The South African Rand Rallies on NEC Meeting Hopes, but Don’t Get Carried Away Warn Analysts

ZAR finds itself in a dominating position as markets play out the final phases of May.

Press reports suggest that the reason for the most recent outperformance in the currency is due to the recent inflation print but to one analyst this makes no sense: lower inflation implies lower rates which should be negative for the currency.

If this is the wrong diagnosis, what could be driving the currency then?

“Admittedly, scope for lower rates could have generated speculative inflows into the bonds — but it did not: foreigners were actually mild sellers yesterday. The better explanation for the rand move is simply that the market continues to build up bets that this weekend’s NEC will spring a surprise,” says John Cairns at RMB in Johannesburg.

The ANC’s National Executive Committee (NEC) will discuss the option of removing Zuma from his post at a May 26-28 meeting, according to two senior party officials who spoke with Bloomberg.

The reaction in the Rand to the announcement confirms ZAR remains highly sensitive to issues surrounding Zuma’s tenure and general high-level political shifts in the country.

The Rand is one of the best-performers amongst the world’s top 20 currencies amidst these political developments and a broader global backdrop that has benefited this and other commodity-linked currencies.

Against the Euro the South African currency is now 0.41% higher on the month, 2.85% up on the US Dollar and up 3.17% against Pound Sterling.

“While we would be careful not to get carried away by the latest revelations (the story was quickly denied by the ANC spokesperson Zizi Kodwa and the NEC rejected similar motion in November), every day more cracks seems to be appearing on Zuma’s previously strong position on the political scene and his grip on the ANC seems to be weakening,” says Piotr Matys, EM FX Strategist at Rabobank in London.

Cairns is also a little wary of the longevity of this story's positive impact on the currency noting the speculation has been built on one brief Bloomberg report siting unnamed sources - i.e. “we have seen big moves on very little”.

“One never knows when a surprise will happen but having been burnt repeatedly in the past in pricing in too much, we would suggest some caution on pushing the rand too far,” says Cairns.

It is worth pointing out that the ANC’s alliance partners - the South African Communist Party and the Congress of South African Trade Unions (Cosatu) – demanded President Zuma to step down.

Earlier this week Cosatu banned Zuma from speaking at its events (Zuma was booed by workers at a May Day rally as they demand his resignation).

“There is plenty of evidence that pressure on President Zuma is rising and the NEC meeting this weekend will be a major test of his influence on the ANC or what’s left out of it,” says Matys.

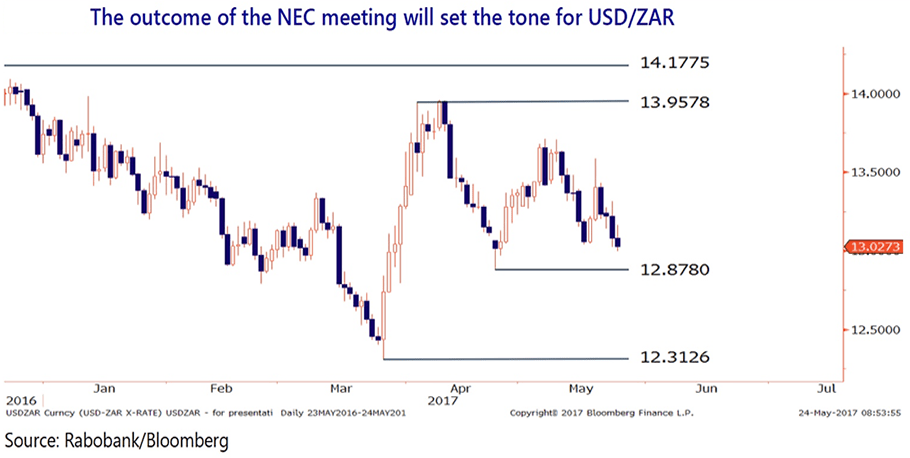

Given more signs of rising pressure on President Zuma to leave, Rabobank say they are prepared for further strength in the Rand.

They see a potential retracement in USD/ZAR in the short-term towards the year-to-date low at 12.3126.

“It is important to emphasise that it is a highly speculative trading position as the outcome of the NEC meeting is a fairly long shot,” warns Matys.

Meanwhile, RMB also take a cautious approach to the interest rate outlook.

This month’s surprise inflation number of 5.3% was the second positive surprise print in a row and analysts believe it might force the SARB to cut its own inflation forecast and make it difficult for it to remain hawkish in its rhetoric.

“This could lead the market to price in an interest rate cut. But we still caution that despite the fast building momentum behind cuts, the likely timing of a move will probably only be post the October MTBPS,” says Cairns.