Australian Dollar Forecast to Remain Under Pressure by Morgan Stanley, Cite Fundamentally Dovish RBA

- Written by: Gary Howes

- Morgan Stanley stay bearish AUD

- RBA won't shift in AUD-supportive mode

- AUD/USD forecast at 0.77

- GBP/AUD forecast towards 1.81

- GBP/AUD reference rates at publication:

- Spot: 1.8366

- Bank transfer rates (indicative guide): 1.7723-1.7850

- Money transfer specialist rates (indicative): 1.8200-1.8237

- More information on securing specialist rates, here

- Set up an exchange rate alert, here

Foreign exchange analysts at Wall Street banking giant Morgan Stanley aren't convinced the Reserve Bank of Australia will become a source of upside impetus for the Australian Dollar in the foreseeable future.

"The RBA remains a fundamentally-dovish central bank," says David S. Adams, Head of North America G10 FX Strategy at Morgan Stanley in a recent research briefing note.

The call underpins a view by the investment bank that the Australian Dollar is likely to remain under pressure for over coming months, particularly as other central banks initiate more 'hawkish' policy outlooks.

The U.S. Federal Reserve on Wednesday June 17 initiated a sharp rise in the value of the U.S. Dollar after policy setters said they may now be minded to begin lifting U.S. interest rates as soon as the end of 2023 rather than in 2024.

The rise in the U.S. Dollar was met with a fall in the Australian Dollar by over a percent with declines not just being felt against the U.S. Dollar but against other majors.

Indeed, the Pound-to-Australian Dollar exchange rate rose by a third of a percent to quote back at 1.84.

The RBA's 'dovish' credentials will come under increasing scrutiny as the RBA approaches a July decision to "top-up" its quantitative easing programme, which could well set the tone for the Australian Dollar over the remainder of 2021.

Secure a retail exchange rate that is between 3-5% stronger than offered by leading banks, learn more.

The RBA is engaged in a form of quantitative easing known as yield curve control (YCC) established during the Covid crisis of 2020 when the RBA sought to lower the cost of finance right across the financial system in order to support the Aussie.

This was achieved by buying up Australian government bonds, creating a demand that mechanically lowers the yield those bonds pay. The RBA uses this form of quantitative easing to keep the yield paid on bonds (effectively the interest) capped at 0.10%, this in turn keeps the cost of borrowing right across the financial spectrum low.

In February the RBA said it would supply an additional A$100BN to the economy by September via its quantitative easing programme.

With just three months remaining before this envelope is exhausted, another decision must be made.

The RBA is therefore expected to initiate a change to its quantitative easing programme come July.

Economists at ANZ Bank say they don't expect the RBA to announce another quantitative easing envelope to replace the soon-to-expire A$100BN, instead they say the RBA will opt to conduct weekly purchases.

"We now expect the RBA to announce a shift to ‘flexible’ QE that entails no set total and starts at a weekly amount of AUD5bn that will be reviewed before year end," says David Plank, Head of Australian Economics at ANZ.

{wbamp-hide start} {wbamp-hide end}{wbamp-show start}{wbamp-show end}

This will afford the RBA more flexibility in ending the quantitative easing programme. We noted in this report that the market might assume this to be a 'hawkish' signal for the Australian Dollar as the RBA would be effectively reducing the scale of its quantitative easing programme.

But, Morgan Stanley's Adams says this flexibility cuts both ways as it can allow the RBA to enhance its quantitative easing programme if need be.

"In the grand scheme of things, the RBA has plenty of tools to be dovish – and we think it is dovish at heart," says Adams.

The RBA has said it intends to raise inflation to the 2.0% target on a sustainable basis by raising the employment rate to around 4% and ensuring wage growth trends around 3%.

Therefore support will be offered to the economy via quantitative easing and low interest rates for as long as required to achieve these goals.

"We think its ultimate goal is similar to that of the Fed – generate a tight labor market, raise incomes, and generate sustainably higher inflation," says Adams.

Morgan Stanley's economists believe the RBA recognises the challenges of household deleveraging and, by keeping front-end rates low for longer they can ensure mortgage rates remain low too.

"If debt service costs are outpaced by wage growth, then households can build up savings without having to reduce consumption," says Adams.

Based on the where they see the RBA moving the team at Morgan Stanley say in a research briefing that they continue to see scope for Australian Dollar structural underperformance over time, against the U.S. Dollar and other currencies.

After all, interest rates in Australia matter greatly for the Australian Dollar: the record highs of the early 2010s coincided with a period when rates at the RBA were the highest in the developed world.

The high returns on monetary assets in Australia created a strong demand from international investors which in turn bid the value of the currency higher.

With interest rates in Australia now low, and the RBA unlikely to shift stance, the Aussie Dollar might find itself lacking support from its central bank.

"A dovish RBAis AUD negative all else equal, a fairly straightforward thesis," says Adams.

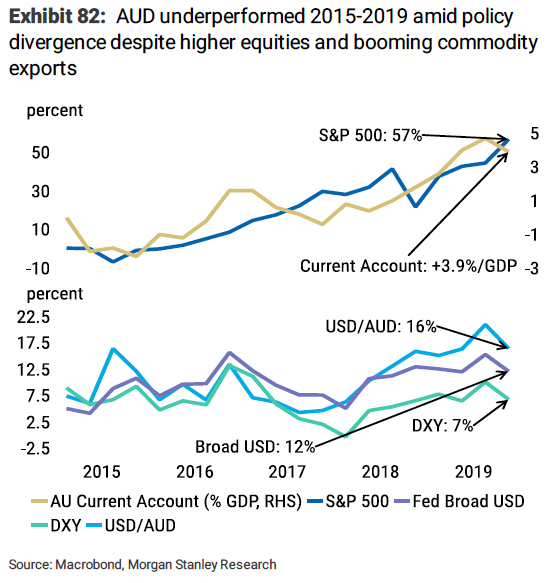

Morgan Stanley observe that commodity prices and exports boomed in 2019, alongside higher equities and abating trade tensions, which they say would have typically been AUD positive.

"Yet AUD not only weakened (not strengthened), it actually underperformed even more than other currencies relative to the USD. This is clear evidence that RBA policy divergence, when it comes front and center, is a powerful theme," says Adams.

Morgan Stanley forecast the Australian-to-U.S. Dollar exchange rate at 0.77 by the end of 2021 and 0.75 by mid-2022.

Their GBP/USD forecast is set at 1.40 and 1.41 for these respective target dates, giving a cross forecast for the Pound-to-Australian Dollar exchange rate of 1.8181 and 1.88.