Australian Dollar Fumbles Amidst Commodity & Stock Market Selloff

- Written by: Gary Howes

Image © Adobe Stock

The Australian Dollar is near the bottom of the performance board after another selloff in global commodities and stocks.

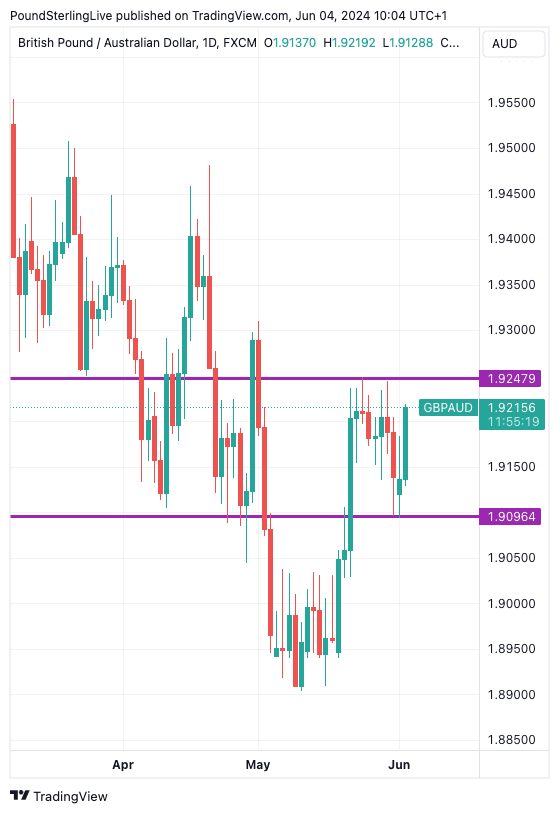

The Pound to Australian Dollar exchange rate (GBP/AUD) is trading a third of a per cent higher on the day at 1.92050 amidst falls in iron ore, copper and oil prices.

The selloff in commodities comes alongside another selloff in global equity markets and hints at a deterioration in global investor sentiment.

The Aussie is off by more than half a per cent against the U.S. dollar (AUD/USD at 0.6650). In fact, AUD has lost value against all G10 peers except the Norwegian Krone, another 'high beta' that tends to struggle when commodities and stocks are in decline.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The Aussie Dollar has a strong positive correlation with commodities as this asset class is Australia's main foreign exchange earner.

The Bloomberg Commodity Index has now erased all the gains it made since late April. Brent crude is down 8.2% over the past four trading sessions trading around the $77.50/barrel level after OPEC+ said it would begin ramping up production from October onwards.

Iron ore prices have fallen four days in succession, while copper was down 1.30% on Tuesday. It lost all the previous day's gains and threatened a retest of the May lows.

"Iron ore prices have fallen to $110/t for the 62% Fe China index, with the Mysteel index slumping below $109/t," says John Meyer, an analyst at SP Angel. "Supply has been strong from main producers Brazil and Australia. Reports suggest that State Council plans will hit steel production in a bid to curb carbon emissions."

Above: GBP/AUD at daily intervals. Track GBP/AUD with your own custom rate alerts. Set Up Here

The market should have a spring in its step following the release of a surprisingly soft U.S. manufacturing survey on Monday. The ISM Manufacturing PMI has fallen below 50 and provides the latest evidence to suggest the U.S. economy is seeing momentum wane, opening the door to Federal Reserve rate cuts.

Expectations for lower interest rates would typically supercharge equities and commodities, which would be expected to boost the Australian Dollar. But the 'bad news is good news' mantra for asset markets appears to be losing its grip. Instead, 'bad news is bad news' could be the new mantra.

"The market is maybe starting to worry that the Fed has stayed too tight for too long," says Neil Wilson, an analyst at Finalto.