South African Rand and Japanese Yen Could Benefit from U.S. Debt Deal

- Written by: James Skinner

"Reality to come is greatly dependent on whether Treasury will bull its way through the markets to raise what’s needed" - TS Lombard.

Image © Adobe Images

The South African Rand and Japanese Yen are among the market's biggest fallers so far in 2023 but both might benefit if a successful passage of legislation to raise the U.S. government debt ceiling leads to stability in the world's largest government bond market and a softening of the Dollar.

South Africa's Rand held up well while the Japanese Yen was an outperformer in risk averse global market conditions on Wednesday when commodities crumbled, stock indices tumbled and sovereign bonds rallied in almost all corners of the world.

Wednesday's rout in risk assets followed hard on the heels of official data suggesting overnight that key sectors in some of the Asia Pacific region's leading economies came under pressure in April with industrial production and retail sales tumbling in unison in both South Korea and Japan.

Meanwhile, the combined manufacturing and services sector PMI published by the National Bureau of Statistics of China told of a moderating economic recovery in the world's second-largest economy in what may have been a further symptom of global monetary policy tightening taking its toll.

"Local sentiment is mixed, our trader Alexey Kovalcuk writes.19.86 and 20 are the resistance levels, while 19.50-60 is a massive support zone for now for USDZAR. Alexey would play the pair from the long side but with a very tight stop below 19.70," says Varshi Karamsetty, an analyst at CitiFX.

Above: USD/ZAR shown at daily intervals alongside USD/JPY.

"Otherwise, geopolitical tensions and Eskom remain top of mind," Kramsetty says.

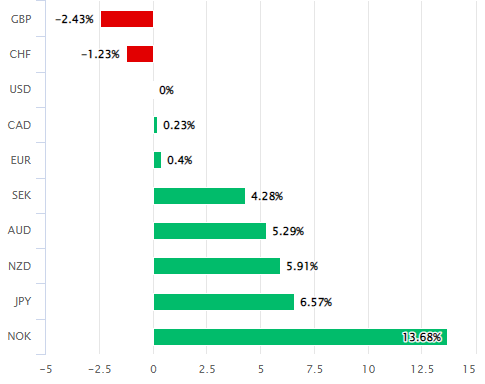

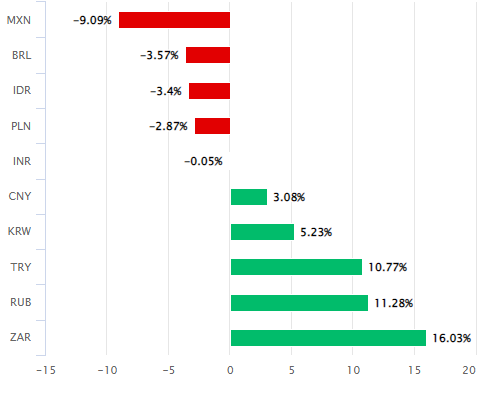

Global monetary policy tightening and its side effects have weighed heavily on government bond markets around the world while driving the U.S. Dollar stronger through much of the year so far but some currencies have been hit harder in sell-off.

The Rand and other 'BRICs' group currencies have been by far the biggest fallers, reflecting economic vulnerabilities and potentially also market concerns about the perceived risk of sanctions for some countries.

But the heavily sold Japanese Yen hasn't been far behind with its negative benchmark interest rates and near-zero yields making it an easy target in the speculative market, leading to fresh speculation this week about the prospect of an intervention to support the currency.

"As was the case last year, we see little prospect of intervention, if it happens, changing the trend of JPY depreciation, so long as it is pushing in the opposite direction to domestic policy in the US/Japan," says Adam Cole, chief FX strategist at RBC Capital Markets.

Above: U.S. Dollar in 2023 relative to G10 and G20 peers. Click images for closer inspection.

In what could yet be a fortunate twist of fate for many currencies, however, all of the indications are that lawmakers in Washington will succeed in efforts to pass legislation raising the U.S. government debt ceiling this week and averting a technical default.

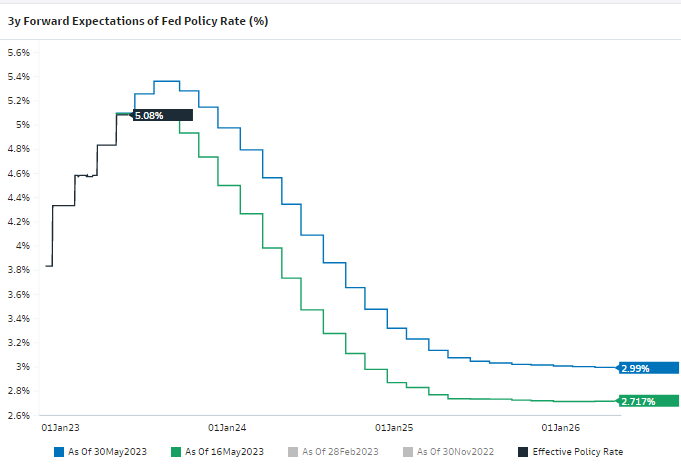

Passage of the legislation would have implications for the U.S. economy, bond markets and Federal Reserve (Fed) interest rate policy, however.

"Sometime in the next several days, markets will trade their last bit of angst over raising the debt ceiling (the vote counting ritual that passes the “Fiscal Responsibility Act”) for what was always going to be the real problem," says Steven Blitz, chief U.S. economist at TS Lombard.

"Markets have been here before, but never quite with this size and not when the Fed was simultaneously shrinking the balance sheet," Blitz says.

While there could be volatility along the way, there is a risk or chance of the debt ceiling deal leading to something like the price action seen in late March and early April when small and medium-sized U.S. banks began to wobble and ultimately led the Fed to adopt a more moderate interest rate stance.

Above: USD/ZAR shown at daily intervals alongside USD/JPY, U.S. Dollar Index and USD/GBP.

This is because the U.S. Treasury will have to carry out funding operations to refill its depleted cash coffers soon after the legislation is passed, and the resulting liquidity drain from the financial system will draw directly from commercial bank balance sheets that are already under pressure.

"Reality to come is greatly dependent on whether Treasury will bull its way through the markets to raise what’s needed in the shortest amount of time to rebuild the TGA and its finances more broadly, and how will the Fed react," TS Lombard's Blitz writes in a Wednesday research briefing.

"The Fed could see this as a gift horse slowing the economy and they can blame the downturn on someone/something else. More immediately, it gives them one more reason to skip the June hike regardless of the data in the coming weeks," he adds.

Commercial bank deposits have fallen notably in the U.S. during recent months while the number of "problem banks" being monitored by the Federal Deposit Insurance Corporation has risen, leading the Fed to fear that reduced availability of credit would magnify the effects of its interest rate policy.

As far as intensifying "credit tightening" leads the Federal Reserve to remain on the sidelines in June and thereafter, it could be bearish for the U.S. Dollar and bullish for currencies like the Japanese Yen and Rand in the weeks ahead, particularly in light of a recent increase in market interest rate expectations.

Above: Change in market-implied expectations for Fed Funds rate between selected dates. Click image for closer inspection.