GBP/AUD Rate Uptrend Looks Overcooked, Pullback Looms

- Written by: Gary Howes

Image © Adobe Images

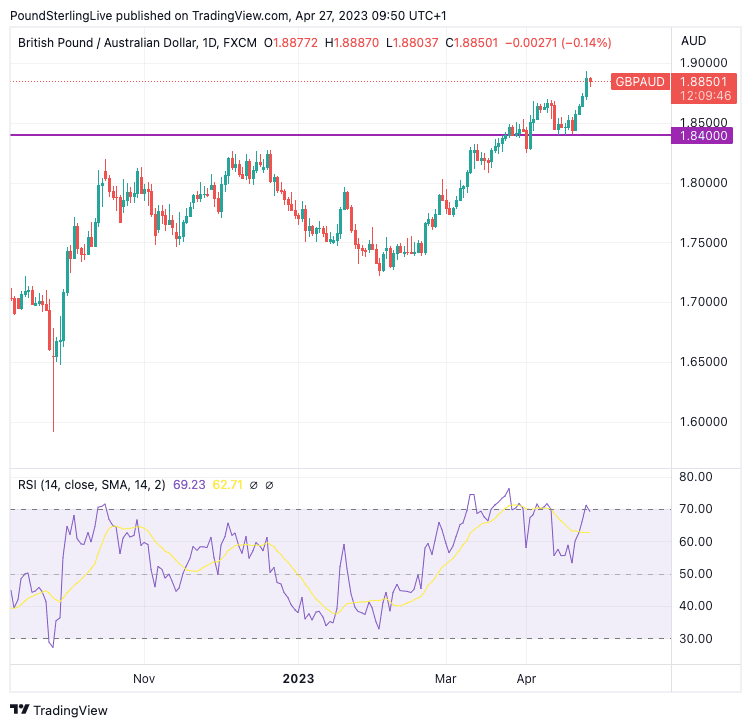

The Pound to Australian Dollar exchange rate (GBP/AUD) is in an uptrend with technical signals suggesting more gains are incoming.

The market has its sights set on the 1.90-1.9050 range, ahead of the January 2022 peak at 1.92.

However, there are concerns that the market will pull back in the near term, as the most recent rally has been rapid and leaves the market overbought.

In particular, the Relative Strength Index breached 70 this week, signalling overbought momentum.

Those watching GBP/AUD could show prudence by anticipating a pullback over the coming days to allow the market to consolidate and rebalance.

Retracement to support at 1.8660 is possible, and a breakdown here would invite a move to 1.84, suggesting that the uptrend has stalled.

Above: GBP/AUD daily, top, with the Relative Strength Index in the lower panel.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

This week, the Australian Dollar faced a setback after headline Australian inflation came in above expectations. CPI inflation rose 7.0% year-on-year in Q1, down from the previous quarter's 7.8% but above consensus for 6.9%.

However, what prompted a slump in the currency was the details of the report which hinted the Reserve Bank of Australia (RBA) will remain on pause.

The trimmed mean inflation reading rose by 1.2% quarter-on-quarter in Q1, which undershot expectations for a reading of 1.4% and represented a sharp slowdown from the previous reading of 1.7%.

This component is of particular interest to the RBA as it gives them a sense of how domestic inflationary pressures are evolving.

The RBA might, therefore, be convinced that it has delivered enough by way of interest rate hikes, prompting markets to pare expectations for further rate rises.

This background context could shape the short-term outlook for the GBP/AUD pair, with a potential pullback on the horizon.

Nevertheless, the uptrend remains intact, and the market could eventually make a push towards the 1.90-1.9050 range.