Pound's Uptrend Against the Yen Still Intact Despite Soft Start to the Week

Image © Adobe Stock

- GBP/JPY is pulling back at the start of the new week

- But breakout from bullish wedge pattern remains valid

- Could still bode bullish longer-term

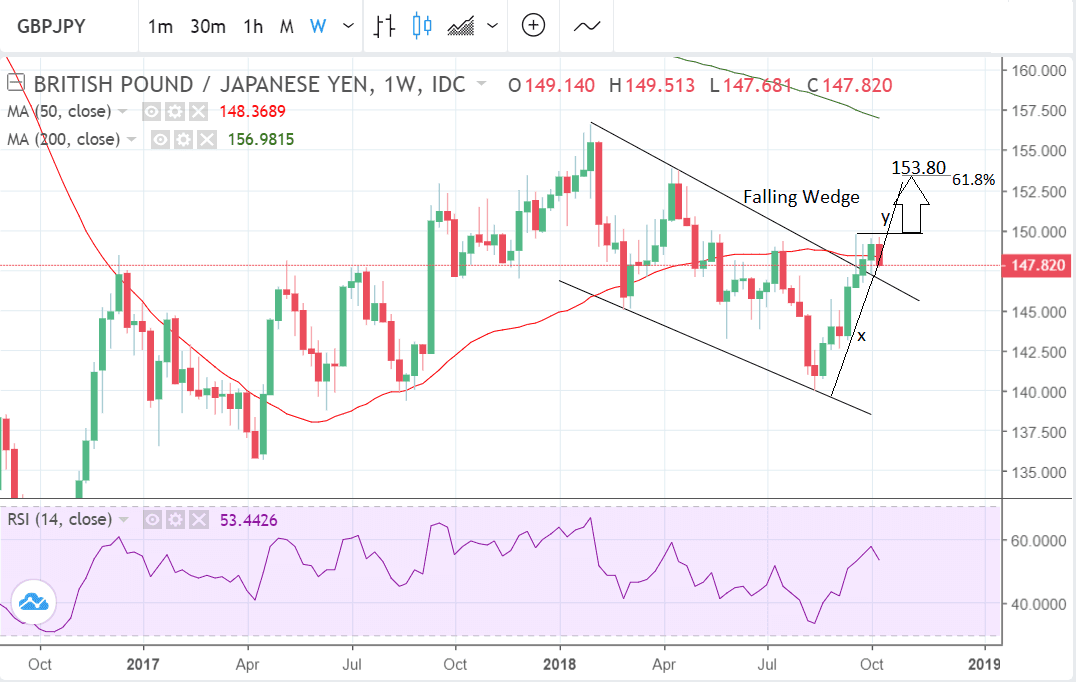

The GBP/JPY exchange rate has broken out above the upper border of a falling wedge pattern and is expected to extend substantially higher.

Short-term weakness at the start of the new trading week is therefore expected to be temporary. Markets are in 'risk-off' mode and showing a demand for the safety of the Yen while Sterling is seen softer right across the board following the strong performance in the previous week.

This may just represent a bout of profit-taking or short-term noise rather than a major reversal and we continue to be bullish seeing a strong chance the uptrend will resume.

A break above the 149.74 highs would provide confirmation of a continuation higher to a conservative target at 153.80.

The 153.80 target is calculated using the height of the wedge (x) as a guide, and extrapolating it by 61.8% from the breakout point (y), for a conservative upside estimate. This is the accepted method amongst market technicians.

There is a lesser chance the pair could also move as far as 100% of the height, which would give an upside target of 157.35.

Momentum, as measured by RSI, in the lower pane of the chart, has turned down after a bullish rise.

The pair has successfully broken above the 50-week moving average (MA) on a closing basis, which is no mean feat given how tough major MAs are as obstacles to the trend.

It is often the case that prices will stall, pull-back or even reverse after touching them.

The effect is heightened by short-term technical traders fading the trend at the level of the MA in anticipation of just such a counter-trend move.

There is a risk the current pull-back will go so far that it invalidates the breakout from the wedge and the break above the MA.

A move below 146 on a closing basis, would invalidate the bullish case.

The Japanese Yen: What to Watch

The main release for the Yen in the week ahead is the current account balance which is forecast to show a ¥1897bn rise in the surplus in August when it is released at 00.50 B.S.T on Tuesday morning compared to the ¥2010bn in July.

The current account is the broadest measure of balance of payments for a country and a surplus indicates more inflows than outflows, which is generally positive for a currency since it indicates increased demand. If the surplus falls more than currently forecast, however, it may weigh on the Yen, and vice-versa if it rises unexpectedly.

Another major release for the Yen is Machine Orders in August, which is forecast to show an -4.0% fall month-on-month, up from the 11.0% rise of the previous period, when it is released at 00.50 on Wednesday.

The metric is a rather volatile series, however, which often shows double-digit changes from month to month, so a response from the Yen may be limited.

The tertiary industry activity index is a measure of the change in the total value of services purchased by businesses.

It is a leading indicator of the economy. It is scheduled for release on Friday, October 12 at 5.30. A higher-than-expected result would be positive for the Yen and vice-versa for a negative result.

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here