Japanese Yen Recovery Has Further to Run: ING

- Written by: Gary Howes

Image © Adobe Images

The Japanese Yen is at the core of current global FX action, and after days of significant appreciation, the question of how much further it can run is being asked.

"The size of the correction in the yen is now the market's primary preoccupation," says Chris Turner, an analyst at ING Bank.

The Yen rose to a three-month against the Dollar, but it's the impact on other currencies, such as the Australian and New Zealand Dollars, where real damage has been done.

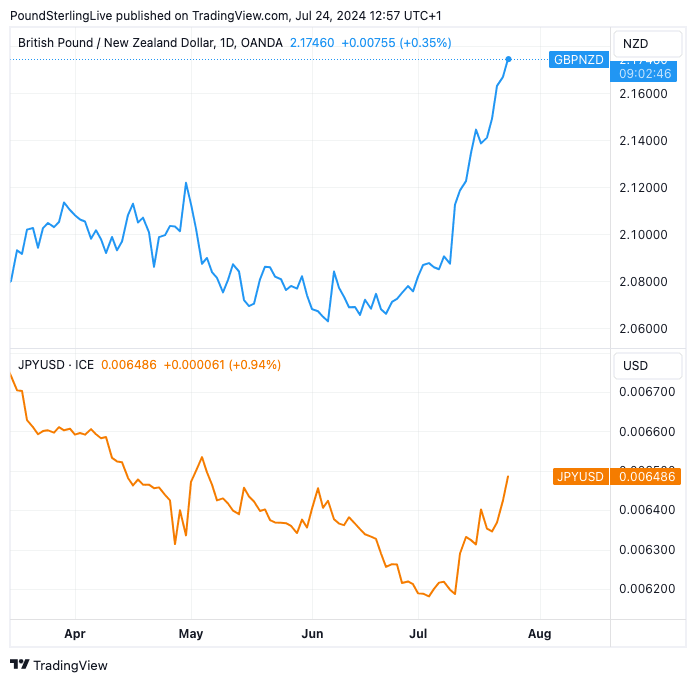

A rapid unwind in yen carry trades is underway, which means investors are repatriating billions of yen from places where interest rates are higher, such as New Zealand and Australia. We note here that the fall in NZD/JPY is having a significant impact on cross currencies such as GBP/NZD and EUR/NZD.

Compare Currency Exchange Rates

Find out how much you could save on your international transfer

Estimated saving compared to high street banks:

£2,500.00

Free • No obligation • Takes 2 minutes

Therefore, what happens to the Yen doesn't just impact the Yen.

"The unwinding of yen shorts is undoubtedly contributing to the global risk-off environment. There is certainly more unwinding to be done here and data/events over the next few days present further downside risk," says Turner.

Above: GBP/NZD surges (top panel) as the Yen recovers.

The stark recovery by the Yen has a couple of factors behind it: 1) effective intervention by the Bank of Japan, which bought yen at an opportune time 2) expectations for lower U.S. interest rates, while expectations for a Bank of Japan rate cut next week grow 3) signs Donald Trump will make a lower USD/JPY a policy objective.

The arrival of these fundamental developments coincides with a heavy one-way market structure that is geared toward investor positioning for ever-more JPY weakness. So, a position unwind is underway.

"The heart of the issue has been stretched positioning. Speculative short yen futures positioning had recently hit the most extreme levels of the last 20 years and have plenty more scope to unwind. We have also made a back-of-the-envelope calculation that short yen futures positions built this year were done so at an average USD/JPY rate of 152.50. In aggregate, those positions are nearly underwater," says Turner.

ING thinks there could be some further unwinding to be done here.

Regarding next week's Bank of Japan meeting, ING thinks the market does not fully price risks of a 15bp rate hike and a cut in the BoJ's JGB buying plans.

"We doubt investors will want to rebuild long USD/JPY positions over the next few days, and with a

market still substantially short yen, the risk is that this USD/JPY correction extends to or just below 150," says Turner.