Australian Dollar Tops The Leaderboard

- Written by: Gary Howes

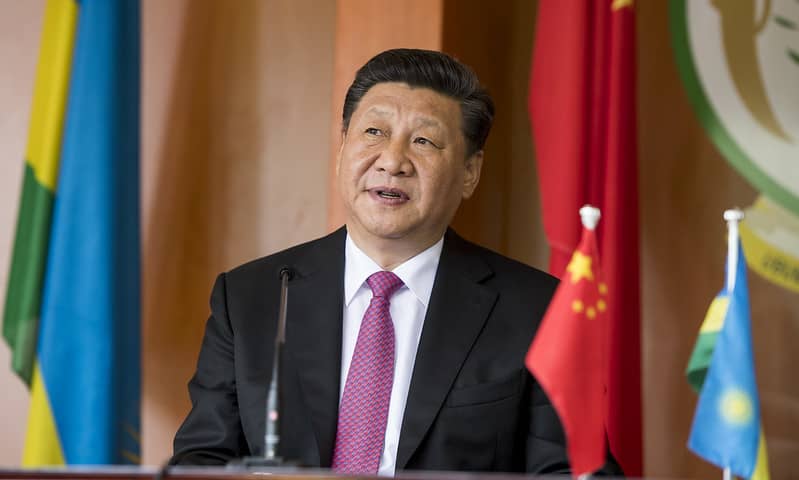

Above: File image of President Xi. Image Source location. Licensing: CC.

The Australian Dollar is today's best-performing currency as China-linked assets rose after China's leaders called for fresh stimulus to bolster the economy.

The Aussie is highly sensitive to the Chinese economy, and news that more stimulus is incoming has boosted the currency.

"Amid rallying Chinese equity markets, the offshore USD-CNH might thus lead the way to a new test below 7.00 ahead of the Chinese Golden Week early in October. AUD-USD and to a lower extent NZD-USD might benefit accordingly," says Roberto Mialich, a foreign exchange analyst at UniCredit Bank.

China's ruling politburo - which includes President Xi Jinping - called for sufficient fiscal spending, measures to stabilise the beleaguered property sector and "forceful" rate cuts at the People's Bank of China (PBoC).

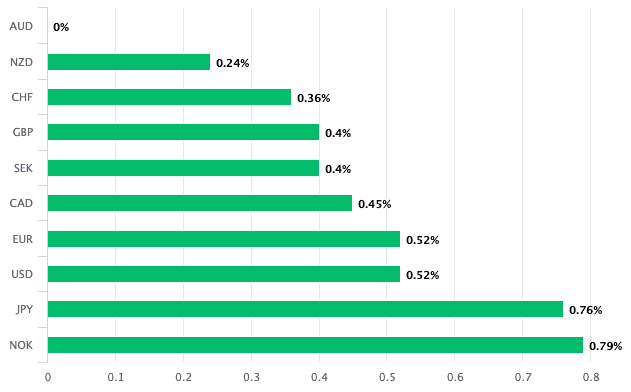

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

The call follows fresh stimulus measures announced earlier this week and indicates a growing commitment to bolstering the country's economy.

"Hopes of further fiscal policy support in China will keep risk sentiment and AUD/USD supported in our view," says Carol Kong, FX Strategist at Commonwealth Bank of Australia.

Above: AUD is the best performing currency on Thursday.

Reports say China is considering injecting up to CNY1TRN ($US142BN) of capital into its biggest state banks to increase their capacity to support the economy.

"Reports of additional stimulus from the Chinese government supported investor sentiment and weighed on USD/CNH," says Kong.

On Tuesday, the PBoC lowered the reserve ratio requirements for banks by 0.5 percentage points, bringing them down to 9.5%. It also cut rates, reducing the 7-day reverse repo rate by 0.2 percentage points to 1.5%.

🎯 GBP/AUD year-ahead forecast: Consensus targets from our survey of over 30 investment bank projections. Request your copy.

Further measures were also announced with the aim of stimulating stock markets and the housing sector.

In addition to the message from the Politburo, Chinese authorities said they will give one‑off cash handouts to disadvantaged groups.

"Shanghai will also reportedly distribute CNY500mn worth of consumption vouchers. The announcements signal a changing focus of government support. Indeed, we continue to expect the government will deliver more fiscal stimulus soon," says Kong.

The Australian Dollar is the second-best performing currency of the past month, after the British Pound, held aloft by developments in China and the Reserve Bank of China's reluctance to lower interest rates.