Japanese Yen Loss Echoed by Renminbi as Each Bolsters U.S. Dollar

- Written by: James Skinner

- USD/JPY hits fresh 20 year high after BoJ decision

- JPY followed by RMB while USD strength broadens

- U.S. bond yields seen as key for USD/JPY outlook

Image © Adobe Images

The Japanese Yen tumbled to a fresh 20-year low after the Bank of Japan (BoJ) stayed its stimulative monetary policy course, eliciting losses that were partially echoed by the Chinese Renminbi and which likely helped to lift the U.S. Dollar broadly during the penultimate session of the week.

Japan’s Yen fell heavily in a Thursday slump that lifted USD/JPY to 131 and its highest level since April 2002 after the Bank of Japan said it would continue buying government bonds in whatever quantities are necessary in order to enforce a 0.25% limit on the 10-year bond’s yield.

The cap on the 10-year yield exists as part of the bank’s continuing “yield curve control” policy but has played a role in diminishing the Yen’s relative appeal to investors and especially in relation to the U.S. Dollar, which has benefited this year from a steep rally in U.S. government bond yields.

“The move in USD/JPY is driving USD strength across other FX pairs as well. The NZD and NOK are both down close to 1%, while the EUR and GBP are down by around -0.50% as I type,” writes Bipan Rai, North American head of FX strategy at CIBC Capital Markets.

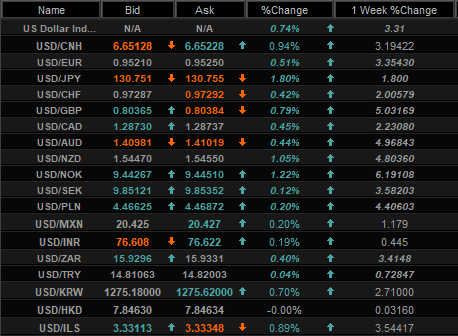

Above: Interbank reference rates for selected U.S. Dollar pairs. Source: Netdania Markets. Click image for closer inspection.

While all major currencies ceded ground to the Dollar on Thursday China’s Renminbi was among the first to follow its Japanese counterpart lower when USD/CNH rose above the 6.60 level that had otherwise capped its advance since Monday, and this too has significant influence over other currencies.

"In our view, much will depend on how the move propagates. If USDCNH re-anchors in the 6.60s and EURUSD finds a floor at 1.05, then USDJPY may top out at 131 or 132 before next week's FOMC. But if those things don't happen, then USDJPY might have considerably more upside," says Greg Anderson, global head of FX strategy at BMO Capital Markets.

The BoJ noted on Thursday that recent increases in energy prices will weigh on the Japanese economy in the short-term before eventually waning, leading it to conclude that further monetary policy support for the economy is necessary if inflation is to reach the 2% target in a sustainable manner.

The BoJ’s policy stance effectively leaves the Yen at the mercy of U.S. government bond yields, which have surged this year in response to a frank admission from the Federal Reserve (Fed) that it’s likely to lift U.S. interest rates significantly in the months ahead.

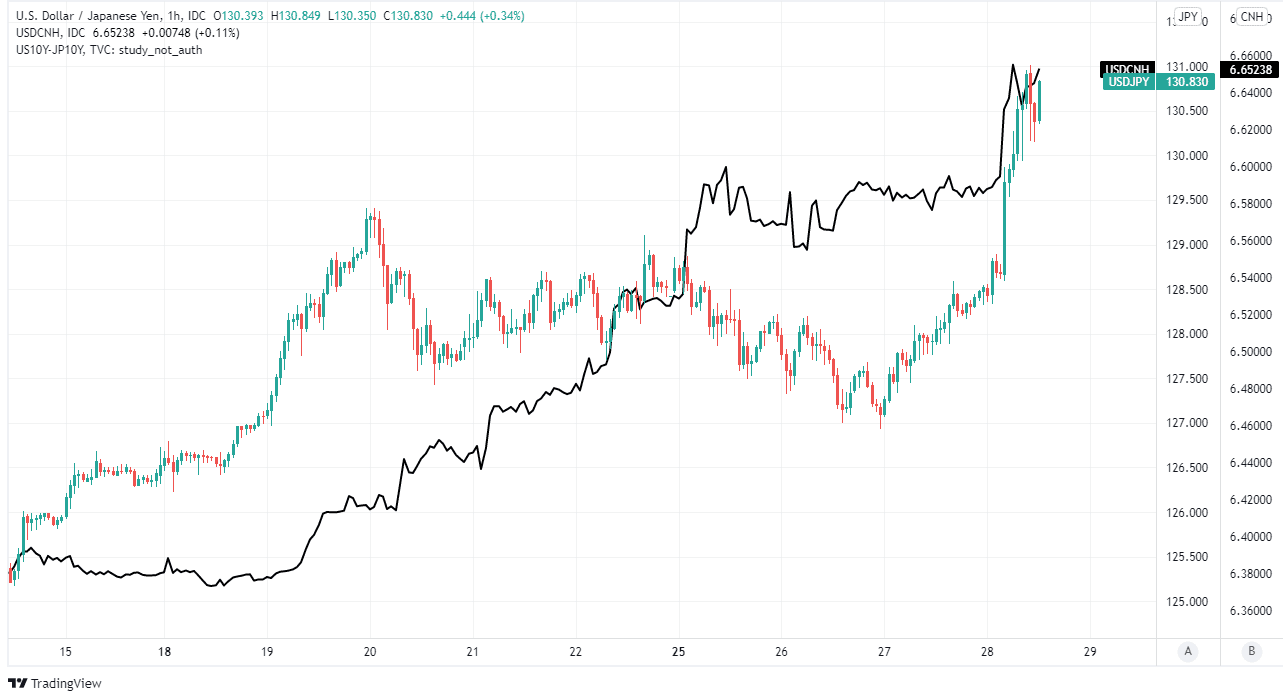

Above: USD/JPY shown at hourly intervals alongside USD/CNH. Click image for closer inspection.

