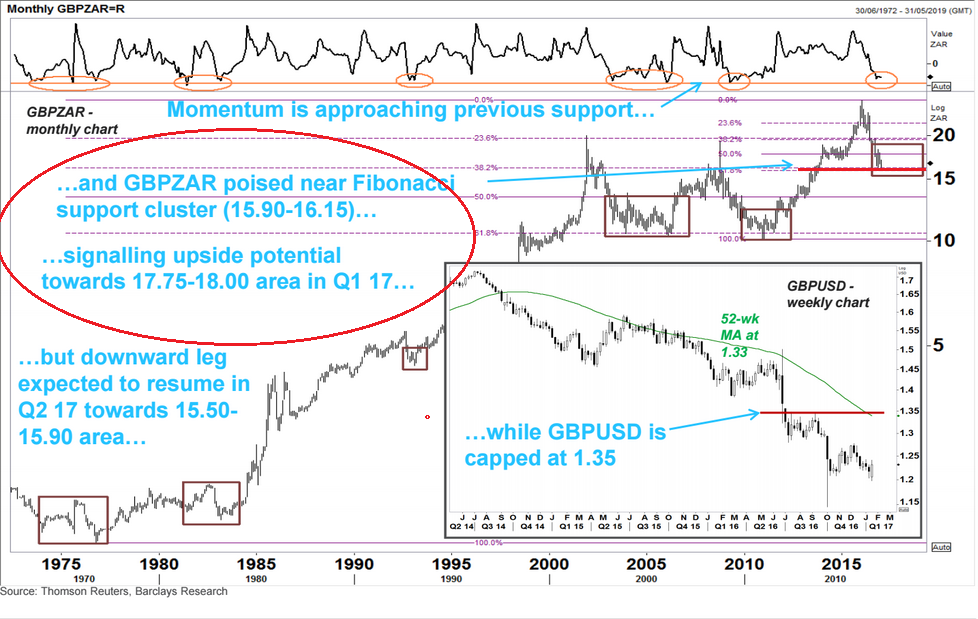

Pound / South African Rand: More Upside Potential

The British Pound continues to recover against the South African Rand having suffered a poor run since mid-November when highs towards 18.00 were rejected.

The fall back to ~16.00 has allowed bargain-hunters to step in however.

The recent rally across the Sterling strip has seen support levels establish and a nascent recovery ensue.

And, price charts are now indicating more upside for GBP/ZAR.

The longer-term monthly chart is showing that the pair has fallen to support from a Fibonacci cluster at the 15.90-16.15 but that is now likely to bounce to 18.00, according to Barclays analyst Judy Padayachee.

The rebound will last for most of Q1 says Padayachee, before the pair runs out of steam and resumes its broader downtrend in Q2.

Nearer-term, the daily chart is showing the exchange rate rising within the confines of a descending channel:

It is now currently trading in the 16.80s, with the next probable target at 17.00.

Just above 17.00 is the upper channel line is forecast to offer a tough obstacle resisting further upside gains.

Zooming in on the four-hour chart - and the near-term timeframe - we see a cluster of lines at 17.00, including the 200-four-hour moving average (MA) situated at 17.00 and resistance from the channel line, which are likely altogether to block any rises, at least temporarily.

Events to Watch for ZAR

The main release on the FX calendar for the Rand is the monetary policy meeting for South African Reserve Bank (SARB) on Tuesday.

“The headline event locally is the MPC interest rate decision tomorrow, although this is highly unlikely to move the Rand market. On the political front, the attacks on Minister Gordhan are intensifying. This has not yet held back the Rand,” noted RMB Strategist John Cairns.

However, we have noted how Gordhan - and moves in the finance ministry - can really shake up the market, so watch this space.

Events to Watch for the Pound

The Pound remains highly attuned to politics and therefore the Supreme Court Ruling on Article 50 - due on for release on Tuesday at 09:30 GMT - will be highly anticipated.

Since Prime Minister May has already said she will be opening up Brexit to a parliamentary vote, the decision will only have a limited impact.

There is, however, a risk that the law lords could say the devolved parliaments of the other parts of the United Kingdom – Scotland, Wales and Northern Ireland - may also be allowed a vote, which could delay the whole Brexit process.

It is therefore possible that devolved parliaments might vote against triggering Article 50 as an expression of their opposition to Brexit.

“If the Scottish and Northern Irish devolved parliaments are entitled to vote on the matter, this could delay Brexit further. In addition, it is possible that local politicians could vote to reject the proposal on behalf of their constituents,” said Siobhan Fenton, writing for the Independent.

This will introduce a fresh layer of uncertainty for the UK and we believe it would actually be negative for the Pound which runs counter to the currency's reaction when the initial rulings on Article 50 were made by the High Court in 2016.