Australian Dollar: Lowe Signals it's Time to Slowdown, Trade Balance Plummets

- Written by: Gary Howes

- AUD trading softer

- Lowe's speech in focus

- RBA to slow rate hiking cycle

- As Aussie trade balance declines

Above: File image of governor Lowe. Image © Crawford Forum, Reproduced Under CC Licensing

Governor Philip Lowe confirmed the Reserve Bank of Australia (RBA) is nearing the end of its interest rate hiking cycle, leading to a lower Australian Dollar.

Further pressure on the Aussie meanwhile came from data showing the country's stellar trade surplus plummeted in July.

Lowe told an audience at the Anika Foundation there was a case for a slower pace of rate hikes as the cash rate rises, saying “all else equal, the case for a slower pace of increase in interest rates becomes stronger as the level of the cash rate rises”.

"How high interest rates need to go and how quickly we get there will depend on incoming data and the evolving outlook for inflation and the labour market," he added.

The comments follow Tuesday's RBA decision to hike interest rates by 50 basis points. Pound Sterling Live reported at the time the guidance coming from the RBA suggested the central bank was ready to slowdown.

Lowe's comments offer concrete evidence this is indeed the case.

"AUD is underperforming in otherwise quiet overnight markets after dovish comments from RBA Governor Lowe, suggesting the pace of hikes may slow in the coming months," says Adam Cole, Chief Currency Strategist at RBC Capital Markets.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Lowe said the RBA could afford to slow down due to differences in wage setting behaviour in Australia compared to the U.S.

The U.S. Federal Reserve is expected to deliver another 75 basis point hike on September 21 and is often seen as setting the pace for other central banks in a quest to raise interest rates to fight inflation.

Following the speech economists at Australian lender ANZ said they have updated our forecasts based on RBA rhetoric from this week and their expectations of the data:

- 50bp hike in October (to 2.85%) – unchanged from our earlier expectations

- 25bp hike in November (to 3.1%) – down from 50bp • 25bp in December (to 3.35%)

"We acknowledge that there is a considerable risk that the RBA could slow its hiking to 25bp in October, in which case we would expect an additional 25bp hike early next year, leaving the terminal rate at 3.35%," says Adelaide Timbrell, Senior economist at ANZ.

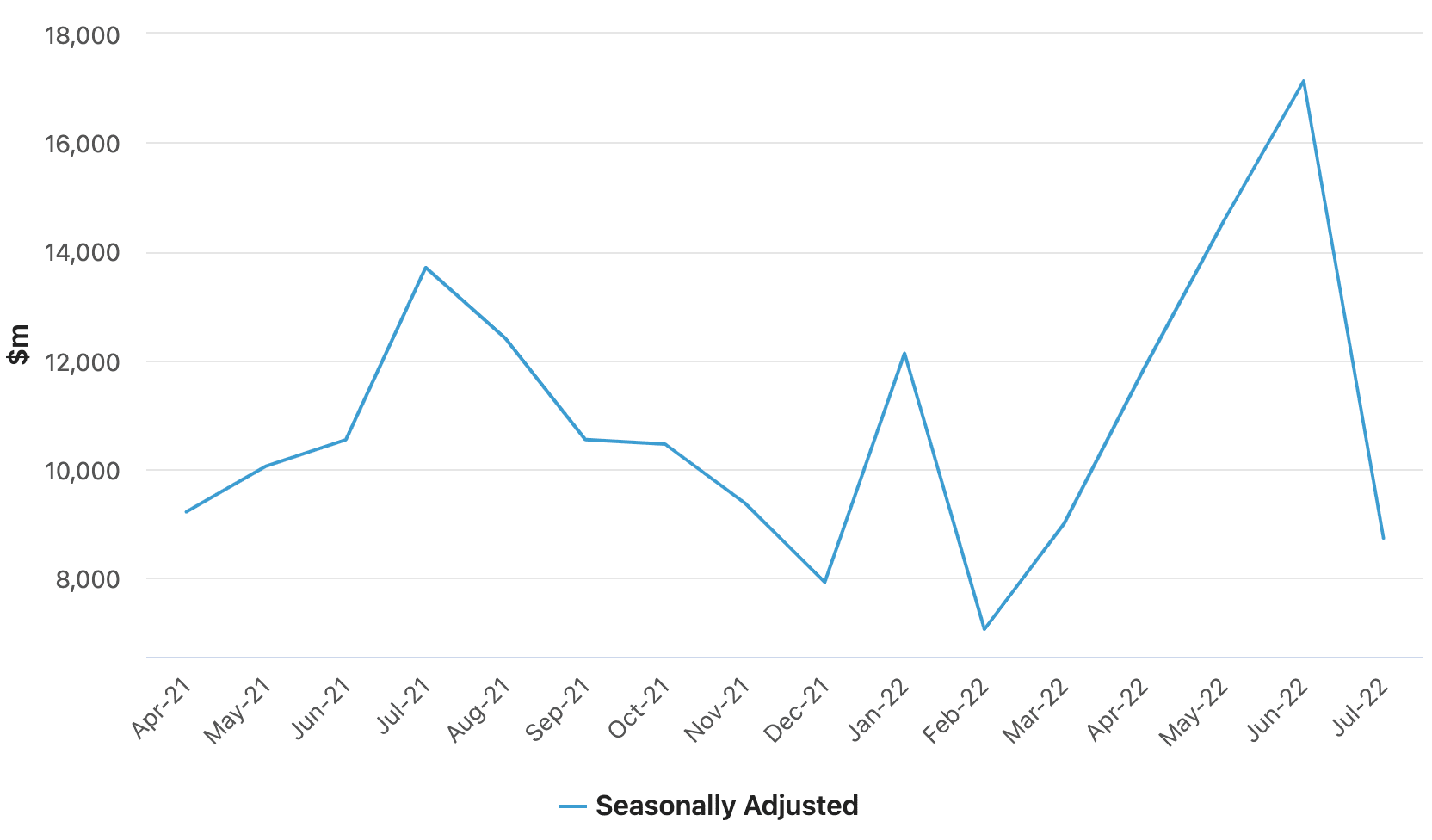

Lowe also noted Australia's July trade surplus also came in smaller than expected.

Australia reported the seasonally adjusted balance on goods and services surplus decreased A$8,398m to A$8,733m in July.

The trade balance is a key fundamental support for the Australian Dollar as it suggests the country earns more in foreign currency than it spends.

This offers a compelling supply and demand dynamic that has meant the Aussie is one of the best performing currencies of 2022.

But a decline in the positive trade balance challenges this.

The ABS said goods and services exports fell $6,077m (9.9%) to $55,282m, driven by falls in export values of coal, metals ores and minerals.

Above: Australia's trade balance has fallen sharply. Image source: ABS.

Following the developments the Australian to U.S. Dollar exchange rate was lower at 0.6740, the Pound to Australian Dollar (GBP/AUD) higher at 1.7076.

GBP/AUD has been consolidating for much of September following months of declines that accelerated in the wake of Russia's invasion of Ukraine.

The surge in commodity prices boosted Australia's terms of trade while negatively impacting that of the UK.

This confirms that a key story of 2022 has been relative trade dynamics, with those countries able to export seeing their currencies better supported.

Given today's data perhaps this trend is losing its lustre.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes