Japanese Yen Under Strain as BoJ Policy Risk Looms Ahead

- Written by: James Skinner

- JPY under pressure amid renewed energy supply risks

- Looming BoJ decision seen as supportive for USD/JPY

- But hint of a BoJ policy shift could turn tables & aid JPY

Image © Adobe Stock

The Yen tumbled alongside many other currencies in the midweek session but faces additional risks stemming from a looming Bank of Japan (BoJ) monetary policy decision that many suspect will cement in place a vast gulf between Japanese and U.S. government bond yields.

Japan’s Yen rose against the Euro and Norwegian Krone on Wednesday but fell against most other major counterparts as the currency market contemplated the prospect of Russian energy supplies to ‘unfriendly countries’ being disrupted.

“A sudden stop of Russian gas supplies to Europe could push Europe into a recession. The precise impact of such an immediate gas embargo is hard to predict,” says Kallum Pickering, a senior economist at Berenberg.

This was after gas supplies to Poland and Bulgaria were reported to have been halted following a refusal by companies operating there to comply with the terms of the Kremlin’s gas-for-Roubles ruse, leading to speculation about similar actions affecting other countries in the near future.

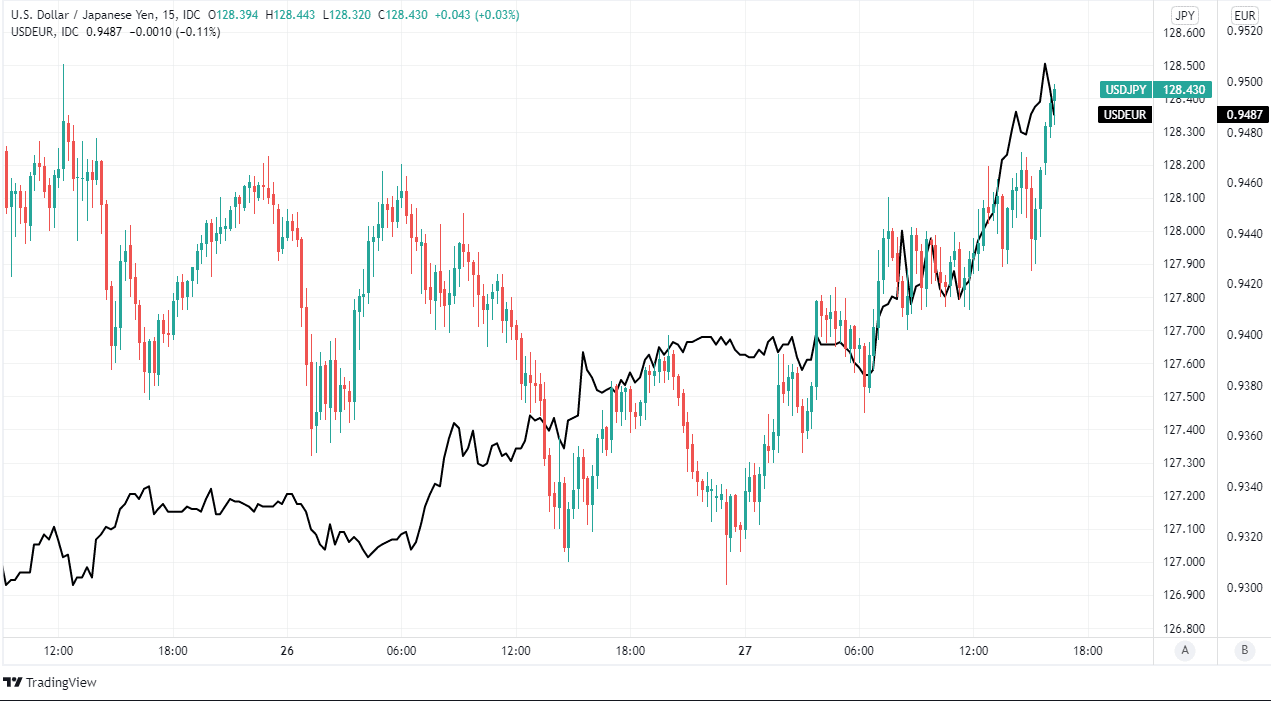

Above: USD/JPY shown at 15-minute intervals alongside USD/EUR. Click image for closer inspection.

Above: USD/JPY shown at 15-minute intervals alongside USD/EUR. Click image for closer inspection.

Japan is one of the “unfriendly countries” participating in sanctions against the Russian government and is also, to a similar extent as Europe, heavily dependent on energy imports from Russia hence why the Yen fell by almost as much as the European single currency on Wednesday.

Wednesday’s losses reversed what had otherwise been a strong performance from the Yen, which appeared to have been afforded relief from weeks of heavy selling when U.S. government bond yields eased lower over the course of Monday and Tuesday.

