RBA Disappoints Hawkish Market Expectations

- Written by: Gary Howes

Above: RBA Governor Bullock addresses the media on May 07.

The Pound to Australian Dollar exchange rate (GBP/AUD) has risen after the Reserve Bank of Australia's May decision, but the bounce is unlikely to shift the tide for those wanting a stronger Pound.

The Australian Dollar was sold following the RBA's decision where interest rates were left unchanged, which disappointed some in the market who thought another interest rate rise might soon be required owing to the above-expectation inflation print for the first quarter.

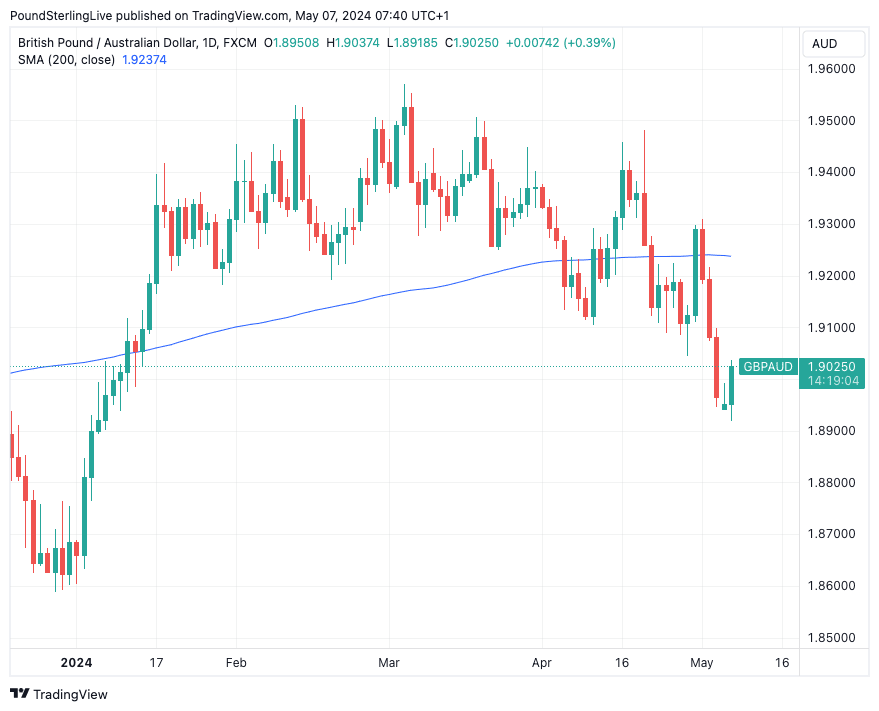

The selloff helped GBP/AUD recover to 1.9025, but significantly more gains will be required to overturn two consecutive weeks of losses totalling more than 1.50%.

In a press conference following the decision, Governor Michelle Bullock was asked why the Bank did not raise interest rates again despite acknowledging inflation is now running ahead of expectations.

"We don't think we necessarily have to tighten again, but we can't rule it out," said Bullock. "If we have to, we will."

But the bar for further action was set high, as Bullock added that for rates to rise again inflation must now print "significantly above" the RBA's forecasts.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

RBA inertia suggests Australians might have to ride out elevated inflation levels for a protracted period as the central bank appears unwilling to risk an economic slowdown.

For the Australian Dollar, this will require markets to lower bets for further rate hikes, which can weigh on the currency.

"AUD/USD fell by around 30 pips to around 0.6600 following the RBA’s on-hold interest rate decision. The RBA did not reinstate their hiking bias as some analysts had expected," says Kristina Clifton, an analyst at Commonwealth Bank of Australia (CBA).

Track GBP/AUD with your own custom rate alerts. Set Up Here

CBA says the first rate cut will come in November because the economy is losing momentum, yet financial markets are still pricing a small chance of another RBA hike.

"If we are correct and the RBA’s next move is a cut, then a repricing of cash rate expectations can weigh on AUD/USD," says Clifton.

Despite the Aussie Dollar's post-RBA weakness, the currency remains one of the better G10 performers of recent weeks which suggests the global background will potentially compensate for any RBA-inspired softness.

The GBP/AUD exchange rate is now in a downturn, and we expect any strength to fade. Only when the pair recovers back above the 200-day moving average (currently at 1.9237) will we call the end of the downtrend, meaning those watching the market should view strength as a counter-trend relief bounce.

Above: GBP/AUD at daily intervals.

The Australian Dollar and other 'risk on' currencies rose sharply last week following revived hopes the U.S. Federal Reserve will cut interest rates in 2024.

A sanguine-sounding Fed Chair Jerome Powell said last Wednesday that the recent rise in inflation was not cause for panic, while Friday's U.S. jobs report was softer than expected.

If the Fed cuts interest rates, assets like commodities and stocks can rally in anticipation of global economic expansion, which is supportive of the Australian Dollar setup.