Dollar-Yen Outlook Could Shift Significantly on Break of 106

- Written by: Richard Perry, Hantec Markets

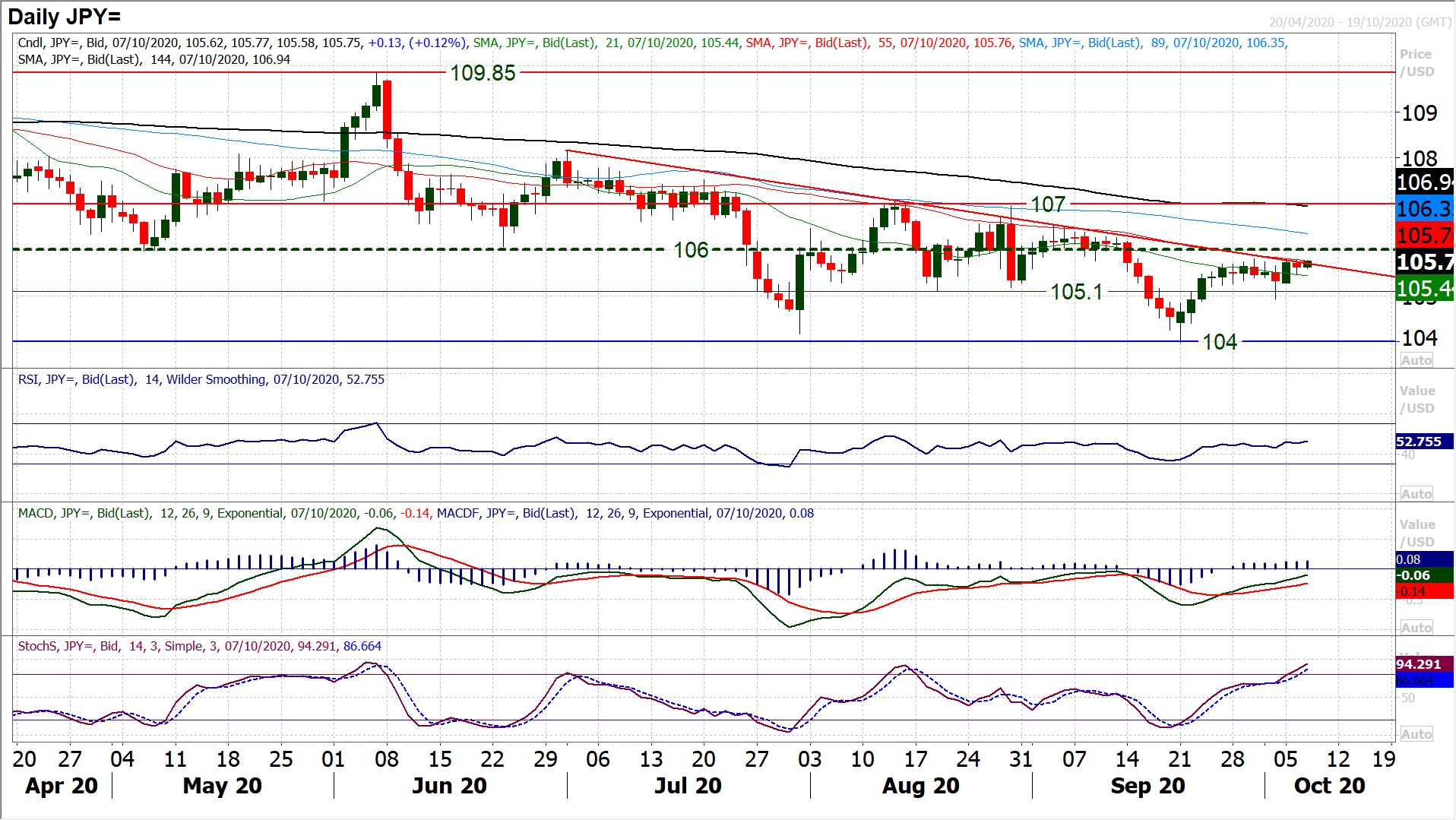

The Dollar-Yen exchange rate retains a firm bias and analyst Richard Perry of Hantec Markets says if a key resistance is broken and the exchange rate goes back above the old 106.00 pivot then a key shift in the outlook will have transpired.

There is somewhat of an uncertain outlook for risk forming and this is leading to some mixed signals on Dollar/Yen.

The yen has not benefitted from the news that Trump is ending negotiations on fiscal support, so perhaps it is not all out risk negative then.

It leaves a mild strengthening on USD which is seeing USD/JPY still hovering around the resistance of 105.80.

This is now seriously testing the resistance of the three month downtrend and the 55 day moving average (at 105.76 and which has been a great basis of resistance in recent months).

It leaves Dollar/Yen on a knife edge. We believe that any move back above the old 106.00 pivot would be a key shift in outlook.

It would end the trend of selling into strength, and leave the pair in a medium term range 104/107 (which it would have then been in for ten weeks).

However, another bull failure here would maintain the struggle that the dollar bulls face and pressure back on 104.90/105.10. Momentum indicators point towards a recovery, but can the market break through 105.80 resistance?

If ever there was a lesson in watching the newsflow as well as the technicals it was yesterday. The dollar weakening and positive risk appetite was turned completely on a sixpence with Trump’s announcement to end negotiations on fiscal support.

Trump has pulled the plug on the White House negotiating with the Democrats, saying that Nancy Pelosi is “not negotiating in good faith”. He has ordered negotiations to stop until after the Presidential election.

This coming even after Fed chair Powell spoke of the need for fiscal support to be used alongside monetary policy. Risk appetite flooded away and the dollar strengthened.

Now, it is all about the reaction today.

We will see what the recent risk recovery was really made of.

Was it all a load of hot air, just pumped up on the assumption that a fiscal support package of possibly towards $2 trillion would flood the economy? Or is there something deeper to the move?

An initial dollar strengthening on the disappointment has started to ebb again early this morning.

Risk appetite is rebounding, with Treasury yields higher, the dollar broadly lower, US index futures higher and gold higher. Can this move continue into and through the US session.

If US traders come in and see another opportunity to sell, it would signal a confirmation that there is likely to be at best choppy trading (likely in front of the election), but could even see another leg of dollar strengthening.

It could be a key session ahead.

Today is quite light on key entries for the economic calendar.

It is only really the EIA Crude Oil Inventories at 1530BST of interest, with an expectation of a slight stock build of +0.4m barrels (after a drawdown of -2.0m barrels last week).

It is however, a day heavy with central bank speakers. The ECB’s Christine ,Lagarde takes top billing at 1310BST where the hope is that perhaps she will give more away that yesterday’s speech.

Then later in the session, the Fed speakers begin, with the FOMC’s Neel Kashkari (voter, very dovish) at 1800BST. The at 1900BST the FOMC’s John Williams (voter, centrist) speaks.