Dollar-Yen At Major Pivotal Area: City Index

- Written by: Fawad Razaqzada, Analyst at City Index

From a technical point of view, the Dollar-Yen exchange rate is at a major pivotal area here.

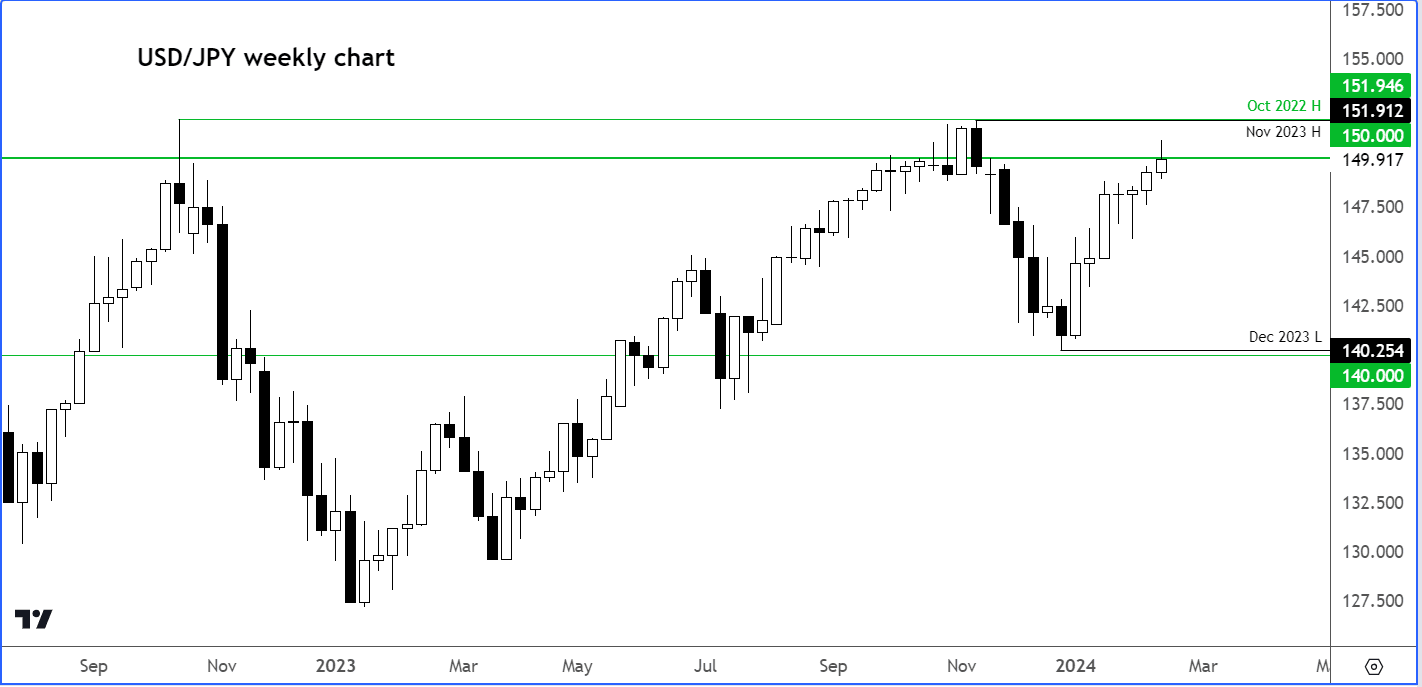

The USD/JPY has faced challenges in maintaining a breakout above the 150.00 handle over the past few years, as evidenced by the weekly chart provided:

However, a cup-and-handle continuation pattern suggests a potential breakout in the future.

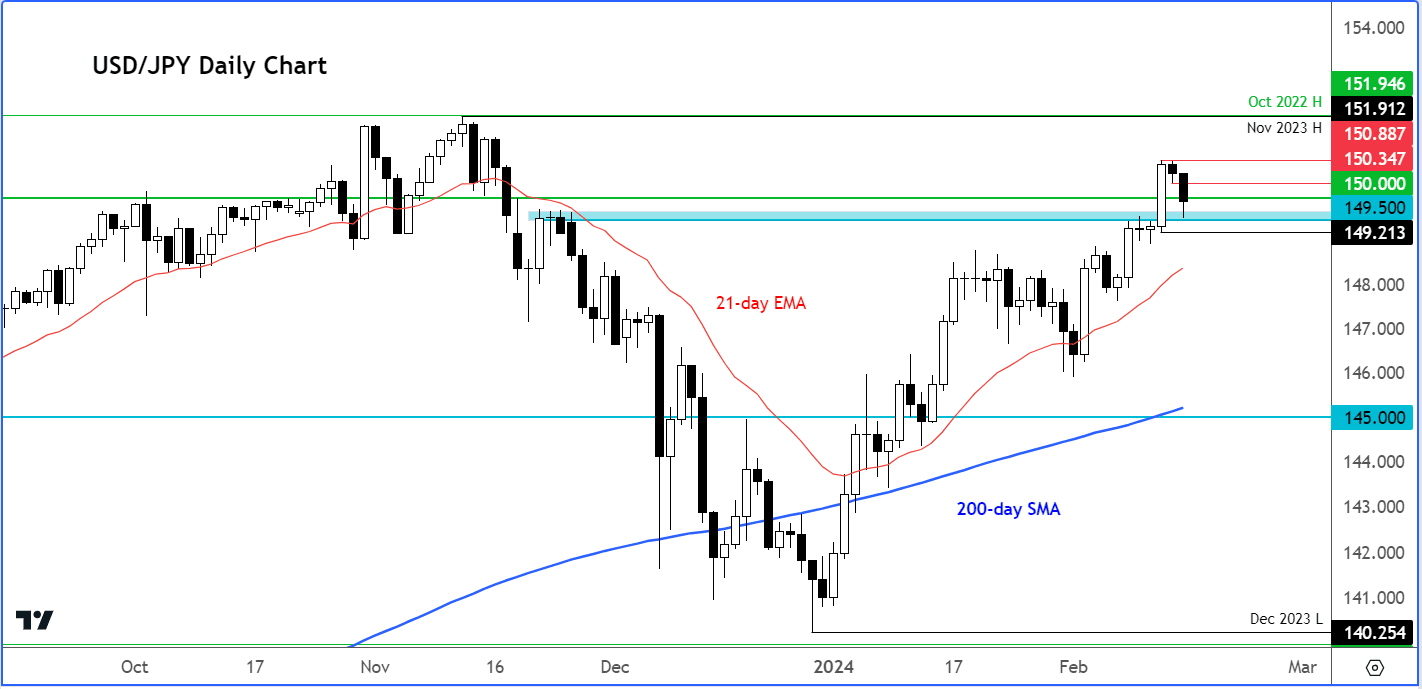

In the immediate term, it's crucial for support to hold within the 150.00 to 149.50 range.

This range, particularly the lower end, served as the starting point for this week's breakout, as depicted in the daily chart:

The big thrust candle on Tuesday implies the possibility of further gains, but a prompt recovery is essential to prevent a loss of momentum.

Tuesday’s low at 149.21 is the line in the sand for me as far as the short-term is concerned. A breach of this level could trigger a rapid sell-off as resting stops below are activated.

However, if my base case scenario unfolds and we witness additional gains, my initial focus would be on reclaiming Wednesday's low at 150.35.

Subsequently, the bulls’ attention may shift to liquidity above this week's high at 150.89, potentially paving the way for a surge towards the double top high around the 181.90-181.95 area, where the USD/JPY reached its peak in the past two years.