Pound / South African Rand Forecast: Bouncing, but Short-term Downtrend Set to Resume

- Written by: Albert Townsend

- GBP/ZAR has rebounded after a five-day losing streak

- Despite recovery, short-term downtrend remains dominant

- Charts show it's likely to extend

- The prices of key South African export commodities looking bullish

Image © Pound Sterling Live

The Pound to South African Rand exchange rate is trading at around 20.47 at the time of writing after rising 0.70% already this week; however the pair had fallen a more substantial 3.0% in the week prior.

Expectations of a February rate hike from the Bank of England (BOE) have supported Sterling in the short-term, whilst a fall in market risk appetite have weighed on the risk-sensitive rand.

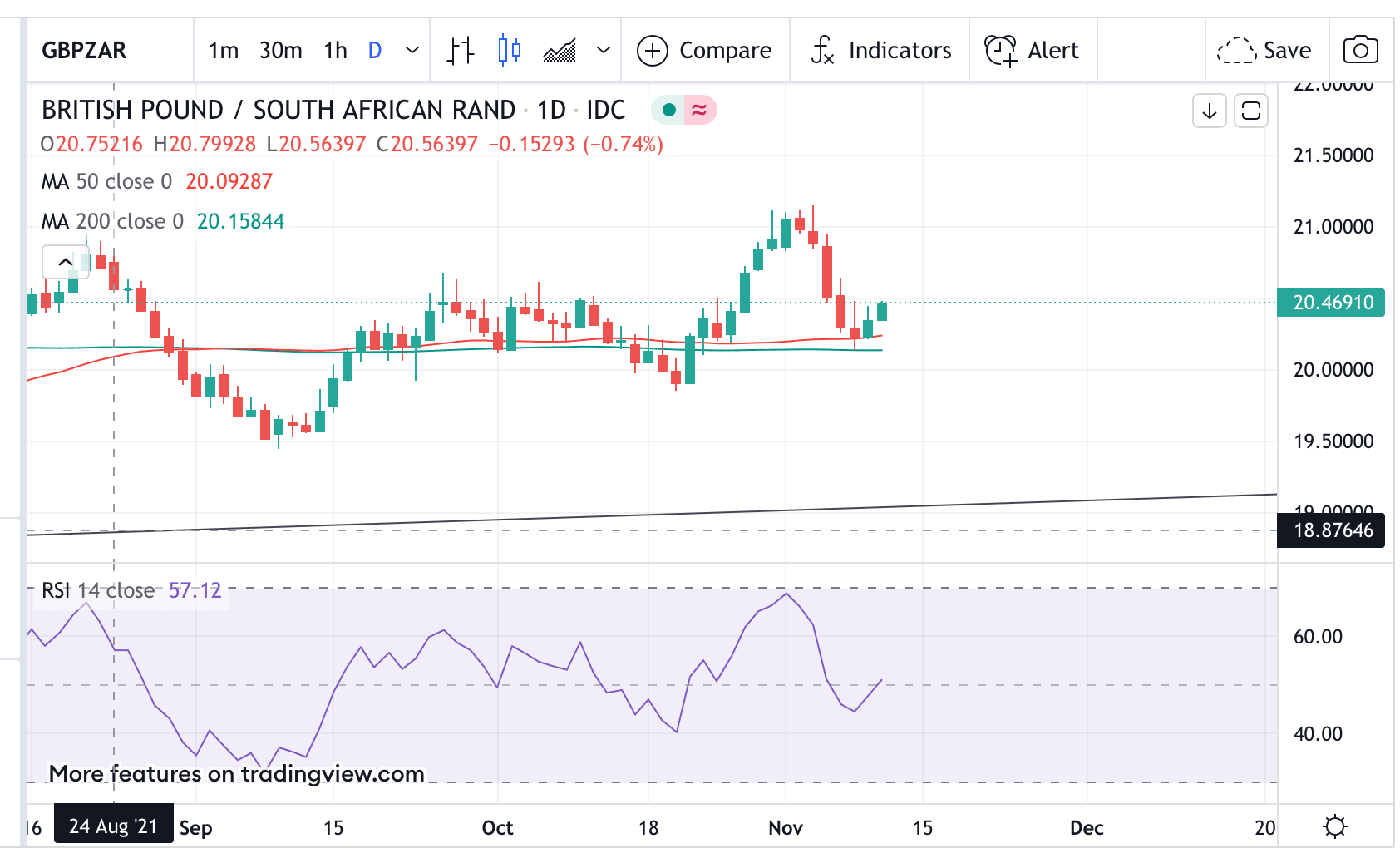

The pair is rising after finding support at the 20.00 handle and bouncing. This level is underpinned by a combination of several major moving averages, including the 50-week MA, 50-day MA and 200-day MA.

Above: GBP/ZAR daily chart.

- GBP/ZAR reference rates at publication:

Spot: 20.45 - High street bank rates (indicative band): 19.74-19.88

- Payment specialist rates (indicative band): 20.27-20.35

- Find out about specialist rates, here

- Or, set up an exchange rate alert, here

It is not clear yet whether the rebound will endure, as it was preceded by a five-day long losing streak - indicating the short-term downtrend remains intact.

