Australian Dollar in Demand: Bumper Inflation Means RBA Might Only Cut in 2025

- Written by: Gary Howes

Image © Adobe Images

The Australian Dollar is the day's best performer after inflation figures kick the prospect of an interest rate cut at the Reserve Bank of Australia (RBA) further into the distance.

The Pound to Australian Dollar exchange rate fell a third of a per cent to 1.9113 after the ABS said CPI inflation rose 3.6% year-on-year in the first quarter, which is stronger than the 3.4% outturn the market was expecting.

Worryingly for the RBA, the details show inflation has actually accelerated on a q/q basis from 0.6% in Q4 to 1.0% in Q1. Core measures of inflation that the RBA tracks closely also showed signs of increasing price pressures: the weighed mean accelerated from 0.9% to 1.1% q/q while the trimmed mean quickened from 0.8% to 1.0% q/q.

Analysts at TD Bank say they no longer expect an Australian interest rate cut in 2024 owing to a strong labour market, impending tax cuts, ongoing strong migration and the continued rise in energy prices.

TD had previously anticipated a November rate cut but now expects the RBA to deliver its first cut in February 2025. "The RBA is likely to adopt a more hawkish stance, but one that it's loath to act upon," says Prashant Newnaha, Senior Asia-Pacific Rates Strategist at TD Bank.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

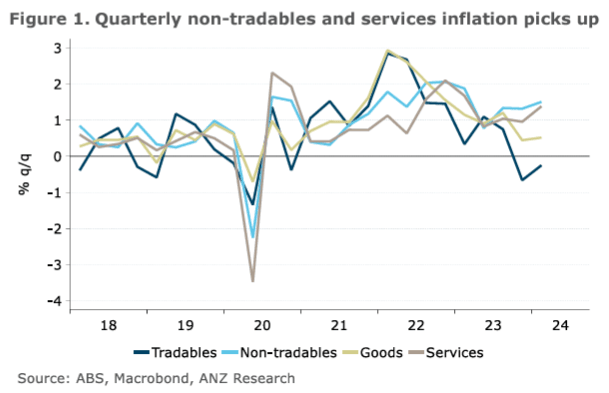

"We think the RBA will want to see a couple of quarters of lower non-tradables and services inflation to be convinced that overall inflation will not only return to the 2–3% target band but remain there," says Catherine Birch, an economist at ANZ Bank. "While our base case remains a November start to RBA rate cuts, today’s Q1 CPI is consistent with the risks around that being skewed towards a later start."

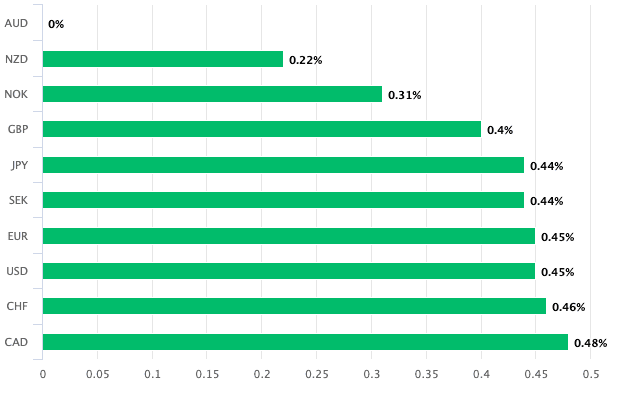

The prospect of a later start to the RBA rate cutting cycle lifted the Australian Dollar across the board, with the currency being the best performer in the G10 on the day. A gain of 0.45% is recorded against the U.S. Dollar and the Euro.

Expectations for higher-for-longer central bank rates mean interest rates on other financial assets and lending products will stay elevated, which the RBA hopes will slow the economy, lower demand and bring inflation down.

Above image courtesy of ANZ.

Higher interest rates also mean Aussie-based financial assets now look increasingly attractive, particularly relative to where interest rates are expected to fall sooner. This creates a flow of capital that can boost the value of the Australian Dollar.

"The yield on the three‑year Australian government bond jumped by 13bp to 4.03%. Interest rate markets are now pricing only a small chance of a sole 25bp rate cut by the end of the year," says Joseph Capurso at Commonwealth Bank of Australia. "AUD/USD jumped above 0.6520."

The currency is looking increasingly attractive, screening as the best performer in the G10 of the past week and the second-best performer of the past month.

Above: AUD performance on April 24. Track AUD with your own custom rate alerts. Set Up Here

CBA's Australian Economics team note the clear risk is a later start date to the easing cycle happening in November versus the current September base case.

"Given the slower progress on disinflation this quarter and the lower starting point for labour market slack, we now expect the first rate cut to occur after the November meeting, rather than September as previously expected. As always, this view is data-dependent and there are risks on both sides of a November timing," says Luci Ellis, Chief Economist at Westpac.