Support Factors for South African Rand Are Gaining Strength, says Nedbank

- Written by: Gary Howes

Image © Adobe Images

One of South Africa's biggest lenders says the factors that can support the South African Rand are growing in strength.

Nedbank says there is good reason to believe the rand will find support on bouts of weakness going forward.

The view follows this week's budget statement, the first by South Africa's coalition government, which disappointed financial markets.

"While the Medium-term Budget Policy Statement (MTBPS) this week may have disappointed the market, the outcome of the key fiscal policy inputs into our bond and currency views moved closer to our own expectations. As such, we do not change our rand view," says Walter De Wet, an analyst at Nedbank.

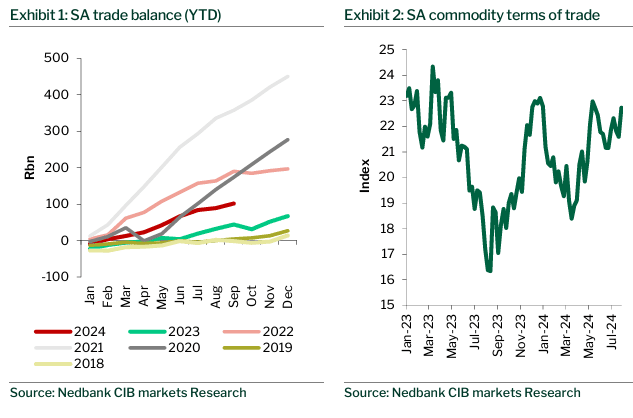

De Wet says one support factor for the Rand going forward is the development of South Africa's trade balance, which continues to outperform expectations.

The year-to-date trade surplus is now outpacing levels seen last year and is on track to mirror levels last seen in 2022.

"At the same time, South Africa’s commodities terms of trade is of the low levels seen in mid-2023 and ahead of the general elections earlier this year. The stronger terms of trade is aided by higher gold prices and lower oil prices," explains De Wet.

"This does suggest that the rand remains better supported than was earlier this year and for most of last year when the currency traded well above the 18,00 level and often above 19,00. This also adds to our narrative that weakness in the rand, as we saw this week, is likely to fade," he adds.

Nedbank's fair value range for the Dollar-Rand exchange rate remains at 17.00-17.25.

"We expect a period of consolidation in the currency around our FV range. Our bias remains for an eventual break lower in the USDZAR," says De Wet.