GBP/JPY Rate Prone to Further Decline hint the Technicals, Trump Tariff Decision on Chinese Imports to be Key Event this week

Image © Adobe Stock

- GBP/JPY falling after touching 50-day MA

- Yen up on strong capex and trade war fears

- Main event is Trump's decision on China tariffs

The Pound-to-Yen exchange rate is trading at 142.99, down by almost 0.66% from last week's close of 143.94 already after the Yen gained on a combination of increasing trade war fears and strong capital expenditure data.

The pair's sell-off has been aided by traders selling the Pound after UK Manufacturing PMI data came out below expectations on Monday morning while the predictable return of Brexit fears gave additional reason to shed weight on Sterling.

Aiding the JPY side of the equation is confirmation Japanese capital spending, which measures investing by Japanese companies and is considered a leading barometer of economic growth, shot up by 12.8% in Q2 2018, a result well above expectations of only a 6.6% rise.

The result was a good sign for the economy and supported the Yen.

During the rest of the week ahead, however, the Yen's fluctuations may be heavily dependent on broader global themes. The Yen is what is known as a 'safe-haven' currency, which means it rises during times of negative investor sentiment due to repatriation flows out of risky assets.

Looking ahead, the main factor influencing the direction of the Yen could therefore be any positive or negative reaction by US President Trump with regards to placing additional tariffs on Chinese imports.

The US administration will conclude its findings on whether or not to impose 25% tariffs on another $200bn worth of Chinese imports on Wednesday, September 5.

A decision as to whether or not to increase the scope of tariffs could be published as soon as Thursday.

The result is likely to be a major mover for the Yen.

If Trump decides to go ahead with the tariffs, which would mean an expansion of tariffs to 40% of Chinese imports, then the Yen is likely to rally along with the Dollar as a result of increased investor risk aversion.

"In this scenario, the US Dollar surges on safe-haven flows. The Japanese Yen may also enjoy such flows, but the strength of the yen depends on the magnitude of the downfall in stock markets. The deeper stocks fall, the deeper the yen drops," Yohay Elam, an analysts for FXStreet.

In relation to whether Trump is likely to go ahead with the extra tariffs, Elam assesses the probabilities as high.

"The scenario has a high probability and is far from being priced in," he says.

He is not the only analyst who sees the tariffs as significant for the Yen.

“The demand for the protective yen and the dollar can remain the predominant theme of this week in anticipation of important news on the labor market and the announcement of Trump tariffs,” says a note from broker FXPro.

The most probable scenario of Trump increasing tariffs would almost certainly lead to GBP/JPY falling as the Pound loses ground against the Yen.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here

