USD/JPY: Hantec Markets Prefer Move to 106.00

- Written by: Richard Perry, Hantec Markets

Image © Adobe Images

The Dollar-Yen exchange rate is relatively flat at the time of writing at 106.27, with a sell-off on global stock markets apparently aiding the two safe havens. Analyst Richard Perry of Hantec Markets says near-term rallies will likely struggle.

Another small bodied candlestick extends the near term uncertainty.

Perhaps it is unwise to read too much into yesterday’s session, given the US public holiday, however, there are still question marks over how far this USD rebound can take Dollar/Yen.

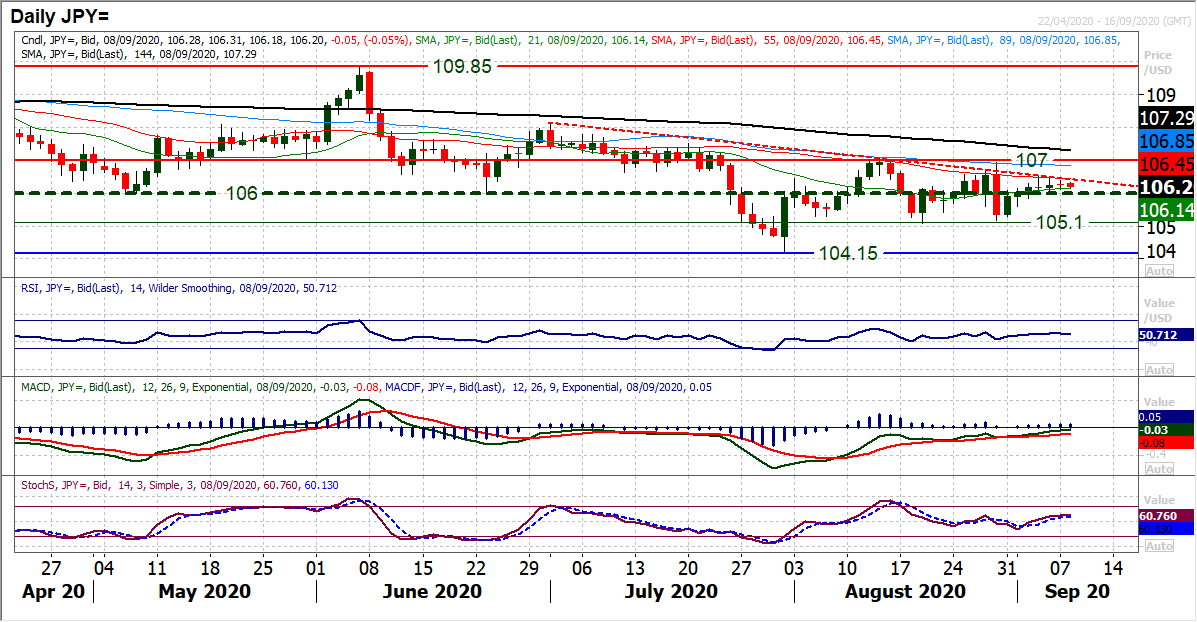

Our assessment continues to be that near term rallies will struggle in the 106/107 band of overhead supply.

Another session also where the bulls have shied away from the two month downtrend (today at 106.45) and the 55 day moving average (today also at 106.45) which has become a basis of resistance in the past eight weeks.

We continue to prefer pressure towards the 106.00 (which has been a near term pivot) and below towards the August lows of 105.10 in due course.

A close above 107.00 would improve the outlook for the bulls and begin to look more seriously at a sustainable recovery.

The hourly chart shows resistance at 106.50/106.55 strengthening.