South African Rand Surges vs Sterling as Zuma No-Confidence Vote to be Held in Secret

The Pound to Rand exchange rate has slumped by 1.25% to reach 17.26 in the wake of news the South African Parliament will hold a secret ballot on whether or not President Jacob Zuma should remain at the helm of the country.

The Parliament will vote on a motion of no-confidence in Zuma; the market reaction suggests traders believe the choice to use a secret ballot heightens the chance of lawmakers from the ruling ANC voting against their leader.

The strong reaction of the Rand suggests traders believe there is a chance the no-confidence vote could pass and a more market-friendly leader for the country beckons.

Speaker Baleka Mbete made the ruling after opposition parties took the case to the Constitutional Court.

Should the motion of no confidence succeed Mbete will become interim President of South Africa for 1-3 months until Parliment elects a new President.

According to Rand Merchant Bank's (RMB's) Isaah Mhlanga, the main risk to the Rand is if the President is voted out and a replacement cannot be found quickly, but he also suggests it could be Rand positive if Zuma is voted out and a new president can be found quickly.

"The risk we think is underestimated is if the vote succeeds and parliament fails to elect a new president within 30 days. That opens the possibility for fresh general elections, which we think none of the opposition, the ruling party, the IEC and the country is prepared for. In such a scenario, USD/ZAR will likely rally if the motion succeeds but the uncertainty that may come after that could weaken the currency again," says Mhlanga.

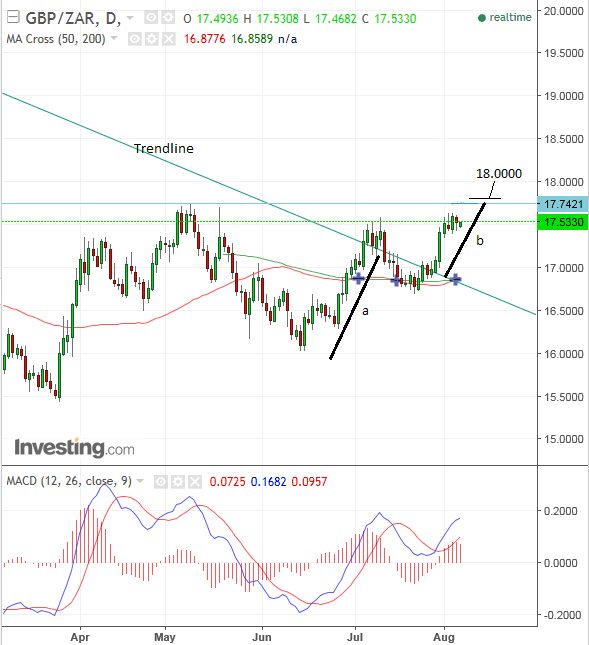

Ahead of thre news, GBP/ZAR had broken above a major multi-month trend-line and was seeen forging higher, reinforcing the expectation that the Rand will weaken.

It has surpassed the previous 17.5983 highs and made a new high at 17.6517.

From a technical perspective, the overall scenario is bullish, on balance, and we expect to the pair to continue rising.

A break above the May highs and 17.7500 would provide confirmation of further bullish momentum and probably lead to a move up to the target from our previous target at 18.0000.

This target was generated by taking the length of the move immediately before the break (a) and extrapolating it higher (b) – which suggests an extension to roughly 18.0000.

Obviously technical considerations will play second fiddle to politics but the charts could still prove useful in determining where GBP/ZAR lands once the dust settles.

Is the fall in value of Sterling impacting your international payments? Get up to 5% more foreign exchange by using a specialist provider by getting closer to the real market rate and avoid the gaping spreads charged by your bank for international payments. Learn more here.

News and Events for the Pound

Bar Halifax House Price data, which has already been released and showed a 2.1% rise in July, the first major release for the Pound is on Tuesday, at 00.01 BST, when British Retail Consortium’s Retail Sales monitor will be released.

This is a sentiment survey asking people in the Retail sector for their assessment of business conditions.

Analysts may being paying more attention to it given the rising rate of inflation and the squeeze in real earnings this has created.

On Thursday, August 10, the RICS House Price balance is to be released, with a probable 8.0% rise expected.

At 9.30 on Thursday we have Industrial and Manufacturing Production for June.

The Trade balance for June is out at the same time, and is expected to show the deficit narrowing to 11.00bn from 11.86bn previously.

The data is unlikely to shake the Pound so keep an eye on technical trends, Brexit-orientated headlines and external drivers.