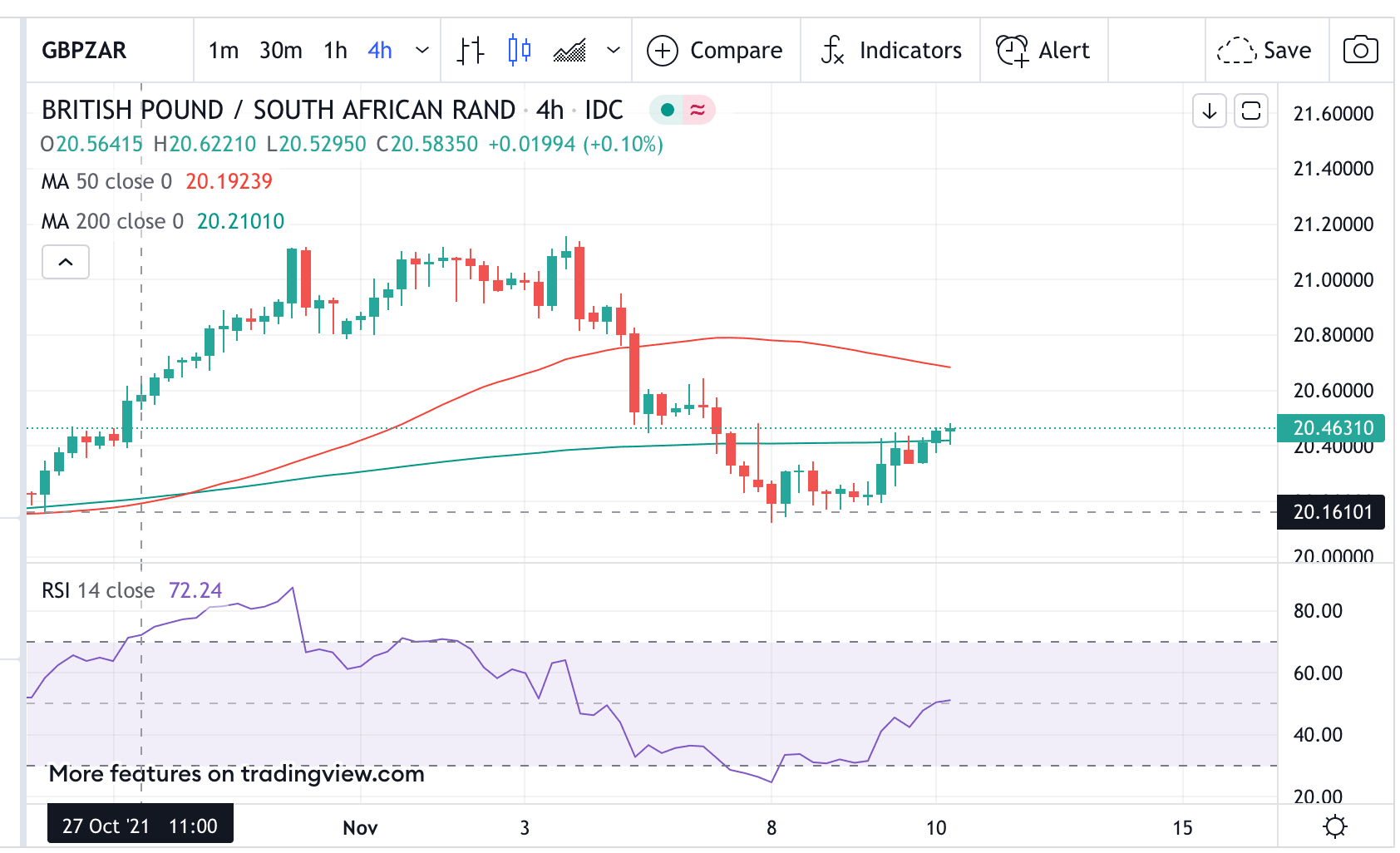

The 4-hour chart below shows the down move in more detail.

Above: GBP/ZAR four-hour chart.

The nascent rebound has broken above tough resistance from the 200-4hr MA suggesting impetus for an extension higher.

It should be remembered, however, that the short-term downtrend remains intact due to the preceding 5-day losing streak, and therefore likely to resume eventually once this rebound runs out of steam.

