South African Rand: Analysts Wary of Yet Further Losses Near-Term

- Written by: James Skinner

- ZAR hits 2 Yr low as Turkish crisis rolls on, drives investor exodus.

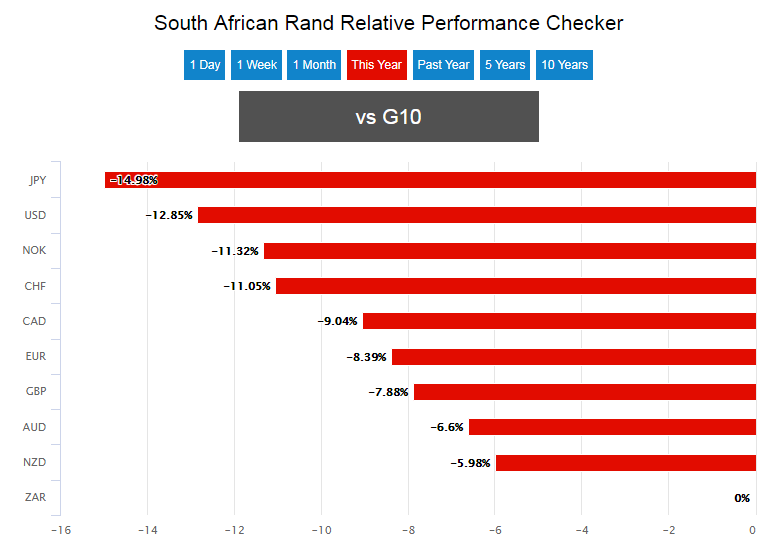

- ZAR losses top 15% for 2018, bringing SARB and rate hikes into play.

- Analysts say ZAR weakness to be short-lived, rate hikes not necessary.

© Comugnero Silvana, Adobe Stock

The Rand hit a two-year low Monday amid ongoing concerns about a possible Turkish financial crisis that is driving an exodus of investors from emerging market economies, and analysts are uncertain as to whether it lthough analysts say the currency should stabilise itself over coming days.

South Africa's currency slumped by more than 10% during the overnight session, ahead of the London morning Monday, as the Turkish crisis entered another week and traders responded by dumping all emerging market assets.

USD/ZAR traded as high as 15.36 momentarily and although the it quickly pared back much of this move, to trade around 2.5% higher in the London noon, the Rand is now down by 15% in 2018 and has crossed a landmark threshold.

The Pound-to-Rand rate also hit a two-year high of 19.50 before paring gains to trade just 1.30% higher at 18.18.

Such a sharp fall in the currency will make imported goods like oil more expensive to buy, pushing up inflation, and could now have implications for South African monetary policy.

"This morning’s initial Rand weakness came in very early Asian trade when liquidity would have been extremely thin. As such, these moves do not represent a fair assessment of where the rand should be trading," says John Cairns, a currency economist at Rand Merchant Bank (RMB). "The Rand’s movements will be influenced by further bouts of risk aversion caused by Turkey."

Above: USD/ZAR rate shown at weekly intervals.

Turkey's Lira has been clobbered on currency markets, falling 17% on Friday and by 82% against the US Dollar this year, as markets fret over an escalating dispute between Ankara and Washington, a politically compromised central bank and deteriorating economic fundamentals.

The currency has been in free-fall ever since it became clear government is preventing the central bank from raising interest rates, despite runaway levels of inflation. Inflation, which reduces real GDP growth, is now being made far worse by the substantial fall in the currency, which is making imported goods more expensive to buy.

With Turkey's President still thought to be tying the central bank's hands, preventing it from raising rates, the Lira fell another 10% Monday. This is raising the cost of servicing Turkey's overseas debts, both government and private, which is in turn leading to fears of a possible Turkish default. These fears have implications for other emerging markets too.

"Foreigners sold -R5.2bn worth of SA bonds net of purchases on Friday alone last week, with negligible net purchases of equities in comparison (R0.2bn) on the day. Concerns around Turkey’s refusal to hike its interest rates in a high inflation environment, despite its plunging Lira, and risk of full scale financial meltdown, has led to risk-off for many emerging market financial assets," says Annabel Bishop, chief economist at Investec Bank.

Bond yields are falling in the US while rising in Turkey, South Africa and other emerging markets. This is a classic sign that investors are selling their riskier emerging market bonds and rotating into safe-havens such as US Treasuries, pushing up emerging market borrowing costs at the same time.

"Global risk aversion has clearly risen, and markets will likely continue to factor in the impact of the high US core inflation print on Fed monetary policy, as well as the crisis in Turkey. The Rand may move weaker than R14.50/USD in the immediate term, although this is a significant resistance level for the domestic currency," Bishop writes.

Above: Pound-to-Rand rate shown at weekly intervals.

The fact the Rand has already probed its way into near-uncharted territory once already may be a sign of things to come for the South African currency.

It was already under pressure from investor fears over the impact President Donald Trump's "trade war" will have on the global economy, concerns about President Cyril Ramaphosa's controversial land reforms and a weakening economy. Now, international investors have even less reason to want to hold the currency.

"The Rand could move towards R14.75/USD this week if it convincingly breaks through R14.50/USD. However, Turkey has started implementing some measures today to shore up its banking sector, and further measures to reduce its crisis would cause EM currency weakness to abate (if risk aversion does not rise from another source)," Bishop warns.

The outlook for South Africa's currency and economy is far from clear, but one thing that is for certain is that the point when the South African Reserve Bank (SARB) is forced to step in with its own interest rate rises, in order to support the currency, may be drawing closer.

South African inflation rose less than was expected in June, but SARB governor Lesetja Kganyago warned of "upside risks" to the inflation outlook back in July, citing a range of domestic factors as well as events in the offshore environment, which included a strong US Dollar and rising oil prices.

The SARB had cut its interest rate from 6.75% to 6.5% back in February and has held it there ever since. But J.P. Morgan strategists wrote last month that another USD/ZAR move above the 14.0 level would likely serve as the trigger for an interest rate rise.

Changes in interest rates, or hints of them being in the cards, are only made in response to movements in inflation but impact currencies because of the push and pull influence they have on international capital flows and their allure for short-term speculators.

"The rand’s weakness will be inflationary – but is unlikely to force the SARB to hike," says RMB's Cairns. "However, if the USD/ZAR did spiral out of control again this week, and it remained closer to 15.00 we expect the SARB would eventually be forced to take some action. However, we think this is unlikely."

Above: South African Rand 2018 performance against G10 before Monday's open.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here