GBP/JPY Poised to Break Out, With Bullish Implications

Image © Adobe Stock

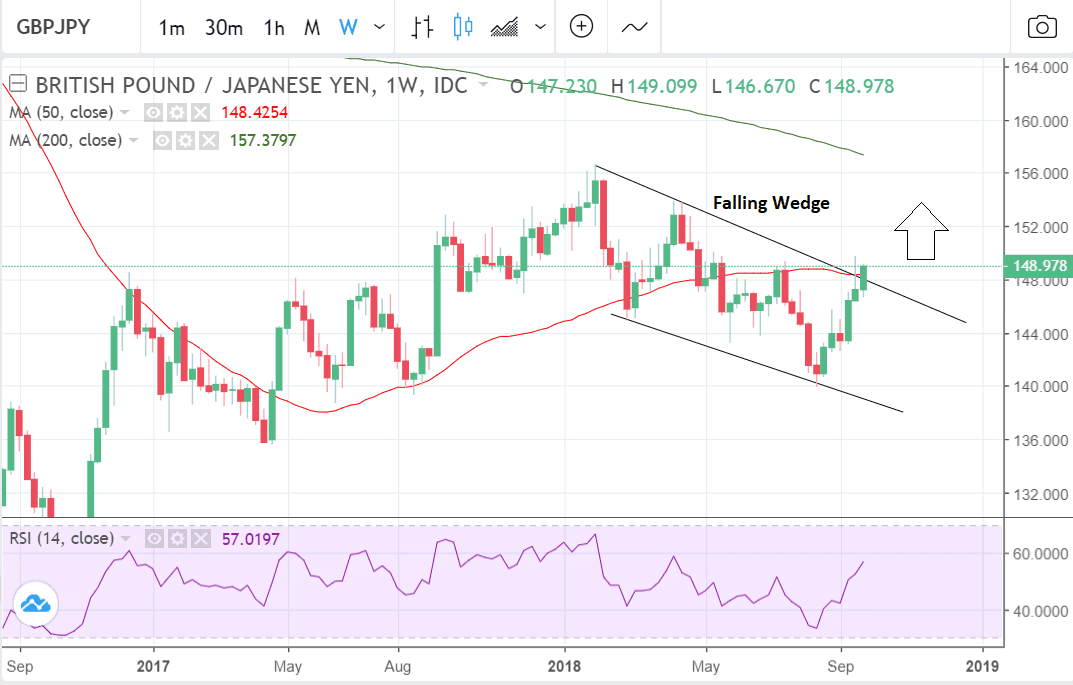

- GBP/JPY attempting to breakout higher from wedge pattern

- Follow-through higher expected to be substantial

- Break above the previous 149 highs would provide confirmation

The Pound-to-Yen exchange rate is attempting to break out of a falling wedge pattern. If it is successful it will probably signal the start of a strong new move higher for the pair.

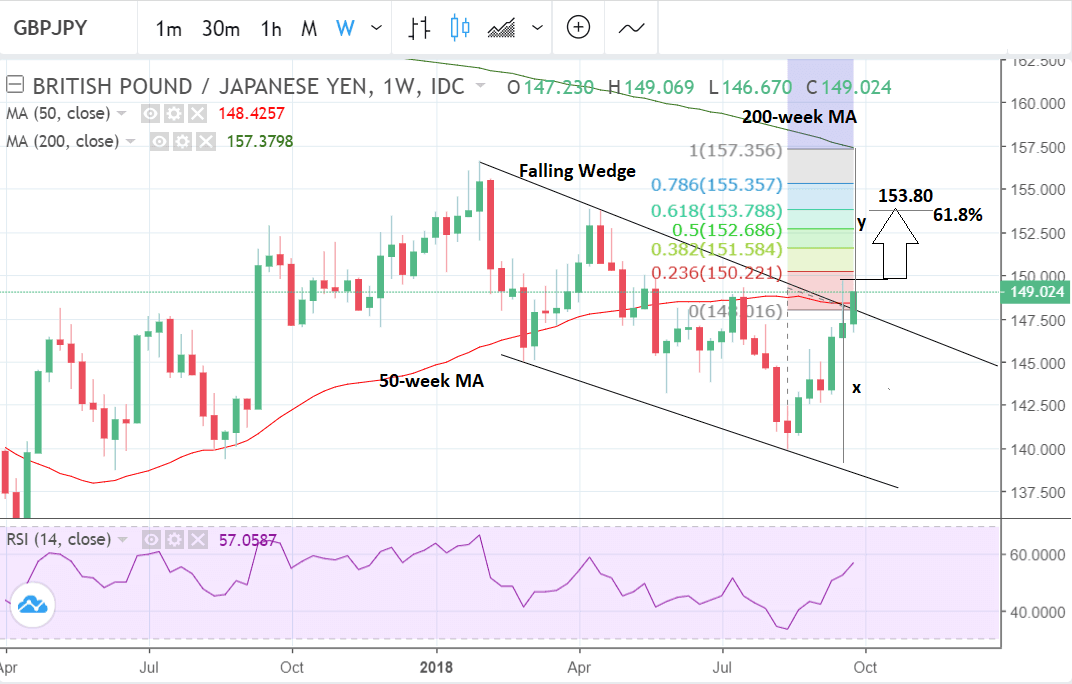

A break above the 149.74 highs would provide confirmation of a breakout and a continuation higher to a target at 153.80.

The target is calculated using the height of the wedge (x) as a guide, and extrapolating it by 61.8% from the breakout point (y), for a conservative upside estimate. Sometimes it will even move as far as 100% of the height, which in this case would give an upside target of 157.35.

Momentum, as measured by RSI in the lower pane of of the chart, is bullish and suggests further upside. It is at the same level it was at when the market was trading at the April highs in the 152s.

Last week the pair rose up and attempted to break out from the falling wedge pattern, but was rejected by the 50-week moving average (MA) and the upper border of the wedge.

Major MAs generally provide tough obstacles to trending prices which often stall, pull-back or even reverse after touching them.

The effect is heightened by short-term technical traders fading the trend at the level of the MA in anticipation of just such a counter-trend move.

Falling wedge patterns are strong bullish continuation patterns, an example of which is shown below:

Image courtesy of Investopedia

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here