However, the burden of those yields - or the gap between them and their Japanese equivalents - will be back in focus again on Thursday when the BoJ is set to announce its latest monetary policy decision.

“While very few are expecting a shift, it wouldn’t take much of a hint to suggest the pressure on the BoJ via the weakening currency is becoming too strong to ignore,” says John Hardy, head of FX strategy at Saxo Bank.

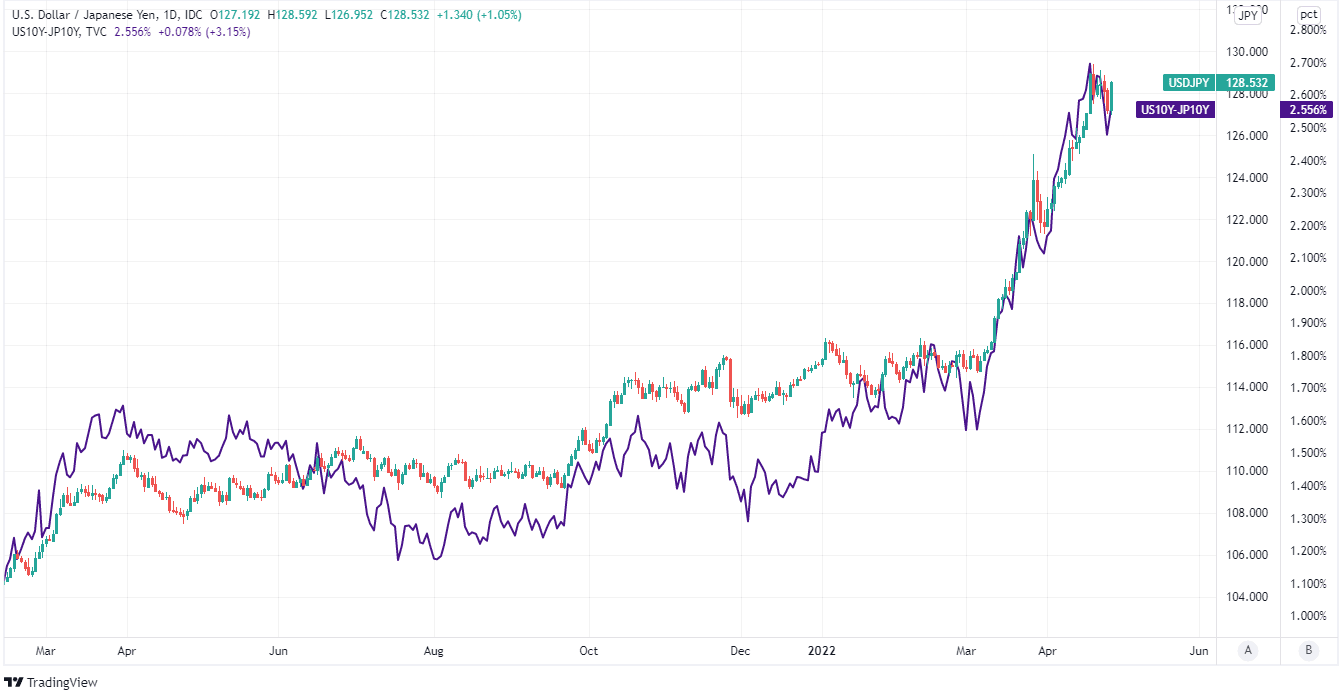

Above: USD/JPY shown at daily intervals alongside spread - or gap - between 10-year U.S. and Japanese government bond yields. Click image for closer inspection.

Above: USD/JPY shown at daily intervals alongside spread - or gap - between 10-year U.S. and Japanese government bond yields. Click image for closer inspection.

“Even a hint that the Bank is mulling tightening without specifics could be enough to trigger a JPY rally, but spelling out that the bank is willing to tinker with its yield cap policy on 10-year JGB’s would likely spark an even sharper move,” Hardy said in a Wednesday market commentary.

The BoJ’s policy of seeking to maintain the 10-year Japanese government bond yield around 0%, while enforcing a hard cap at 0.25% for the benchmark of long-term borrowing costs, has made the Yen vulnerable to the sharp increase in U.S. government bond yields seen in recent months.

Currency depreciation connected with the yield differential has drawn frequent expressions of concern from the finance ministry and prompted speculation in the market about a possible intervention in order to quell the fall in the Yen.

“Investors are likely to be wary of the BoJ maintaining its ultra-easy bias when its two-day policy meeting concludes tomorrow,” says Jeremy Stretch, European head of FX strategy at CIBC Capital Markets.

“That the BoJ has extended unlimited bond purchases to seven straight sessions, as it aims to defend the 0.25% YCC target, underlines their current determination to limit yields, even if the policy comes at the expense of a cheaper JPY,” Stretch and colleagues said on Wednesday.