Above: USD/JPY shown at hourly intervals alongside USD/CNH. Click image for closer inspection.

“The sharp move lower in the value of the JPY this morning suggests that there were plenty of participants in the market who doubted the BoJ’s commitment to its dovish stance,” says Jane Foley, head of FX strategy at Rabobank.

“If US yields push higher and encourage further upside in USD/JPY, the costs of this policy in terms of currency weakness could prove to be greater than the benefits. This explains why the market is likely to continue to suspect that the BoJ could do a policy U-turn,” Foley also said on Thursday.

This is all after Chairman Jerome Powell said last week that U.S. rates should be lifted to “levels that are more neutral and then that are actually tight if that turns out to be appropriate,” and Fed estimates suggest that neutral rate of interest is somewhere between 2% and 3%.

That means U.S. interest rates could rise to 3% or more over the course of this year and next as the Fed seeks to rein in a runaway inflation rate that reached 8.5% in March and which may also have been lifted by the strength of the U.S. economy rather than by just energy and food prices.

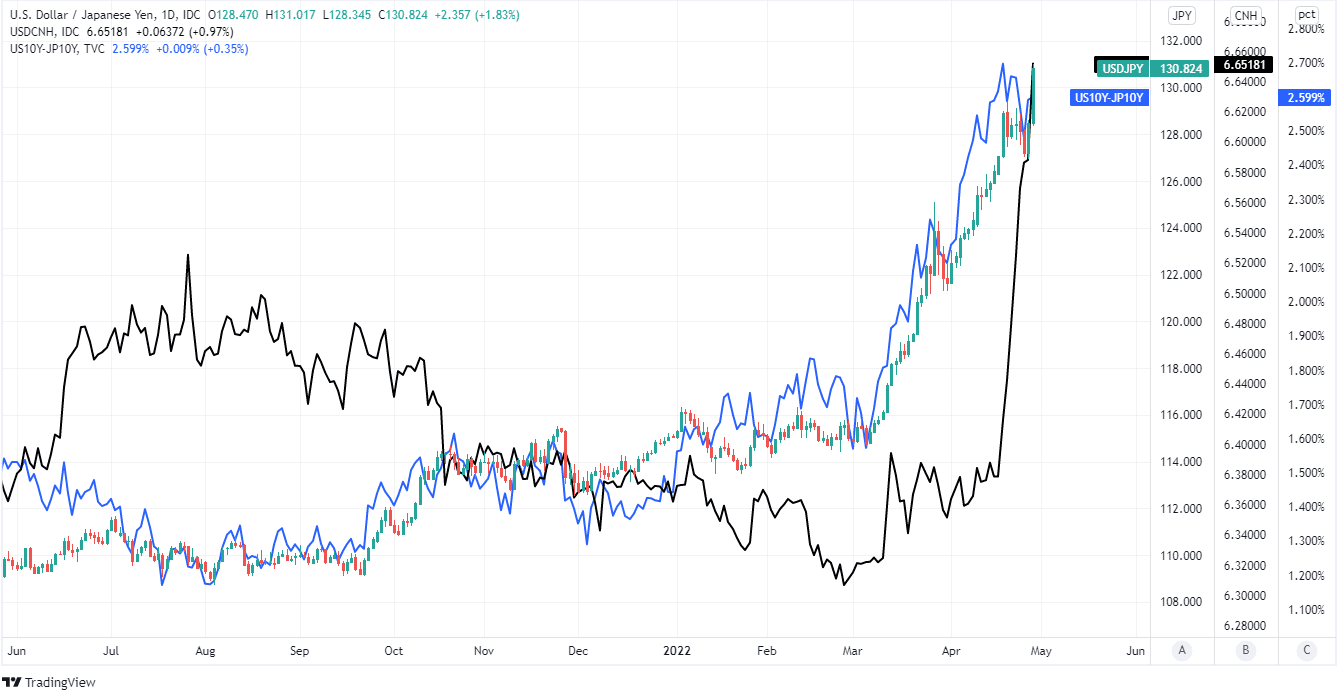

Above: USD/JPY shown at daily intervals with spread - or gap - between 10-year U.S. and Japanese government bond yields and alongside USD/CNH. Click image for closer inspection.

Above: USD/JPY shown at daily intervals with spread - or gap - between 10-year U.S. and Japanese government bond yields and alongside USD/CNH. Click image for closer inspection.

“BoJ policy plays only a minor role in our expectation of further JPY weakness going forward. The key driver is the impact of higher US rates and the implications for the hedging behaviour of JPY-based investors,” says Adam Cole, chief FX strategist at RBC Capital Markets.

Fed policy had already lifted the Dollar broadly during recent trading but the greenback’s gains were bolstered on Thursday by the BoJ-induced declines in the Japanese Yen and the resulting response from the Chinese Renminbi.

“Both USD/CNY and USD/CNH are sharply higher, extending recent gains and today tracking a rally in USD/JPY,” says Patrick Bennett, head of Asia FX strategy at CIBC Capital Markets and a colleague of Rai.

“The next major upside level for USD/CNH is around 6.6700, the point of lows from Feb-Apr 2019. Measures last week seen to curb the weakness, or at least pace of weakness in the yuan, may need to be revisited or extended,” Bennett wrote in a Thursday market commentary.