GBP/AUD Rate Forecast to Remain Under Pressure

- Written by: Gary Howes

Image © Adobe Images

The Australian Dollar is set to remain favoured against the British Pound over coming days amidst the Pound's deteriorating position against the U.S. Dollar and a clear fundamental thesis that favours the commodity rich Australia over the UK.

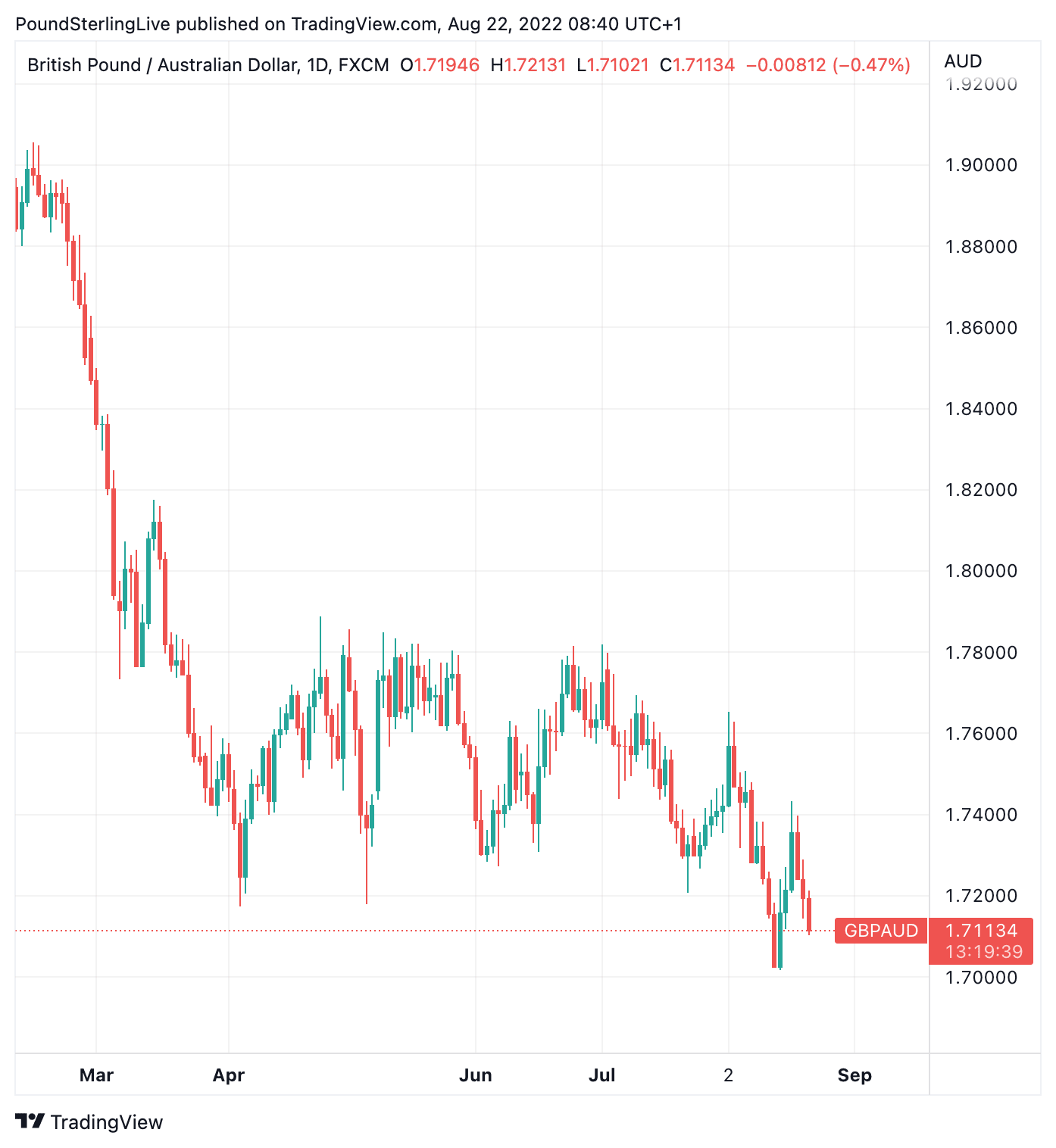

A brief rally in the Pound to Australian Dollar exchange rate (GBP/AUD) took place last week but has ultimately faltered, suggesting downside pressures are to build once again and serving a reminder that any upticks are likely to remain brief.

