Pound to Australian Dollar Forecast for the Week Ahead: Looking for a Recovery

- Written by: Gary Howes

Image © Adobe Images

The Australian Dollar is one of the better performing major currencies thanks to hopes of a Chinese economic revival. But it could suffer a setback this week as embedded expectations are challenged.

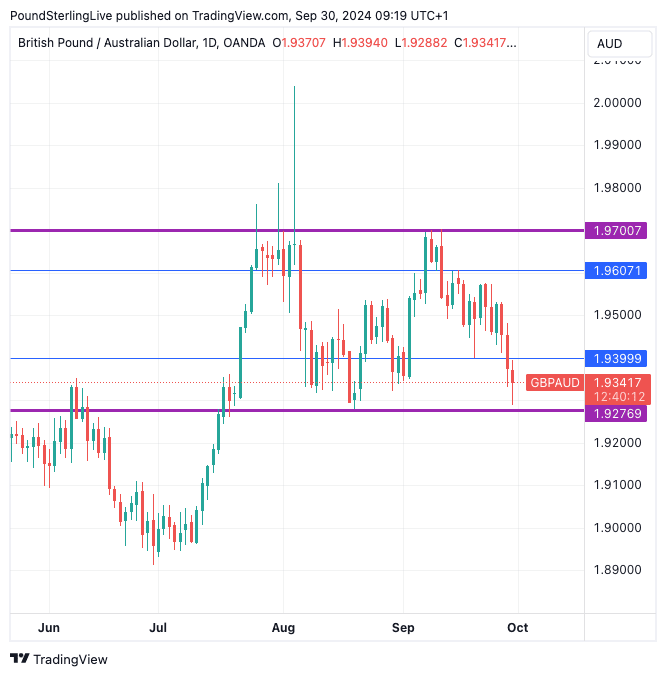

The Pound to Australian Dollar exchange rate (GBP/AUD) has reflected the Aussie's recent outperformance with a slide back to the horizontal graphical support at 1.9277, a level that our Week Ahead Forecast publications have been referencing for some weeks now:

For now, the support level seems likely to hold, which means the exchange rate can recover to the middle of the range at ~1.95 on any countermove.

According to analyst David Forrester at Crédit Agricole, AUD "is looking overextended."

"While we have been AUD bulls all year, the currency is likely becoming a bit overextended at the moment," he says, saying the recent optimism surrounding China might have gone too far.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

China's latest stimulus efforts have seen a jump in iron ore prices back above USD100 per tonne, raising the value of Australia's most important export.

However, Crédit Agricole's China economist notes that the latest stimulus is lacking the fiscal spending needed for a sustained boost to the economy given the lack of demand for private sector credit locally.

The U.S. once again forms the FX market's focus this week with a dump of Federal Reserve speeches and the all-important jobs report.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

The outcome will have a significant bearing on global investor sentiment and, thus, AUD, which is considered one of the most responsive of the major currencies to broader global sentiment.

The assumption is the Federal Reserve has entered a period of consecutive interest rate cuts, that will bolster investors and boost equity markets, giving the AUD a shot in the arm.

The clear risk to these assets is that Fed rate cut expectations take a hit in the wake of stronger-than-expected data and signalling from members of the Fed's Open Market Committee (FOMC).

Crédit Agricole thinks the market is too aggressively priced for Fed rate cuts. "Re-pricing of these factors could weigh on the AUD going forward," says Forrester.

U.S. PMI manufacturing survey data is due on Tuesday, as are speeches from FOMC members Cook, Collins, Barkin and Bostic. Bowman and Barkin speak on Wednesday, making this a significant week for direct messaging from the Fed.

There are more U.S. PMI figures incoming on Thursday, this time covering the services sector, which will keep markets entertained ahead of the week's highlight, which is Friday's non-farm payroll release.

Here, a headline of 144k is expected. The rule of thumb is that anything slightly below would signal the need for more cuts at the Fed and keep the mood music supportive of global risk and the Australian Dollar.

But any big downside miss could also backfire as it would suggest maybe the economy is slipping into recession.

If the figures give a significant upside surprise, markets will almost certainly fall as investors race to bet the Federal Reserve will slow down the pace of cuts.

This would deal a setback to the Aussie against the Pound, Euro and U.S. Dollar.

AUD Downside Limited

But, Crédit Agricole's Forrester thinks weakness will likely be limited. "We continue to expect the RBA to remain on hold and hawkish, and so an underlying support for the AUD."

With this in mind, keep an eye on Tuesday's release of Australian retail figures for signs of rising consumer demand, which would potentially bolster expectations that the RBA stays on hold into 2025.

The RBA has said it is interested in seeing how electricity rebates from State Governments and the Federal Government, as well as tax cuts, will influence household spending.

"Retail sales data for August will be released Tuesday and will be closely watched by investors as well as the RBA for evidence of a rise in consumer spending on the back of higher household disposable incomes," says Forrester.