Looking Prone to a Further Decline

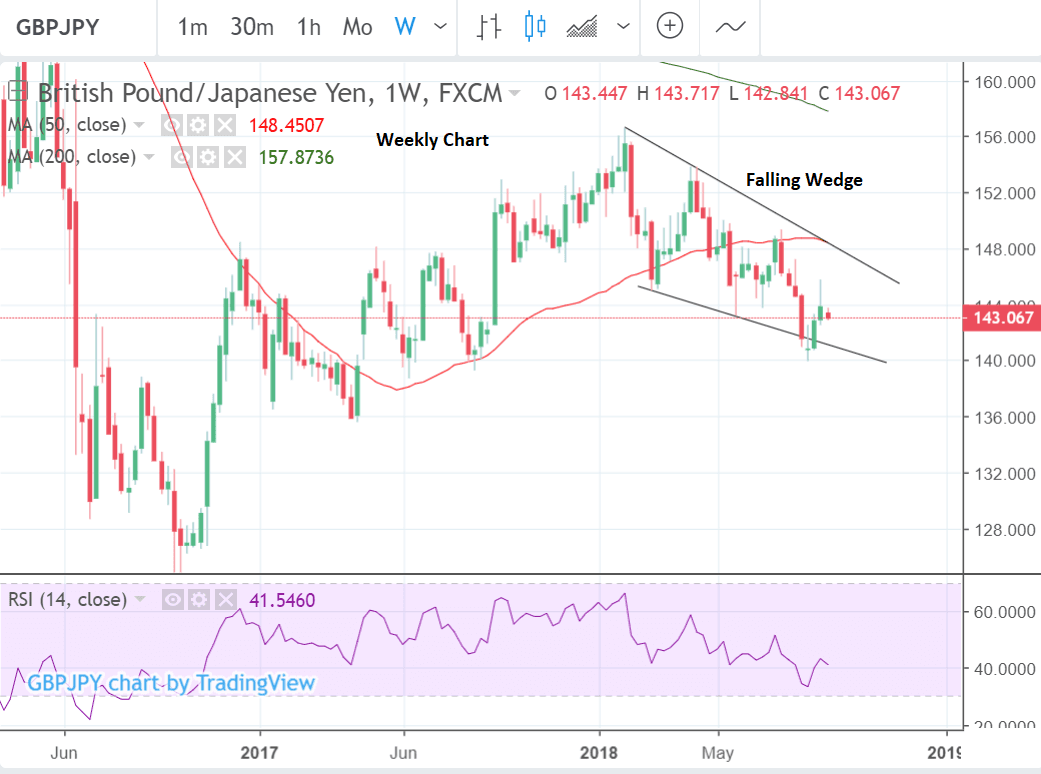

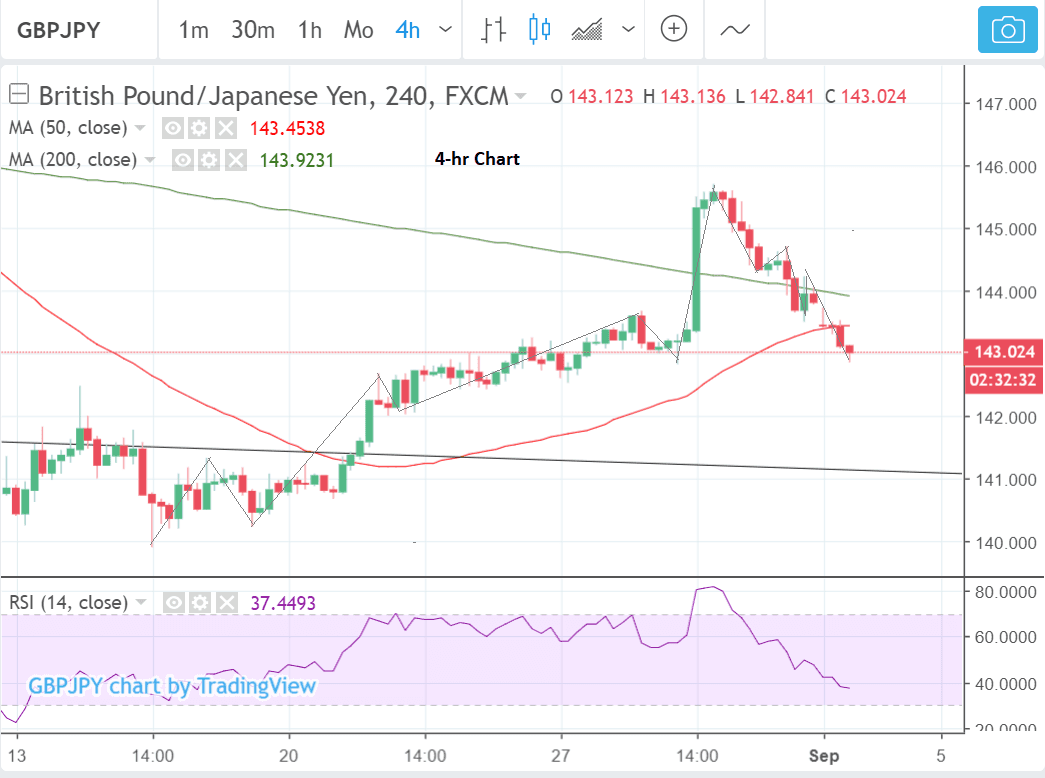

The pair has already rotated after touching the 50-day MA at last week's 145 highs but such an outcome would probably speed up the sell-off.

On a purely technical basis there is not enough evidence to support a continuation of the sell-off, so there is still a possibility that GBP/JPY could recover and attempt to break above the 50-day MA again, in line with the short-term uptrend.

Although the sell-off since the August 30 highs has been sharp and steep, it is still a little early to call a reversal, and we see a risk of more upside subject to confirmation from the pair breaking above the 30 August 145.69 highs.

Such a break would probably lead to a continuation up to a target at 148 and the level of the upper border of the descending range/wedge that the pair has formed.

Our forecast is not a confidence call, however, as the recent sharp move lower and the fundamentals outlined above also argue a strong case for more downside rather than upside.

Japanese Data in the Week Ahead

On the data front the main release for the Yen over the remainder of the week is household spending which is forecast to show a decline of -1.2% in July compared to the previous month of June, when it comes out on Thursday, September 6, at 19.30.

Household spending is a barometer of inflation and therefore could impact on the currency. Higher inflation is more likely to support the Yen as it is likely to lead the Bank of Japan to stop printing more money and make it more likely it will raise interest rates.

Higher interest rates are generally supportive of a currency as they bias inflows of foreign capital over outflows, drawn by the promise of higher returns.

Advertisement

Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here