Japanese Yen Sellers Beware: Bank of Japan Could Have the Last Laugh

- Written by: James Skinner

- USD/JPY edges higher again but top may already be in

- Buyers risk being flattened in spectacular JPY recovery

- FX intervention, Volckerian Fed could unravel USD/JPY

© European Central Bank, reproduced under CC licensing

The Japanese Yen was slipping again in the penultimate session of the week but recent speculation about the prospect of direct intervention by the Bank of Japan (BoJ) to support the currency is not the only reason why the Yen may already have bottomed and could be on the cusp of a spectacular recovery.

Japan's currency had previously risen against all G20 counterparts on Wednesday after Nikkei reported that the BoJ had engaged in conversations with local banks that would normally only be had when the Ministry of Finance is considering a direct intervention in the currency market.

"We continue to expect Japanese officials to actively signal to the FX market that it doesn't want to see 145.00 break, largely because that could lead to a very quick run on 150.00. However, we continue to think that that Japan will be very shy about conducting actual cash intervention in the FX market because doing so runs the risk of failure and credibility loss," says Greg Anderson, global head of FX strategy at BMO Capital Markets.

"Conducting unconfirmed rate checks doesn't carry the same potential credibility damage, although it isn't completely free. Like other forms of jawboning, it loses effectiveness after a while if it isn't backed up, and it can at times act like blood in the water that attracts a rush of sharks to the general vicinity," Anderson wrote in a Wednesday market commentary.

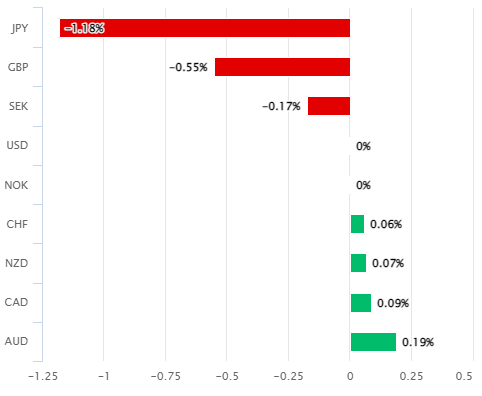

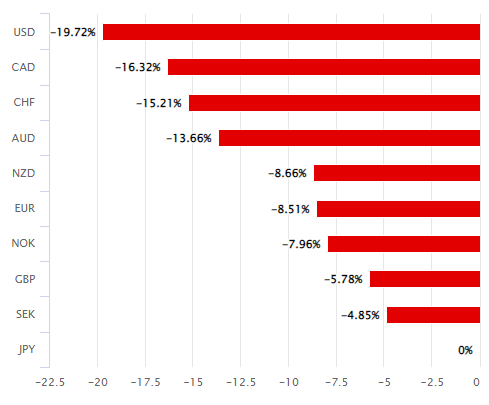

Above: U.S. Dollar relative to G10 and G20 currencies on Wednesday, 14 September. Click each image for closer inspection. Source: Pound Sterling Live.

Many in the market doubt the BoJ's capacity to defend the Yen but they may be overlooking the effect that its actions could have when combined with the possible effects of next week's interest rate decision from the Federal Reserve.

Put simply, the two things together may be enough to prompt a spectacular reversal of the Yen's 2022 decline and in part because they could also take the legs out from underneath a runaway U.S. Dollar, which has flattened all currencies this year and yielded almost nothing to nobody.

“The latest CPI and PPI prints this week proved to be pivotal for the rates space. Resilient growth and still hot inflation might well require a more forceful response from central banks,” says Eugen Leow, a senior rates strategist at DBS Group Research.

“The upshot is the data thus far has been supportive of further tightening, and fading Fed cuts in 2023 (relative to the 2Q23 peak priced) makes sense. There might also be a bit of complacency on inflation expectations in longer term rates,” Leow and colleagues said on Thursday.

Wednesday's data out of the U.S. was significant for revealing a fresh upturn in core inflation following earlier declines and at a point when Fed officials have been expressing increasing concerns about rising inflation expectations while also making references to the 1980s Fed Chairman Paul Volcker.

Above: USD/JPY shown at monthly intervals with Fibonacci retracements of 1985 and 1998 downtrends indicating possible areas of medium and long-term technical resistance. Click image for closer inspection.

Above: USD/JPY shown at monthly intervals with Fibonacci retracements of 1985 and 1998 downtrends indicating possible areas of medium and long-term technical resistance. Click image for closer inspection.

Chairman Volcker famously used brutally high borrowing costs to drive double-digit inflations rates out of the U.S. economy between 1979 and 1987, which was a volatile period for global financial markets as well as for the Dollar, which is relevant because it appears as if Fed Chairman Jerome Powell and 2022 colleagues may be about to follow in his footsteps next Wednesday.

This would mean there is a risk of a serious uplift in U.S treasury yields following next Wednesday's Fed decision and one that could also be likely to place already-stressed U.S. stock markets under further.

It's far from obvious that even the Dollar could remain on its feet in those circumstances and any rollover would have potentially significant implications for the Yen, which is the most heavily sold of G10 currencies this year and would also be likely to benefit from any intervention by the BoJ around that time.

"The Bank of Japan and Japanese Ministry of Finance may make life difficult for FX traders," says John Hardy, head of FX strategy at Saxo Bank.

"History shows that determined intervention can make for very choppy markets, even for other USD pairs as USDJPY volatility spikes back and forth," Hardy and colleagues said on Wednesday.

Above: Japanese Yen relative to G10 and G20 currencies on Wednesday, 14 September. Click each image for closer inspection. Source: Pound Sterling Live.