Australian Dollar At Two-week Low As RBA Shuffles Towards Rate Cuts

- Written by: Gary Howes

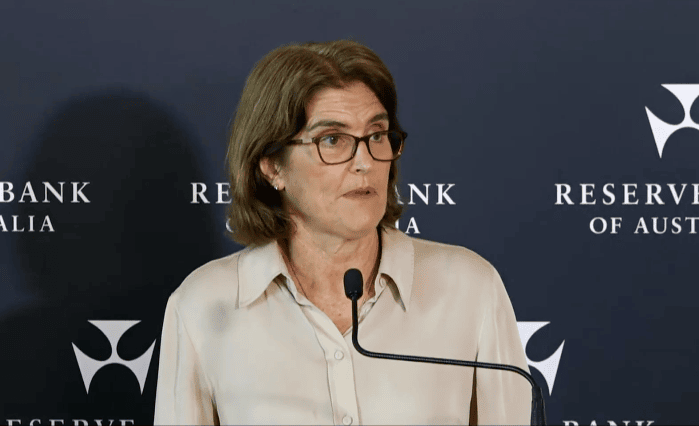

Above: RBA Governor Bullock speaks following the March decision. Image: Pound Sterling Live, RBA.

The Australian Dollar fell after the Reserve Bank of Australia (RBA) kept interest rates unchanged but stepped back from a commitment to raise them again if required.

The decision to keep rates on hold at 4.35% was unremarkable and of little interest to exchange rates; instead, the guidance on future decisions was of interest.

The RBA's decision to weaken a reference to the need to raise interest rates again in the future triggered a sizeable market reaction. This is judged to be a 'dovish' tilt and puts the RBA on course for rate cuts later in the year.

Specifically, February’s RBA statement said, "a further increase in interest rates cannot be ruled out". In March, this line is dropped from the statement and replaced with "the path of interest rates that will best ensure that inflation returns to target in a reasonable timeframe remains uncertain and the Board is not ruling anything in or out".

The Australian Dollar fell two-thirds of a per cent to 0.6519 following the decision.

"In Australia, the RBA kept its policy rate unchanged as expected, but more importantly, it dropped its tightening bias, which suggests the hiking cycle has come to an end. AUD/USD fell to a two-week low on the announcement," says a note from Danske Bank.

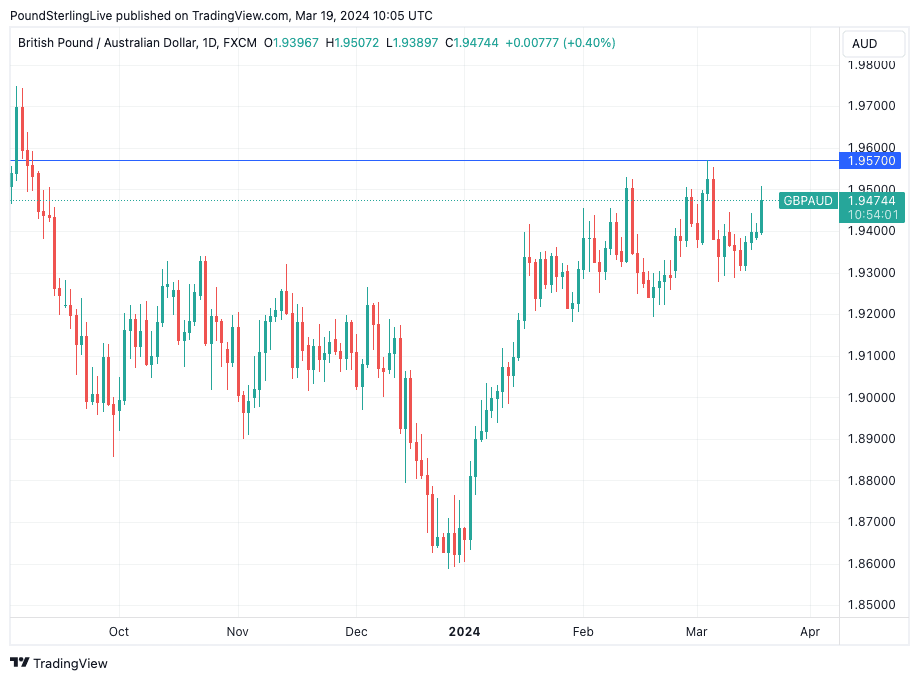

The Pound to Australian Dollar exchange rate rose 0.45% to 1.9492, the Euro to Australian Dollar exchange rate rose half a per cent to 1.6661.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

"On balance we are left concluding it is an evolution and weakening in the bias, rather than a complete dropping altogether," says Adam Boyton, an economist at ANZ. "We continue to favour November for the start of a mild easing cycle".

If ANZ is correct, the RBA will cut interest rates well after its major peers at the ECB, Fed and Bank of England.

This will mean Australian interest rates will look increasingly attractive to global investors, prompting capital to flow into Australia and boost AUD.

Above: GBP/AUD at daily intervals, showing the 2024 high. Track GBP and AUD with your own custom rate alerts. Set Up Here

"That said, the February labour force survey (due this Thursday) and the Q1 CPI (due 24 April) are critical data prints. Should employment on Thursday surprise and again print on the weak side, risks of earlier RBA easing would rise further," says Boyton.

Looking at the money markets, where investors trade complex products in anticipation of future levels in interest rates, we can see a first RBA rate cut is expected as soon as August.

Pricing shows there are around 18 basis points of cuts priced for August, suggesting a 72% likelihood. A 25bps rate cut is fully priced in by September, with 50bp cuts priced for the whole year.