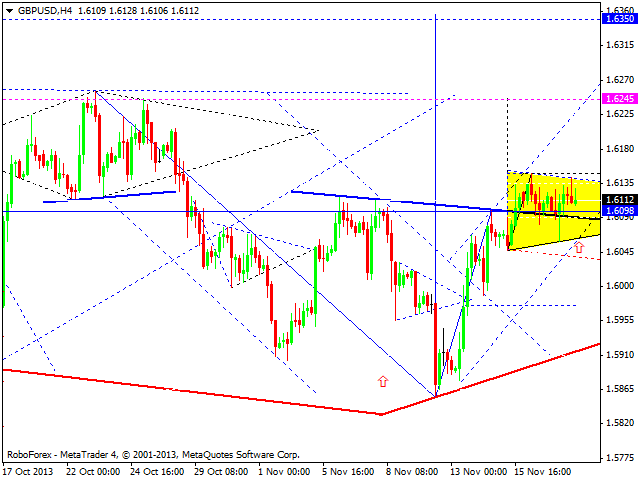

We have mentioned we are at key levels for the pound dollar exchange rate already today. Matt Weller at GFT has this to say:

We have mentioned we are at key levels for the pound dollar exchange rate already today. Matt Weller at GFT has this to say:

"The GBP/USD continued to grind higher over the last 24 hours. As we go to press, the pair is peeking out to a new 3-week high above 1.6140, and if this breakout is confirmed, it would open the door for a continuation rally up toward the 1.6200 round handle and previous resistance at 1.6250 next. The recent Piercing Candle on the 4hr chart confirms the choppy uptrend, so more aggressive traders may want to consider buy opportunities on the GBP/USD during today’s North American trading session."

13:55: EUR/GBP remains under pressure

ICN Financial on the near-term outlook for the euro pound rate:

"The pair remains under pressure, retreating from 0.8415 resistance level, currently attempting to break the minor ascending support shown on chart. Further downside remains our favoured scenario."

13:45: GBP/USD just below key resistance

These are important levels for GBP/USD says Gareth Berry at UBS:

"Initial support is at 1.6037, a break below this level would extend the weakness to 1.5967. Resistance is at 1.6149 ahead of the critical 1.6260."

12:34: "We see room for further upside"

"GBPUSD attempt to break the 1.6150-resistance turned successful. The strengthening bull momentum (MACD above the zeroline for the second day) is likely to limit the selloffs above the 21-day moving average (1.6068). We see room for further upside.

"GBPUSD has renewed it upwards assent as demand remains resilient. MACD is now stabilizing above the zeroline and should provide renewed strength." - Ipek Ozkardeskaya at Swissquote Research.

11:53: Look out for GBP advances vs EUR

Stephen Gallo says we could be entering a GBP/EUR strengthening phase:

Stephen Gallo says we could be entering a GBP/EUR strengthening phase:

"The macro economic environment is, for now, bestowing the BoE with more policy flexibility to keep rates low. One of the worst possible scenarios for the Bank would be if it were forced into an early, pre-emptive tightening of monetary policy, but that continues to be the lower risk scenario for now. We are therefore still of the mindset to look for more reasons for GBP rallies to be capped rather than persistent over time.

"Policy divergence between the BoE and the ECB over the next 6 months should very much restrain GBP weakness in trade-weighted terms, so the better opportunities to buy EURGBP are unlikely to emerge until the 0.8000-0.8250 range comes into view. We’re in a period now where another policy shift by the ECB, in one form or another, is in its build-up phase."

11:40: Euro's bounce against sterling looks to have ended

More from Luyet at MIG, this time on EUR/GBP:

More from Luyet at MIG, this time on EUR/GBP:

"EUR/GBP has likely ended its short-term bounce. A break of the hourly support at 0.8358 (15/11/2013 low) would confirm our short-term scenario of a test of the recent low at 0.8301. The hourly resistance at 0.8416 (14/11/2013 high) has thus far held. Another resistance stands at 0.8464.

"The medium-term declining channel, in place since the February 2013 top, calls for a mild bearish bias. We favour further declines below the support at 0.8333. Other supports can be found at 0.8225 (28/12/2012 high) and 0.8082 (01/01/2013 low)."