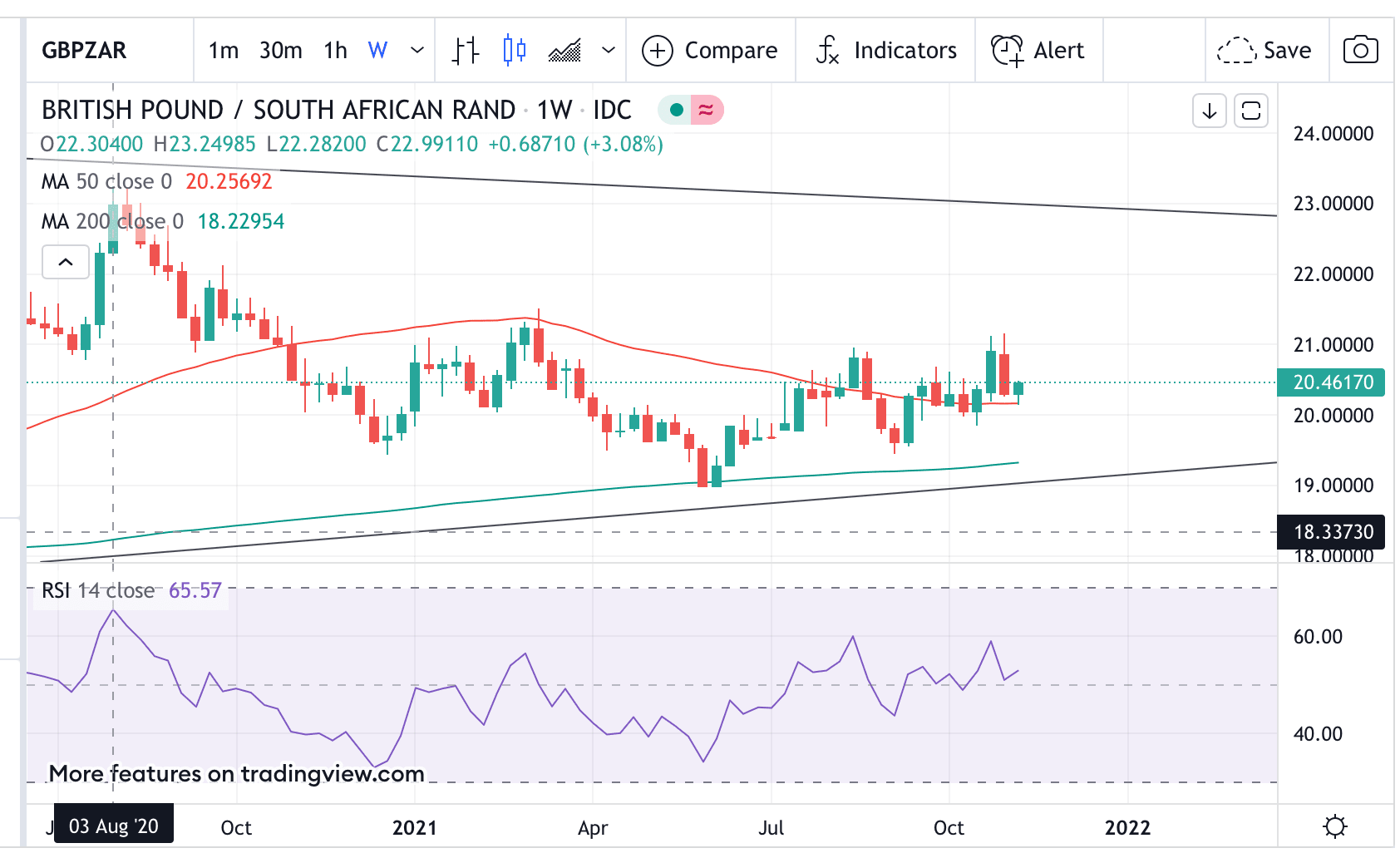

Longer-term, there is no clear trend in GBP/ZAR, making it difficult to determine the direction of the overall broader trend.

The weekly chart below shows the pair consolidating in a sideways long move in which it has been oscillating for over a year and a half.

