Japan's Yen on the Move

- Written by: Gary Howes

Above: The Bank of Japan. Image © Adobe Stock.

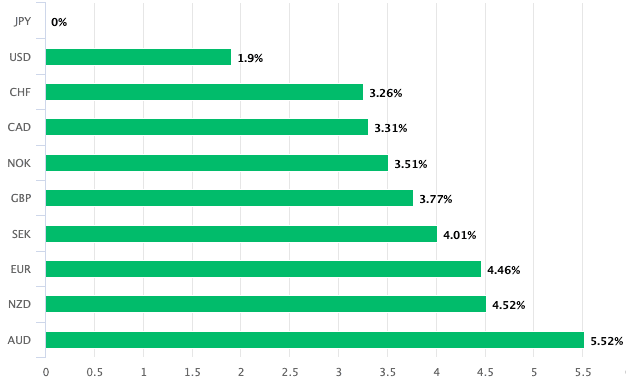

The best-performing currency of the past month is the Japanese Yen, which has received another boost today.

The Yen is outperforming most of its G10 FX peers after a board member of the Bank of Japan's interest rate-setting body signalled a December hike was still in play.

"I'm not against rate hikes," said Toyoaki Nakamura. "It's important to make decisions based on data."

He said to watch upcoming wage data and the Tankan survey.

"The comments have boosted market expectations that the BoJ will raise rates again as soon as this month," says Lee Hardman, Senior Currency Analyst at MUFG Bank Ltd.

Nakamura's comments are significant, with Hardman pointing out he is one of the most dovish Bank of Japan members, having voted against rate hikes in March and July and also objecting to making adjustments to the Bank's yield curve control.

The intervention comes a day after a Jiji Press report said there is a view at the Bank of Japan that a premature rate increase should be avoided unless there’s a big risk of consumer prices rising on factors such as a weakening yen.

This saw market expectations for a December rate cut fall.

However, Nakamura has resuscitated expectations, which has firmed the Yen.

The Bank of Japan is likely to be the only major central bank to raise interest rates in the coming months, going against the flow and, in the process, shrinking the Yen's long-running interest rate disadvantage.

The Yen has nevertheless fallen sharply against the U.S. Dollar in the October-November period, which the Bank of Japan is keen to keep a lid on.

Fighting currency weakness could justify the central bank's need to hike again before year-end.

"We are sticking to our forecast for the next 25bps hike to be delivered at this month’s policy meeting. A development that would help the yen continue to outperform heading into year end," says Hardman.