Pound-Yen in Japanese Inflation Setback, But Uptrend Still Strong

- Written by: Gary Howes

Image © Adobe Stock

The Japanese Yen was stronger across the board following the release of consensus-beating inflation data, however, it will further inflation beats and the global central bank rate cutting cycle to break the currency's downtrend.

The Pound to Yen exchange rate fell to 190.53 after it was reported Japan's Core CPI slid to 2.0% from 2.3% in December, but this was above the consensus expectation for 1.8%. The Dollar to Yen exchange rate pared its advance by a third of a per cent to 150.21.

"Japan's core consumer inflation slowed for a third month in January, but topped expectations... The yen strengthened on the news," says Neil Wilson, Chief Market Analyst at Finalto.

Wilson says the Bank of Japan is expected to begin normalising policy in April; "it's still the base case, but the more inflation slows, the harder the BoJ will find it to move on time."

The Yen strengthened in late 2023, but 2024 has seen those gains reversed amidst a 'hawkish' repricing in rate cut expectations in the U.S., UK and elsewhere. This means the Yen might struggle until global central banks begin cutting in earnest.

It will take more than speculation of a single rate hike at the Bank of Japan to shift the tide in the Yen's favour.

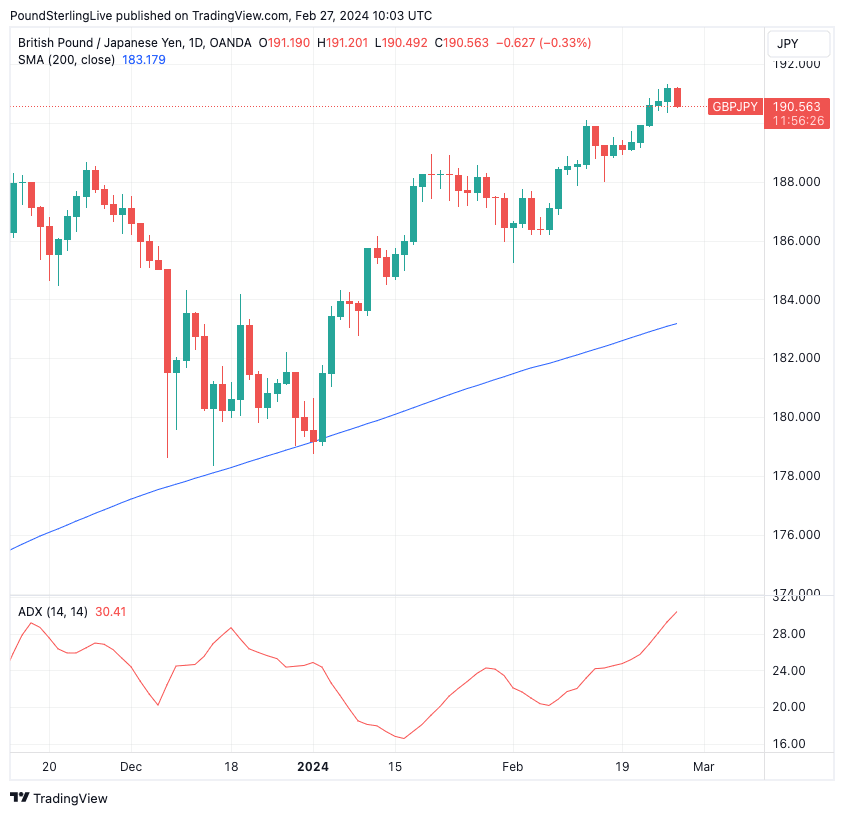

The Pound to Yen exchange rate on Monday reached a fresh high at 191.32 and all technical indicators confirm the pair is in a clear uptrend that will prove difficult to resist given the current market setup.

Above: Pound-Yen is trending strongly (ADX - a trend indicator is firmly positive in lower panel). Track JPY with your own custom rate alerts. Set Up Here.

The Dollar-Yen exchange rate unwound yesterday’s gain during the Asian session and is currently trading near 150.50, with technical indicators also advocating for further advances.

Japanese 10-year government bond yields rose by 1.7 basis points to 0.69% after market pricing for a Bank of Japan rate hike increased slightly to around an 80% chance of a 10bp increase.

"We forecast an April rate hike from the BoJ and expect a mild tightening cycle to follow. We have official interest rates peaking at 0.50% in Q3 2025," says Kristina Clifton, a strategist at Commonwealth Bank.

Commonwealth Bank meanwhile expects the Federal Reserve to begin a rate cutting cycle in May.

At this point, "narrowing interest differentials between the U.S. and Japan can remove some of the upward pressure on USD/JPY," says Clifton.