Australian Dollar: RBA Nears the End of its Rate Hike Cycle

- Written by: Gary Howes

Image © Adobe Images

The Australian Dollar was a cast adrift following another 50 basis point interest rate hike at the Reserve Bank of Australia (RBA) thatch alongside signs the central bank is nearing the end of its tightening cycle.

The RBA met market expectations by hiking 50 basis points and committed to further rate hikes in its guidance.

However, in a statement the RBA acknowledged "higher inflation and higher interest rates are putting pressure on household budgets, with the full effects of higher interest rates yet to be felt in mortgage payments".

This is a signal from the Bank that it believes it is nearing a point at which it can ease back on hiking interest rates given the full effect of recent actions are yet to be fully felt.

"At this stage, our Australian economics team continue to expect one further 25bp rate hike that will take the cash rate to a peak of 2.60% with a risk of a higher peak of 2.85%," says strategist Carol Kong at Commonwealth Bank of Australia.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

Pound Sterling Live's RBA preview found that a 50 basis point hike would offer little support to the Aussie and that it was the guidance concerning further hikes that would matter for the currency.

We noted that a 'dovish' hike, one where the Bank sought to cool expectations for further aggressive action, might weigh on the Aussie Dollar.

This appears to have been the outcome with the Australian Dollar staying flat against the U.S. Dollar at $0.6813; to be sure this is an underperformance given the broader decline in the U.S. Dollar.

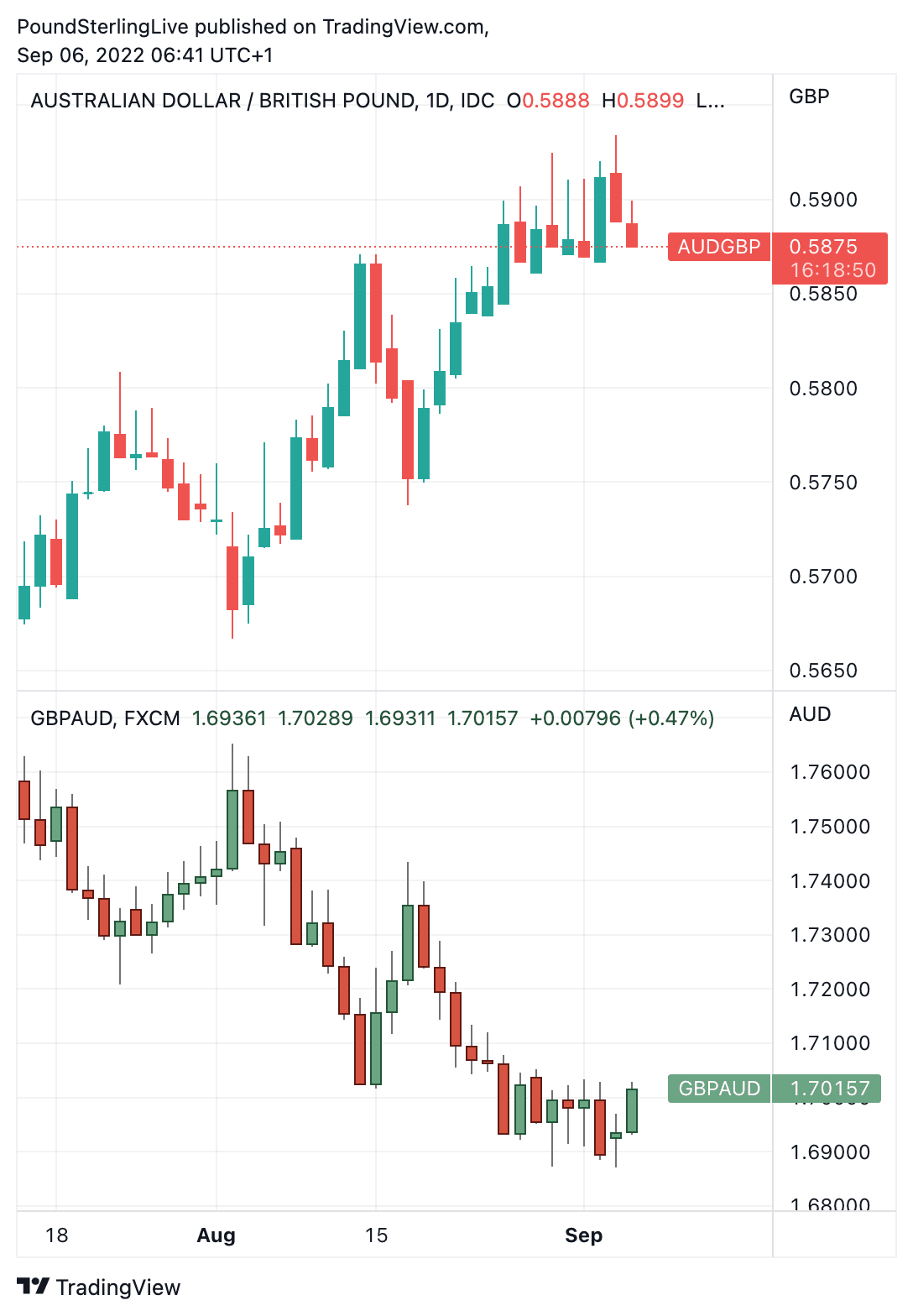

The Pound to Australian Dollar exchange rate is higher at 1.7013 as it defends the floor at around 1.69. Bank accounts are seen offering Aussie dollars at around 1.6538 and payment specialists at 1.6960.

Above: AUD/USD (top) and GBP/AUD (bottom) at daily intervals. Set your FX rate alert here.

By increasing the Cash Rate to 2.35% the RBA takes Australia's basic lending rate into a band of 2-3% that it considers to be the 'neutral' point.

This means it views interest rates as being neither stimulatory or constrictive, further adding weight to the view the RBA could start considering easing back.

"Together with removing the reference to ‘a further step in the normalization of policy’ and replacing it with noting this further increase would 'help bring inflation back to target' and that 'the full effects of higher interest rates yet to be felt in mortgage payments', these look like subtle hints that the pace of tightening may ease in the coming months (which is our base case)," says Elsa Lignos, Global Head of FX Strategy at RBC Capital Markets.

Looking ahead, strategists at Westpac say domestic and RBA issues are less likely to impact on the Australian Dollar, instead the focus would be global.

"AUD/USD swings have been largely driven by the US dollar mood and equity sentiment, linked to the outlook for global growth and commodities. Near term, we see the renewed squeeze on net energy importers such as Europe and North Asia as likely to keep a lid on global risk appetite and thus expect the A$ to slip towards another test of the July lows around 0.6680, with rallies capped in the 0.6850/90 zone," says Sean Callow, a foreign exchange strategist at Westpac.

In particular, investors will trade the Aussie according to the latest developments in China where authorities continue their battle against Covid.

The major centres of Chengdu and Shenzhen are locked down and. Reports suggest more than 30 cities have been fully or partially locked down.

This will likely continue to constrain Chinese economic activity, denting demand for Australian exports and potentially capping the Aussie, which has thus far been one of 2022's better performers.

"Rates may now increase at a slower pace over the remainder of the year, and AUD may struggle to recover amid external challenges," says Francesco Pesole, FX Strategist at ING Bank.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes