Dollar-Yen Rate's Drop Below 157 Sends a Clear Signal Says XS.com

- Written by: Rania Gule, Market Analyst at XS.com.

Image © Adobe Stock

"This level acts as a pivotal point, where further breaks could exert additional downward pressure on the pair."

The USD/JPY pair witnessed a sharp decline ahead of the start of 2025, dropping by 0.7% to fall below the 157.00 level.

It opens Tuesday's trading session at 156.42 amidst slowing market activity as the New Year holiday approaches.

In my view, this decline reflects a return to more balanced ranges after a period of sharp rallies, highlighting the importance of balancing economic expectations and monetary policies in determining the direction of major currency pairs.

The recent drop below 157.00 highlights the fragility of the USD/JPY's latest rally. This level acts as a pivotal point, where further breaks could exert additional downward pressure on the pair.

With inflation and monetary policy challenges persisting in the U.S., the dollar may face additional headwinds if the Fed moves to cut interest rates sooner than expected.

Conversely, the BoJ's ability to capitalise on these challenges depends on adopting more assertive policies. Hesitation to raise rates could further erode the yen’s appeal, deepening its struggles. Should the central bank embrace a more proactive stance, however, a positive shift in the yen's performance may occur.

The USD/JPY’s price chart reveals a clear slowdown in bullish momentum, with current levels offering an opportunity for investors to reassess their positions. As we enter the new year, volatility remains high, necessitating cautious trading strategies.

The pair’s performance reflects global economic changes and the challenges of monetary policies, requiring close monitoring of economic data and central bank actions.

Without decisive measures from the BoJ, yen pressures may persist, while any easing by the Fed could lead to fundamental shifts in this pair’s trajectory.

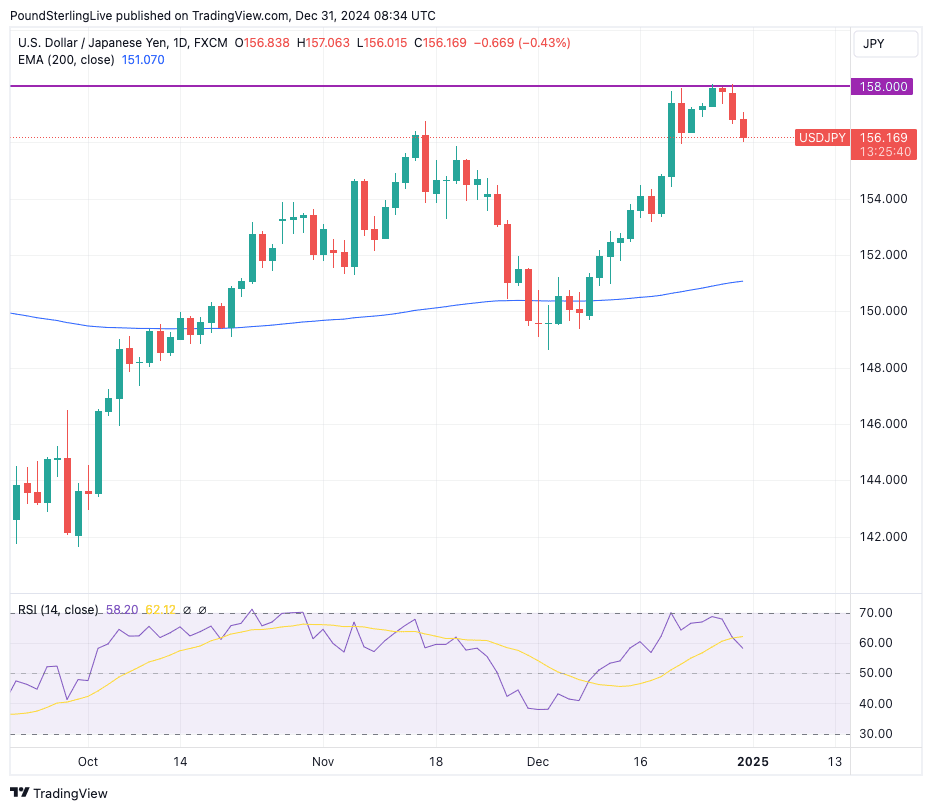

Above: While above the 200-day moving average. USD/JPY is in a broader uptrend, although near-term a correction can occur while below 158.00.

The USD/JPY pair demonstrates consolidation within a strong upward trend, maintaining trades above the 200-day Exponential Moving Average (EMA) near the 150.00 level, which has proven to be a key long-term support.

The 6.35% rebound from the recent low to the high indicates sustained bullish momentum. However, the pair faces resistance at the 158.00 level, a significant psychological barrier that could determine the continuation of the uptrend and support the likelihood of a correction.

The moving averages play a crucial role in guiding the USD/JPY pair's movements.

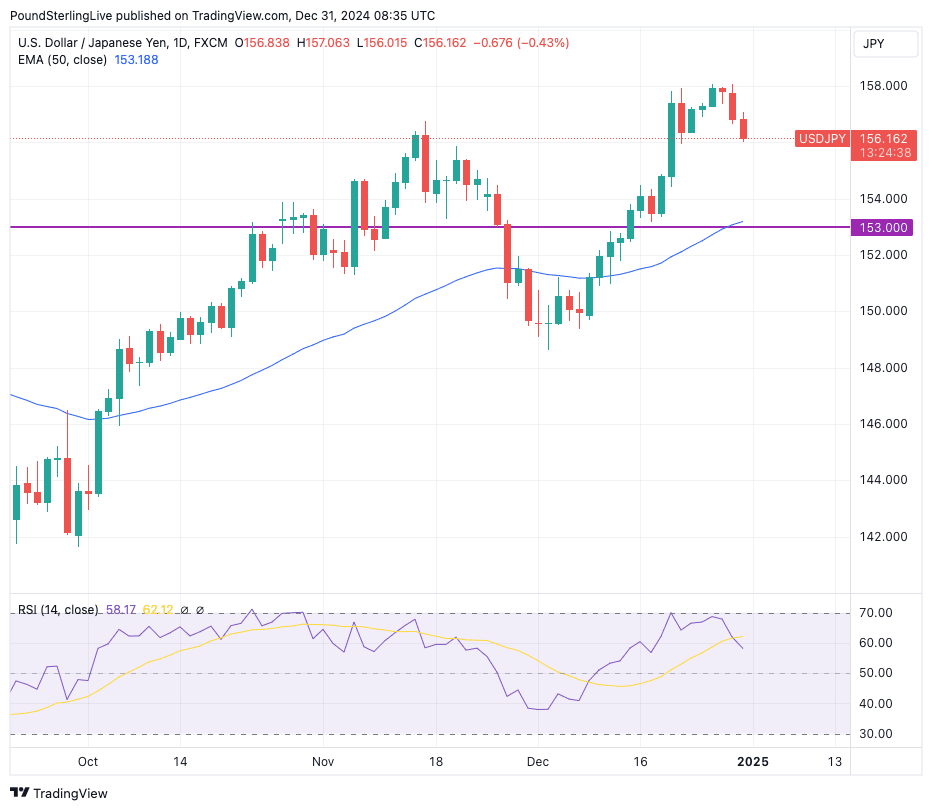

The 50-day Exponential Moving Average (EMA), positioned above the 153.00 level, serves as a significant support for buyers.

Sustaining trades above this level enhances the likelihood of testing higher levels, such as 157.00, and potentially retargeting the resistance at 158.00. Conversely, a break below 153.00 could lead to a deeper correction towards the 200-day EMA at 151.00.

Above: USD/JPY with the 50-day EMA shown. Gule says this could act as a support level on any further weakness.

Monday’s bearish candlestick signals potential short-term volatility as the pair encounters downward pressure near its recent highs. However, continued trading within the bullish zone suggests that buyers remain in control.

Momentum indicators like the Relative Strength Index (RSI) still favour the upside but approaching overbought levels, cautioning against the risk of an extended correction.

In terms of scenarios, maintaining trades above the 50-day EMA at 153.00 would likely pave the way for targets at 157.00 and 158.00 in the short term. On the other hand, breaking below 153.00 might push the pair towards 151.00, a strong demand zone near the 200-day EMA.

Ultimately, the uptrend remains intact unless there is a clear breach of the critical support at 150.00.

The performance of USD/JPY underscores the ongoing struggle of the Bank of Japan (BoJ) in addressing the yen's two-year decline.

Despite significant efforts, the BoJ remains hesitant to raise interest rates as a decisive measure.

The Bank’s monetary policy demonstrates limited flexibility, as rates were temporarily increased to 0.25% before being stabilized again, reflecting extreme caution.

From my perspective, this hesitancy may stem from the BoJ's desire to assess the impact of previous changes, but it’s time for bolder actions if achieving real currency stability is the goal.

The decline in trading volumes in Japan and the U.S. at the end of the year has also made price movements sharper. Meanwhile, investors await the U.S. ISM Manufacturing PMI figures, which may offer deeper insights into economic conditions and market trends for the new year.

To me, the current scenario points to the unwinding of carry trades, previously a lucrative tool for forex traders. Carry trades rely on interest rate differentials to earn daily profits and have been a primary driver of the USD/JPY’s bullish trend since 2021.

When the Federal Reserve began raising interest rates in 2022, USD/JPY reached record highs, rising from below 105 to 150.00 within two years.

This upward momentum was fueled by carry trade inflows but has since raised concerns due to interventions by Japan’s Ministry of Finance aimed at curbing yen weakness. While these interventions have effectively slowed the decline, they’ve failed to achieve lasting stability.