GBP/AUD Rate Gains in the Wake of Aussie CPI Inflation

- Written by: Gary Howes

Image © Adobe Images

Headline Australian inflation came in above expectations on Wednesday, however, the Australian Dollar slumped as the details of the much-anticipated report were soft and hinted that the Reserve Bank of Australia (RBA) will remain on pause.

CPI inflation rose 7.0% year-on-year in the first quarter, which was down on the previous quarter's 7.8% but above consensus for 6.9%. The quarter-on-quarter reading stood at 1.4%, which was down on 1.9% and above estimates for 1.3%.

But the Pound to Australian Dollar (GBP/AUD) rallied by nearly half a per cent to 1.8814 as it was revealed the trimmed mean inflation reading rose by 1.2% quarter-on-quarter in Q1.

This means it undershot expectations for a reading of 1.4% and represents a sharp slowdown on the previous reading of 1.7%.

The trimmed mean component is of particular interest to the Reserve Bank of Australia as it gives them a sense of how domestic inflationary pressures are evolving.

The RBA might therefore be convinced it has delivered enough by way of interest rate hikes, prompting markets to pare expectations for further rate rises.

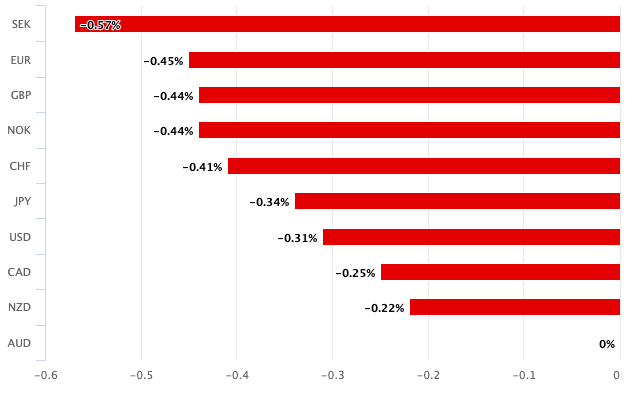

This has weighed on the Australian Dollar across the board:

Above: AUD performance on April 26.

"Most of the key measures and detail were softer though still elevated with some clear stickiness in service sector inflation. For an RBA that is reluctant to tighten much further and prepared to tolerate higher inflation to preserve the labour market gains, today’s data provide an excuse to stay on hold and we remove our final 25bp May hike," says RBC Capital's chief Australian economist.

RBC Capital says clearer signs of a peak in overall inflation, a disinflationary trend in goods, and strength in services prices that the RBA has little influence over will likely see this pause extend.

Pricing for another 25bp RBA hike in May has dropped from 25% pre-CPI (and 32% a few days ago) to only about 9%.

In total, about 20bp has been taken out of the interbank cash rate futures strip to end-2023.

"The data suggest that the RBA will not raise the key rate next week either, but leave it at 3.60%. However, with (core) inflation still well above the 2-3% inflation target, it is likely to maintain the restrictive undertone in its statement and assure that it is ready to do more should it be necessary," says Antje Praefcke, an analyst at Commerzbank.

Nevertheless, the market expects the RBA to cut interest rates towards the third quarter, an expectation that could weigh on the Aussie Dollar going forward.

"Economic data will again attract more attention: if they indicate a slowdown in the economy, the market could strengthen its rate cut expectations and pull them forward in time, which should weigh on the AUD," says Praefcke.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes