Stay Bullish on South African Rand: Soc Gen

Image © Adobe Images

- GBP/ZAR spot rate at publication: 20.40

- Bank transfer rates (indicative guide): 19.68-19.80

- Transfer specialist rates (indicative): 19.60-20.00

- Get a specialist rate quote, here

- Set up an exchange rate alert, here

Foreign exchange strategists at a leading European investment bank say they are compelled to retain an optimistic stance on the South African Rand's outlook.

Analysts at Société Générale, the Paris-based lender and global investment bank, say they are "tactically bullish" on the Rand as they believe the global backdrop will remain supportive to the currency over coming months while they do not anticipate any further sovereign credit ratings downgrades for South Africa.

"We are inclined to reload on tactically bullish ZAR positions as global markets move closer to finding a new Developing Markets rates equilibrium environment," says Kit Juckes, Chief Global FX Strategist at Société Générale in London.

Juckes says the key strengths supporting the Rand's outlook in 2021 include strong, credible institutions, liquid and deep financial markets, commodity-exporting industries, growing linkages with China, and high exposure to global trade.

Global trade suffered a severe setback in the first half of 2020 as the spreading covid-19 pandemic shuttered economies and caused a crisis in confidence amongst the world's businesses and investor community. The hit to trade corresponded to record-lows in the value of the Rand: the Pound-to-Rand exchange rate (GBP/ZAR) rallied to 23.70 in early May 2020 while the Dollar-to-Rand exchange rate rose to record a best of 19.34.

However, a steady pickup in trade and commodity prices through the latter half of 2020 and into 2021 have benefited commodity-linked currencies, including the Rand, as investors anticipate a strong economic recovery in 2021.

Should this global macro trend continue, the South African currency would likely maintain its period of outperformance.

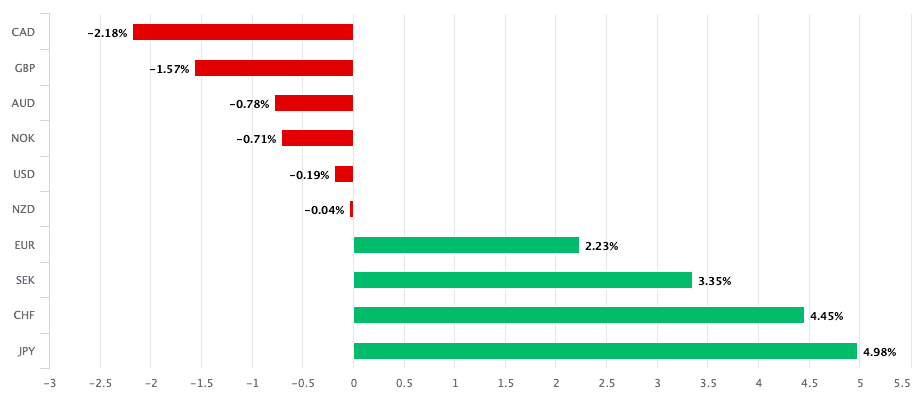

The above shows the Rand has advanced in value against a number of the G10 currencies already in 2021, but a period of outperformance by both the Pound and U.S. Dollar mean the GBP/ZAR and USD/ZAR rates have not been subject to the South African currency's rebound.

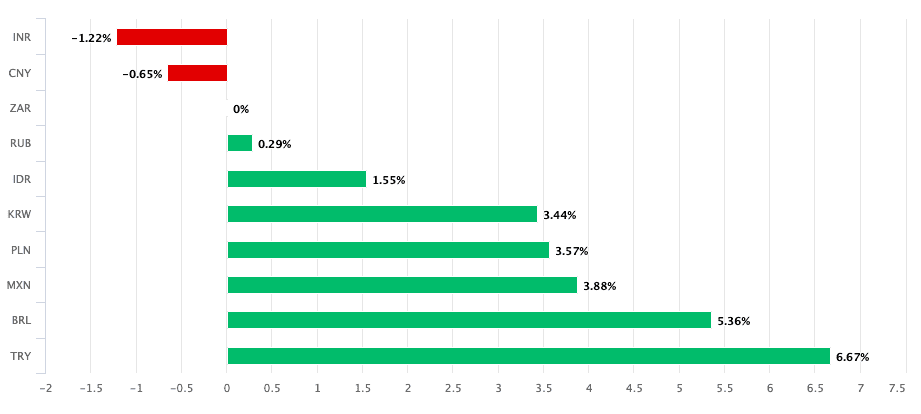

But when contrasted to its Emerging Market peers, it does however appear the Rand is currently proving to be a 'preferred play' in this space:

The Rand's performance in 2021 will nevertheless also reflect how the domestic political and financial story evolves.

The covid-19 crisis has exacerbated the South African government's fiscal deficit and highlighted the structural short falls in the economy; recall these were issues weighing on the currency even before the covid crisis struck as the economy actually contracted in the latter part of 2019.

Any further deterioration in South Africa's fiscal accounts are seen as being a potential headwind to substantive ZAR appreciation, according to numerous analysts we follow.

"Sustained improvement in South Africa’s fiscal position relies squarely on implementing structural reforms necessary to achieve stronger growth," warns Juckes.

How the Rand evolves in 2021 could therefore depend on what progress President Cyril Ramaphosa makes in reforming state parastatals and rooting out corruption in all levels of government and the civil service, a key ingredient to boosting business and investor confidence.

Nevertheless, Société Générale says South Africa retains solid institutions and is potentially well poised to avoid any further sovereign ratings downgrades, which would be a beneficial outcome for those backing a stronger Rand.

"We anticipate no credit rating downgrades on the sovereign this year," says Juckes.

South Africa’s economy contracted 7.0% in 2020 and Société Générale says the South African government appears reasonable in anticipating real GDP growth in 2021 of 3.3% and an average CPI of 3.9%.

Soc Gen forecast the USD/ZAR exchange rate at 14.60 by mid-year, a stronger level than the 15.20 consensus estimate held by the analyst community.

ZAR strength pushes the exchange rate to 14.30 by the end of September and 14.00 by year-end (against consensus for 15.00 and 15.20.