Dollar-Yen (USDJPY) Outlook Upgraded at Julius Baer

- Written by: Sam Coventry

Image © Adobe Stock

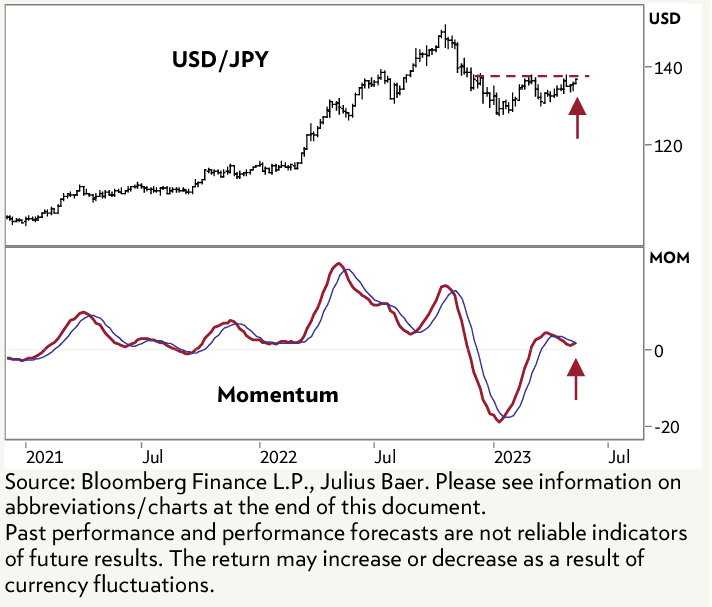

Julius Baer's Head of Technical Analysis, Mensur Pocinci, suggests that the Dollar to Yen (USD/JPY) currency pair is poised for a potential medium-term recovery after a period of volatile consolidation since January.

Pocinci notes that the pair is approaching the highs of the year, and the medium-term momentum indicator indicates a new bottom, signalling the possibility of an upward movement. However, Pocinci believes that the USD/JPY is unlikely to reach its October highs.

Pocinci explains, "will the USD/JPY rise back to its highs of October? Probably not. Most likely, the Japanese yen will remain generally weak and see more weakness, whilst the US dollar should record a minor improvement."

This assessment suggests that while the Japanese yen may continue to exhibit weakness, the U.S. dollar is expected to experience a slight improvement.

Based on this analysis, Pocinci recommends investors to close their short USD/JPY positions.

This recommendation suggests a shift in strategy, indicating that Pocinci expects a potential turnaround in the currency pair's performance.

In addition to the USD/JPY, Pocinci also comments on the Chinese renminbi's recent performance. He highlights that the renminbi is deteriorating and has reached a new high for the year against the USD.

Pocinci states, "Similarly, the Chinese renminbi is deteriorating and has risen to a new high for the year. A rise above 7.05 against the USD would open the way for a retest of 7.20."

These observations suggest that the Chinese renminbi is facing downward pressure, with the potential for further weakness against the US dollar.

Pocinci's analysis points out a specific level to watch for in the USD/CNY exchange rate, indicating that a rise above 7.05 could lead to a retest of 7.20.

As the market dynamics continue to evolve, investors and traders may find value in considering these insights provided by Mensur Pocinci of Julius Baer.

However, it is important to note that the foreign exchange market can be subject to various factors and uncertainties that may influence currency movements.