11:36: Further rise ahead for GBP/USD

Luc Luyet at MIG Bank gives his prediction on GBP/USD:

"GBP/USD has broken the resistance at 1.6119, opening the way for a further rise towards the resistance at 1.6260. Despite the resistance at 1.6149, a short-term positive bias is favoured as long as the support at 1.6048 (15/11/2013 low)

holds. Another support can be found at 1.5989 (14/11/2013 low)."

11:00: GBP to ascend to 1.63 vs USD?

The latest technical forecast on Cable is interesting:

"The pound is still moving inside consolidation channel; trading range looks like triangle pattern. We think, today price may form another descending structure towards pattern’s lower border and then start new ascending movement to break upper one and continue growing up towards 1.6300."

10:53: Initial GBP sell-off corrected

Boris Schlossberg at BK Asset Management notes a rebound in GBP/USD was halted at the 1.6150 barrier:

Boris Schlossberg at BK Asset Management notes a rebound in GBP/USD was halted at the 1.6150 barrier:

"In UK today the release of the BoE minutes initially caused a selloff in the pound, as UK policymakers showed little inclination to tighten policy anytime soon despite some of the most positive economic data in the G-7 universe.

"UK monetary authorities essentially reiterated their position presented at the Inflation report last week noting that they see both upside and downside risks to the economy after a better than expected H2.

"Much like the Fed, UK officials stressed that rates will not necessarily rise even if the unemployment targets are reached especially if inflation remains tame.

"Cable initially sold off on the comments but then recovered to take out stops at the 1.6150 barrier as traders remained optimistic about the UK economy especially on a relative basis."

09:46: Sterling unchanged on MPC minutes

No major reactions to today's MPC minutes. This will allow us to get back to focusing on the technical setup of the currency. Also, we have some important US dollar events ahead.

09:30: Bank of England MPC's November minutes are released

"Minutes of the MPC Meeting held on 6 & 7 November reveal unanimous vote on BankRate and Asset Purchases" - Bank of England.

"Minutes of the MPC Meeting held on 6 & 7 November reveal unanimous vote on BankRate and Asset Purchases" - Bank of England.

09:03: Lloyds on EUR/GBP

"We still favour EUR underperformance, and in the absence of dovish surprise from the BoE Minutes we favour for EUR/GBP downside ahead of tomorrow’s Eurozone flash PMIs." - Lloyds Bank.

09:02: 1.6150 is topside resistance for GBP/USD, markets looking for divergence amongst MPC

Lloyds Bank say the split of voting intentions amongst MPC members is an important factor to keep a lookout for at 09:30:

Lloyds Bank say the split of voting intentions amongst MPC members is an important factor to keep a lookout for at 09:30:

"With the unemployment rate now forecasted to reach the 7% threshold in Q3 2015 (Q2 2016 previously), attention will be paid to any divergences among the committee members from the new central view. We do not expect much market reaction on today’s minutes.

"Speeches from BoE member Spencer Dale and Martin Weale could trigger some market reaction but for today with key releases from the US we think GBP/USD will be largely dominated by USD sentiment.

"For GBP/USD, the recent high of 1.6150 provides initial resistance on the topside."

08:35: MPC Minutes no threat to sterling rally?

Kathy Lien tells us how to prepare for the MPC Minutes release at 09:30:

"Their decision to maintain steady policy in October was unanimous and we the expect same to be true for November. However if there is even one member that favours an earlier withdrawal or believes that more QE is needed, sterling could react sharply as this would represent a shift in monetary policy bias for the central bank.

"Outside of the voting record, we expect a generally cautiously optimistic tone that should pose no major threat to the current rally in sterling."

08:30: British pound (GBP) firm ahead of MPC minutes release

The British pound sterling is on the front foot on Wednesday morning with a strong rebound against the Australian and New Zealand dollars ending a poor start to the week for GBP/NZD and GBP/AUD.

Elsewhere, the pound to euro exchange rate appears firmly rooted in the early 1.19's. We may see 1.19 continue to provide solid support for the remainder of the month.

The pound to US dollar exchange rate is being USD driven: "Markets are expected to scrutinise in depth the latest BoE minutes this morning on the back of last week’s Inflation Report. However, cable’s recent appreciation is largely USD-driven and we doubt that it will last long. EUR-GBP is also seen rallying above 0.84." - UniCredit Bank.

08:12: US data to drive forex markets today

US data releases are key for forex markets today US data releases are expected to be the main driver for currencies today.

Sluggish retail sales, falling inflation and declining existing home sales are likely to weigh further on the US dollar. The minutes of the October FOMC meeting will also attract attention later in the day.