GBP/AUD rose to 1.7433 last week after the Aussie Dollar suffered weakness linked to a softer than expected jobs report and softer than expected Chinese economic numbers.

The exchange rate has since pared these gains and is now lower again at 1.711; the 2022 low is located close by at 1.7027.

Above: GBP/AUD at daily intervals, showing ongoing weakness that is favoured to extent. Set your FX alert here and get notified of any developments.

The movement in GBP/AUD is symptomatic of a broader malaise facing the Pound which is weak across the board and looks close to capitulation against the U.S. Dollar.

The Pound-Dollar exchange rate (GBP/USD) is probing multi-year lows near 1.1792 and a breakdown lower looks possible, in price action that somewhat reflects GBP/AUD's probe of multi-month lows:

Above: GBP/USD at daily intervals showing a major breakdown is at hand. This could determine future action in GBP/AUD.

Should a breakdown in GBP/USD occur then GBP/AUD would also likely follow suit and will print fresh lows; indeed, the USD could be the key determinant to any further developments in GBP/AUD.

The Dollar's recent comeback is meanwhile a reflection of a creeping anxiety that has returned to markets as investors discount an ongoing global economic slowdown that has its roots in Europe's energy crisis and China's property-lead and zero-lockdown fuelled economic slowdown.

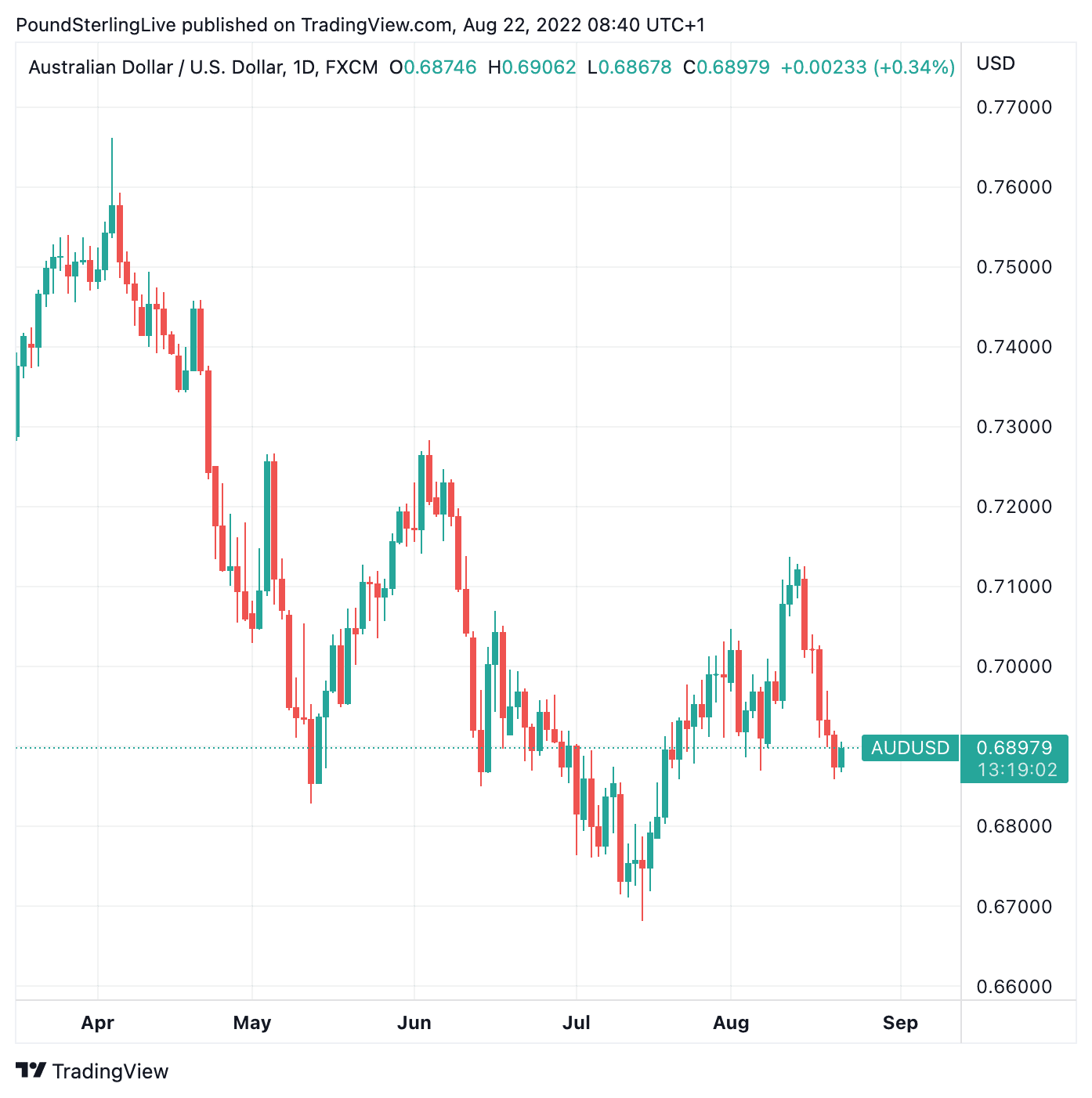

As such the Australian Dollar has itself come under pressure against the U.S. Dollar of late. However, weakness in the Aussie against the Dollar (AUD/USD) is less severe than that seen in GBP/USD, which implies GBP/AUD underperformance.

Above: AUD/USD is under pressure again, but is losing ground at a lesser pace than GBP/USD, ensuring a mechanical decline in GBP/AUD.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes

"We expect AUDUSD to track the broad USD more closely, after its underperformance last week, with a relatively light data week providing no domestic triggers. Downside risks persist as equity risk sentiment appears vulnerable and weak China data adds to headwinds," says a weekly currency market strategy note from Barclays.

