South African Rand: More Gains Ahead as the Centre Wins

- Written by: Sam Coventry

Above: The Secretary to Parliament, Mr Xolile George, receives President Cyril Ramaphosa at the CTICC where he registered for the 7th administration. Photos: GCIS, GovZA.

News that the ANC has chosen the centre ground by agreeing to work with the DA to form the next government has boosted the Rand, and further gains are likely.

Following two weeks of intense speculation and negotiation, the best-case scenario for the South African Rand has come to fruition: the ANC will work with the DA and Inkhata Freedom Party and deliver under a government of national unity.

The ANC "agreed on the need to gravitate towards the centre," said Fikile Mbalula, ANC General Secretary.

"The growing prospect of this coalition outcome had already helped the rand to appreciate in recent days and it is up by another 0.5% against the dollar today," says Jason Tuvey, Deputy Chief Emerging Markets Economist at Capital Economics.

The far-left radical EEF refused to join any government, to the relief of investors, ensuring a significant negative tail-risk for the Rand has been avoided. The newly-minted MK Party of former President Jacob Zuma, also a radical far-left prospect, was also proved an unsavoury prospect for the ANC.

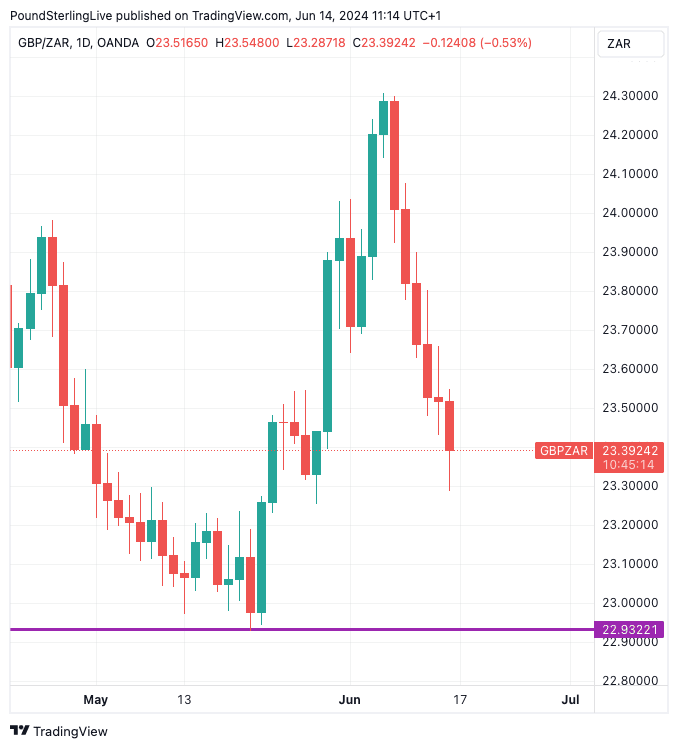

The Pound to Rand exchange rate is at 23.34 and has fallen nearly 4.0% from the highs it reached at the peak of political uncertainty that followed the election that saw the ANC lose its outright majority for the first time since 1994.

The Dollar to Rand is at 18.39, 3.0% lower than the peak, and the Euro to Rand is at 19.66, 5.0% lower.

Above: GBP/ZAR can target the pre-election lows that were consistent with speculation at the time that an ANC/DA tie-up was in the making.

ZAR would be stronger right across the board were it not for a deterioration in global risk sentiment stemming from the midweek Federal Reserve policy meeting and rising political anxieties in France.

That the currency - which tends to underperform when sentiment deteriorates - is making gains in this environment speaks to a notable relief regarding the South African situation.

"President Ramaphosa’s broad policy agenda, centred around fiscal tightening and addressing infrastructure problems, is likely to remain intact," says Jason Tuvey, Deputy Chief Emerging Markets Economist.

The South African Rand likely has more political risk premium to unwind and further gains are possible in the coming days.

Risks to the ZAR in the coming weeks and months will stem from the inherent fragility of the coalition. "Such a coalition may even cause the political environment to fracture further, particularly given that there will be many within the ANC (especially on the party’s left) who will be uncomfortable aligning with the DA," says Tuvey.