Westpac Forecasts Pound Weakness against Australian Dollar, But says Major Break Below 1.70 Unlikely

- Written by: Gary Howes

Image © Adobe Stock

The Australian Dollar will likely remain preferred to the British Pound for the foreseeable future, but a break below a key level looks unlikely says Westpac who reckon much of the UK's energy shock is 'in the price'.

The Australian bank have updated clients with their latest views and expectations for the Pound to Australian Dollar exchange rate (GBP/AUD), which has already fallen 8.0% in 2022.

The majority of gains were sustained in the immediate wake of Russia's invasion of Ukraine, but recently the pair has begun to see downside pressures build up once again.

"GBP/AUD fell steeply in the wake of Russia’s invasion of Ukraine on 24 February, from about 1.87 to as low as 1.72 on 5 April. This slide arguably priced in most of the terms of trade shock of soaring energy prices which hits the UK hard but benefits Australia," says Robert Rennie, Head of FM Strategy at Westpac.

"Australia is a massive net exporter of energy products, already running record trade surpluses. Westpac forecasts GDP growth of 4.4% over 2022 and a current account surplus of >1% of GDP versus UK deficits running around -5% of GDP," he adds.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

With UK inflation already reaching 10.1% year-on-year in July, Westpac anticipates the Bank of England to hike interest rates further, noting the market now prices Bank Rate to rise from 1.75% to 3.20% by year-end.

The Bank of England will continue to hike interest rates as they forecast inflation to go as high as 13% as the impact of the latest rises in gas prices feeds into UK consumer bills.

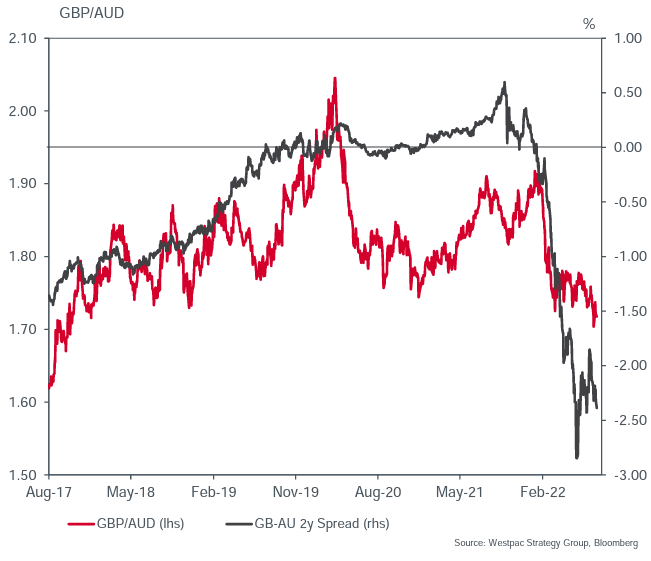

Higher interest rate expectations are meanwhile reflected in bond markets were yields continue to rise. However, Australian yields are seen to be climbing faster than those of the UK and this should keep GBP/AUD under pressure.

"But markets are also pricing in aggressive RBA tightening, to a cash rate of 3.23% by end-2022. The AU yield pickup versus GBP reached multi-year highs in June. This A$ yield support should weigh GBP/AUD multimonth," says Rennie.

Above: "GBP 2 year swap premium over AUD disappeared this year" - Westpac.

However, Westpac don't see a catalyst for a sustained break below 1.70 right now.

Their base case for the exchange rate by the third quarter remains at 1.72, "with the energy price and relative growth stories probably priced in".

Furthermore, the Aussie Dollar is expected to be hampered by concerns over China's economic and global growth trajectories.

This should underpin the pair.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes