Australian Dollar is G10 Laggard On Signs Domestic Jobs Market is Loosening

- Written by: Gary Howes

Image © Adobe Images

The Australian Dollar fell against all its G10 currency peers after Australia's labour market statistics disappointed against expectations.

The Pound to Australian Dollar exchange rate rose to 1.8975 after Australia reported a surprise rise in its unemployment rate to 4.1% from 3.9%.

Following the data, the Australian Dollar to U.S. Dollar exchange rate fell to 0.6679, unwinding some of the previous day's impressive gains.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

The losses come despite the country recording 38,500 new jobs (versus 23,700 expected), as the majority of these new placements were in temporary positions.

"AUD/USD eased a touch to near 0.6680," says Carol Kong, a strategist at Commonwealth Bank of Australia. "The April survey, alongside other indicators, point to further loosening in the labour market."

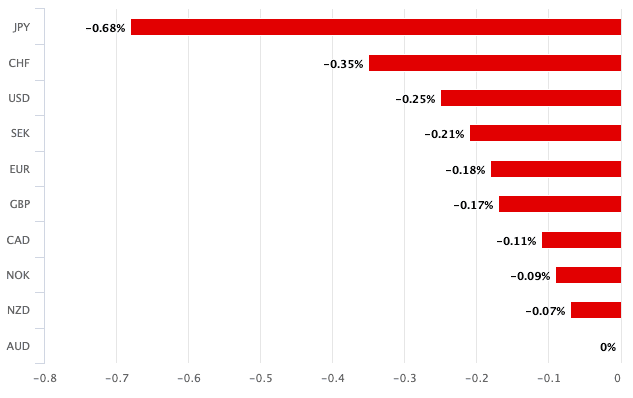

The Australian Dollar is the day's underperformer, which speaks of an AUD-specific weight, confirming the labour market data has had an impact:

Above: AUD performance over the past day.

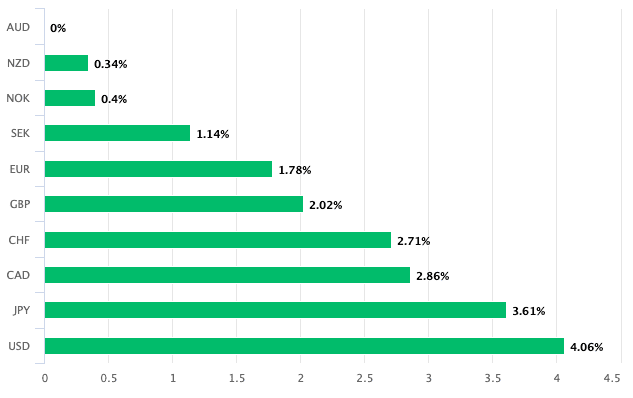

The day's underperformance comes in the context of a strong performance over recent weeks, with the currency being the best performer in the G10 when screened over the past month:

Above: AUD performance over the past month. Track GBP/AUD with your own custom rate alerts. Set Up Here

Market pricing shows investors expect the RBA to have delivered its first interest rate cut by 2025, which is well after its G10 peers.

This expectation provides support to Australian bond yields relative to elsewhere, creating demand for the currency.

The risk is that these assumptions are tested in the coming weeks by softer data. There is ample scope for a repricing in RBA rate cut expectations, more than elsewhere, which can create headwinds to AUD outperformance.

However, the next potential risk to AUD performance is global in nature, with markets awaiting a deluge of data from China, scheduled for Friday.

Note the AUD gained into the midweek session thanks to news that Chinese authorities are looking to buy properties to help its distressed property market.

China remains the other key driver of AUD, and strong industrial, housing, and retail figures on Friday can help the currency put these soft domestic figures behind it.

But disappointment would potentially convince traders the recent strong run is coming to an end.