Pound Hits Exhaustion Point Against South African Rand, ZAR Sell-Off seen as Overdone

Image © Natanael Ginting, Adobe Stock

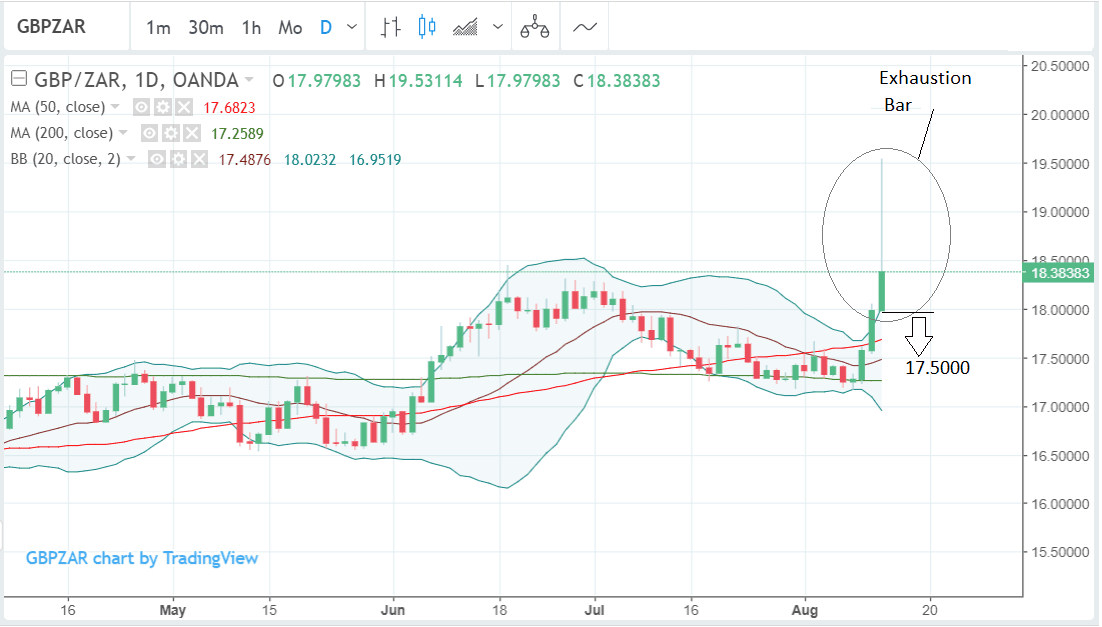

- GBP/ZAR surges on emerging market safety concerns

- But, chart forms an exhaustion bar which indicates potential downside

- For the Rand, macro themes are the main driver going forward

The Pound-to-South African Rand exchange rate surged to hit a multi-month best at 19.59 in the early hours of Monday, August 14 as the Rand collapsed in illiquid Asian markets which served to amplify concerns relating to the Turkish financial crisis.

The South African Rand and Turkish Lira sit in the same 'emerging market' currency basket and there is often a transmission mechanism when one of those currencies in the basket comes under stress.

That some of this stress played out during early Asian where currency liquidity can often be in short supply will have caused something of a 'flash crash'.

The GBP/ZAR pair rose from an open price of 17.98 to a high of 19.53 but has since fallen back down to 18.00 at the time of writing on Tuesday, confirming the move might have been overdone.

The pair has formed a high probability bearish exhaustion bar in the process of spiking higher which indicates the exchange rate will probably fall. A conservative target would be at the 20-day MA at 17.50.

The exhaustion bar formed well outside the upper bollinger band on the daily chart and this increases the chances of a reaction back down towards the middle of the band where the 20-day MA is situated.

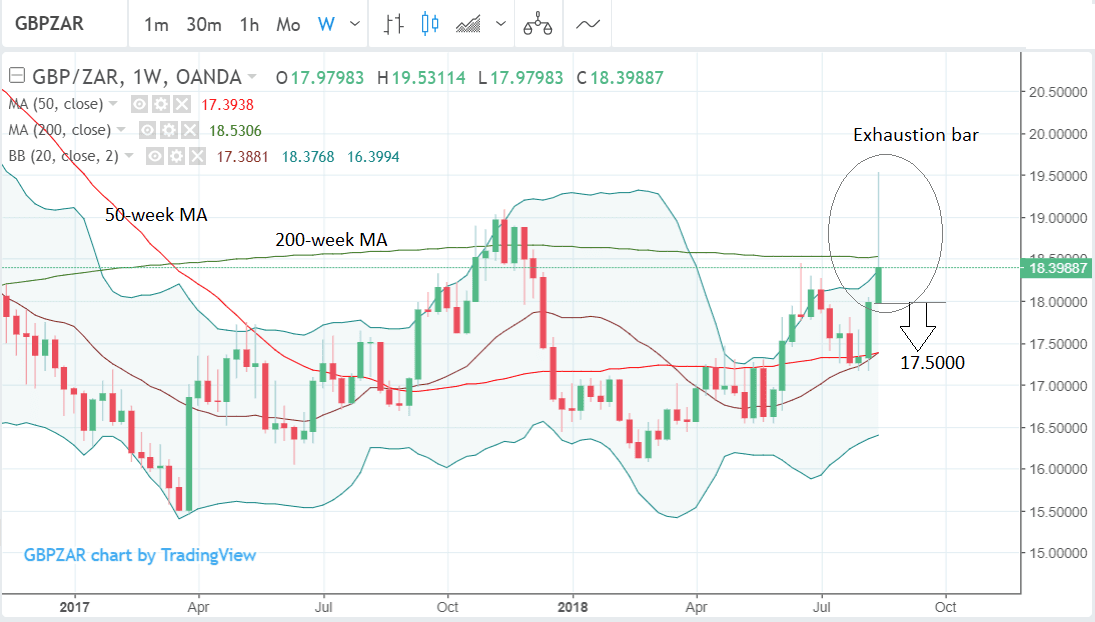

The weekly price chart is showing the same set-up, with a long price bar which has over half its length exposed above the upper bollinger band - providing further confirmation of upside exhaustion and a probable move back down to within the bands.

A break below the lows of the day as they stand, at 17.98, would signal a continuation lower, to the 17.50 target.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Sell-Off Overdone

It appears markets are fast reversing the worst excesses of the recent ZAR selloff.

The Rand has felt the full intensity of the Turkish crisis, at one stage having fallen nearly 5% against the Pound over the past five days and nearly 6% against the Dollar.

Analysts at RMB in Johannesburg note ZAR has been hit harder than its developing nation contemporaries and blame South Africa's own domestic concerns for the added pain.

Indeed, analyst John Cairn at RMB says "the underperformance must/will be attributed to local issues, but while there are enough problems to which to allude, the Rand weakness does feel overdone."

Studies by RMB shows that the recent weakness saw ZAR push weaker than its long-term PPP fair-value level.

Therefore, an argument can be made that any deviation from fair-value is not liable to be sustainable.

However, what is for sure is that volatility in this currency is a major feature to consider.

"The Rand is now pricing extreme short-term volatility and higher-than-normal volatility over the next few months and even the next year (three-month volatility is at 22% as against the long-term average of around 16%)," says Cairns.

And, "that the sharp rise in Rand risk reversals (three-month 25-delta) has, from under 3% a week ago, gone to almost 5%, shows the market is now pricing that there is a much stronger probability of sharp Rand weakness rather than sharp Rand strength," adds the analyst.

So while ZAR might be stabilising near-term, markets clearly remain nervous with the balance of probabilities on the next major move pointed lower.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here