Bullish Commodity Charts Support ZAR

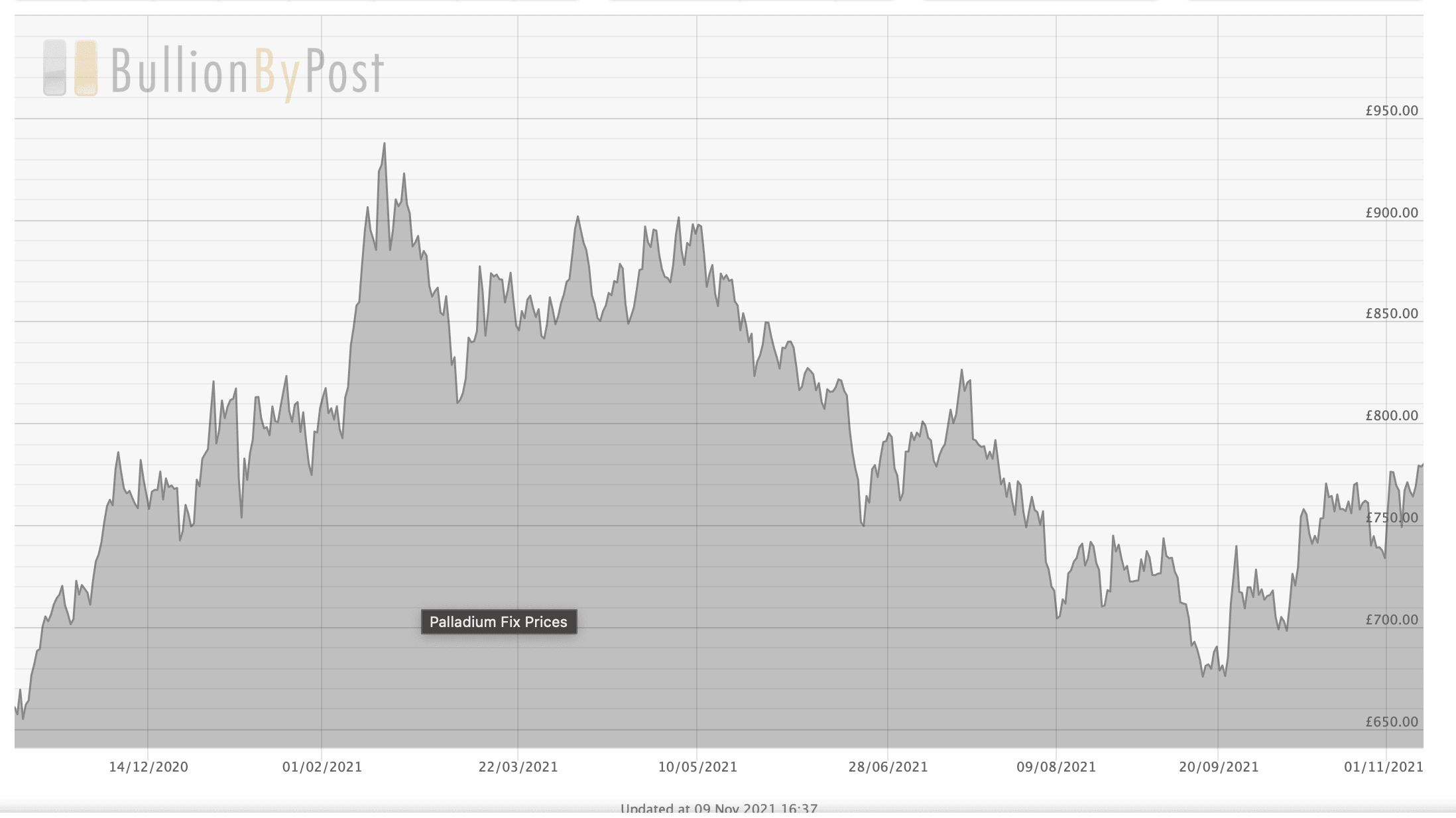

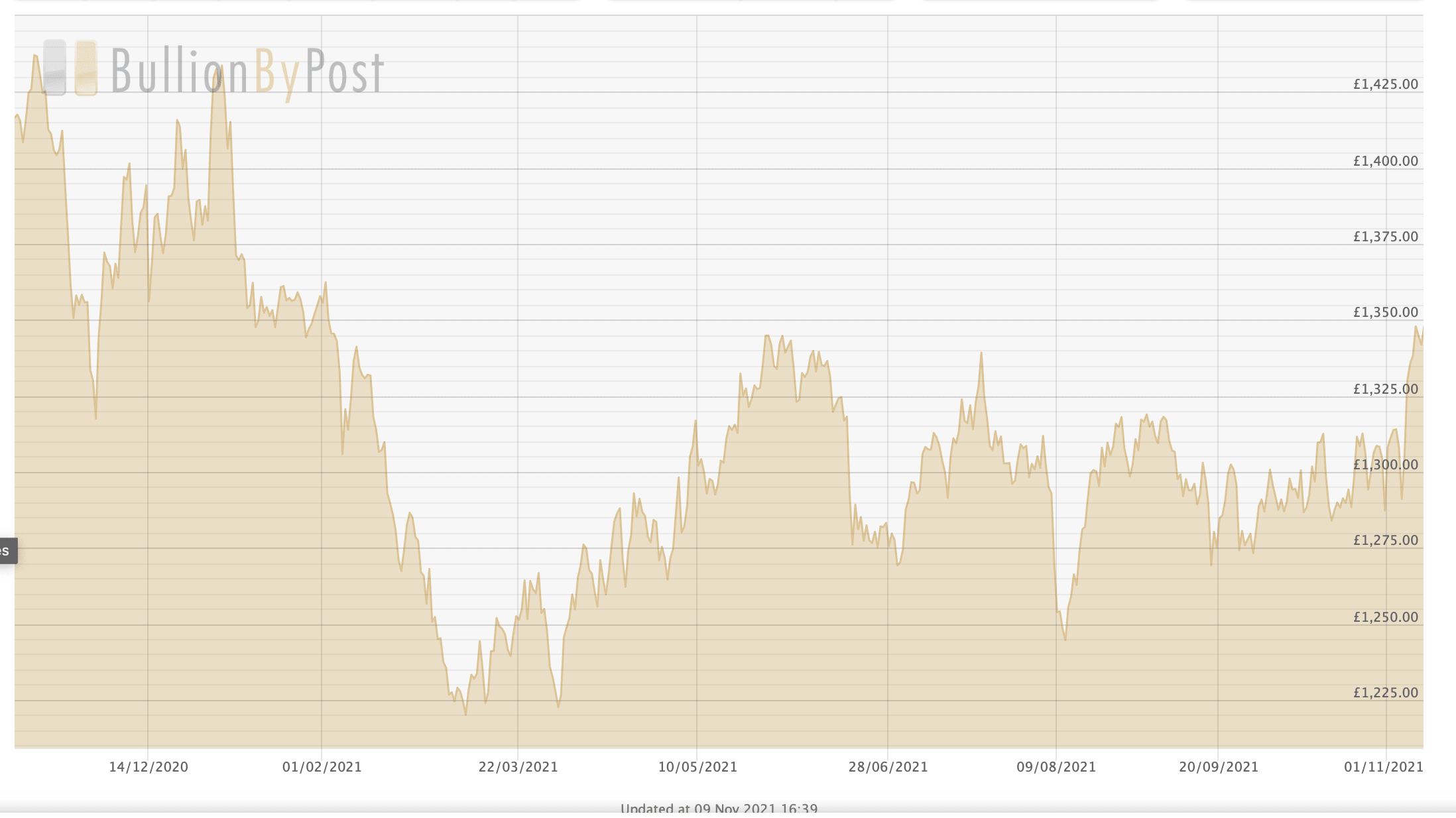

South Africa is a major exporter of platinum, gold, iron and coal, and the prices of these commodities often have a strong impact on the Rand.

Several of these commodities appear to be reaching potential reversal points - or are in uptrends, or forming price patterns that suggest more upside could be on the horizon.

These would be expected to provide support to the Rand, all other factors being the same. This would be negative for GBP/ZAR.

South Africa is a major exporter of iron ore which has seen its price fall sharply since the May highs.

This decline, however, has outlined an almost textbook five-wave bearish Elliot Wave which appears to be in the process of finishing.

Although it is still too early to say, iron ore price may be on the cusp of reversing and making a substantial recovery - this would be supportive of the rand.

Above: Iron ore price trends over the past year.

Both platinum and gold are in short-term uptrend.

Platinum is forming a base that looks like an inverse head and shoulders which could suggest the metal is about to push higher.

Above: Platinum prices.

Finally, gold has reached six-month highs.

Taken together, these signs, from the key commodity markets for South Africa suggest the possibility of the rand gaining a backdraught from commodity markets, over the short-to-medium term.

Looking at the other side of the GBP/ZAR equation, a potential headwind to Sterling are renewed Brexit concerns.

One major threat is the possibility the British government will trigger article 16 of the Northern Ireland agreement, essentially ending the current arrangement in which goods are checked at ports in the Irish sea.

If the UK government were to take this drastic step the EU has threatened to retaliate by imposing punitive tariffs on UK goods entering Europe and effectively begin a trade war.

If this were the case it would be very detrimental to the pound and provide the fundamental catalyst needed for a resumption of the short-term downtrend in GBP/ZAR to fresh lows.

From a technical perspective, a clear break and close below 20.00 and the brace of major moving averages at that level, on a daily basis, would confirm such a continuation.