Stepping away from the technical elements of cross-currency flows, from a fundamental perspective it makes sense to back the Aussie against the Pound:

1) the world is in the throes of a commodity crisis, with the currencies of net importers being punished by those of net exporters

2) GBP is a net energy and commodity importer, Australia is an exporter

3) Australia continues to print record trade surpluses

4) The UK is registering deeper Balance of Payment deficits

"We remain constructive on AUD, particularly on the crosses," says Patrick R Locke, FX Strategist at JP Morgan. "Terms of trade gains that should be AUD-positive, particularly in energy exports."

The UK's inflation shock just gets worse as energy prices in Europe and the UK continue a relentless climb higher.

Rupert Harrison, a portfolio manager at BlackRock, says UK and European gas and power prices continue rising to "truly scary levels".

"The Government will have to act on a very large scale to support households, especially those on lower incomes - and also probably small businesses," he says, adding:

"The scale of this shock is hard to overstate."

On Monday a research note from Citi said UK inflation would now likely peak at a scarcely-believeable 18%, assuming the government takes no further steps to intervene.

The call comes days after GfK's measure of UK consumer confidence fell to an all-time low according to a release out Friday, confirming a bleak winter awaits the UK economy.

GfK said, "the crisis of confidence will only worsen with the darkening days of autumn and the colder months of winter".

Although Australia is also seeing energy price rises and upside inflation pressures they pale in comparison to those of Europe and the UK.

This is allowing the market to bet Australia is nearing its inflation spike which should allow for better real GDP growth rates compared to the UK and Europe.

Compare GBP to AUD Exchange Rates

Find out how much you could save on your pound to Australian dollar transfer

Potential saving vs high street banks:

A$4,875.00

Free • No obligation • Takes 2 minutes