GBP/USD and EUR/USD Subject to "Massive Pre-Fed Options Expiries"

Image © DragonImages, Adobe Stock

- Options market could be key driver of price action ahead of Fed

- This leads prices to hover close to or around option levels

- Big expiry levels on GBP/USD lie at 1.3190-1.3200 and 1.3225

The expiry of large volumes of option contracts at certain levels on G10 FX has the potential to affect market direction on Wednesday in the run up to the highly anticipated meeting of the U.S. Federal Reserve.

Options - a type of derivative which provides traders with extra leverage - are set to expire in large enough volumes to move EUR/USD, GBP/USD, USD/JPY, USD/CAD, AUD/USD, and NZD/USD.

The expiry levels correspond to the options' strike prices - the level the market needs to beat for the options to make a profit.

The expiry time is 15.00 B.S.T (14.00 GMT) and option expiry levels exert an increasingly pronounced effect on the price the nearer the time gets to expiry.

"The only time that counts for these options expiries is at 14.00 G.M.T each day," says Mike Paterson at Liveforex.

The impact can be pronounced, says Paterson:

"As a former market maker I worked very closely with my options desk and there are times, quite a few times when USD/CHF did not go through a certain level (because of expiry flows)."

Option expiries impact on market direction via a process known as 'pinning' in which option writers try to manipulate the market price to avoid costly losses.

When an option becomes profitable to its holder it becomes loss-making for the writer, and the process of 'pinning' occurs when option writers try to manipulate the market down and away from profit.

Only larger expires, valued at over $600m, tend to cause a measurable impact, says Jarratt Davis, a renowned forex trader, and hedge fund manager.

The expiry levels tend to act as a kind of "magnet" to the price drawing it down or up to it.

"Very often an options expiration of a certain price will act almost like a magnet. For example, if you got an options expiration of a billion on EUR/USD at 1.10 the price will tend to gravitate around 1.10. It might come up maybe beyond 1.10 a little bit but most likely it will eventually come back down.

In a way it will just hover around options expiration price until the time of the cut," says Davis.

Gamma Explosion

Although the effect of the expiries is normally to 'pin' the exchange rate to the option expiry level traders should beware of blindly interpreting option expiries in this way, as there is also a risk that a really big move could pivot traders in the opposite direction to the expiry level as they give up trying to manipulate the market and instead join the trend.

This is known as a 'Gamma Explosion' and can ignite big waves of buying or selling.

GBP/USD

GBP/USD is currently quoted at 1.3158, and the big expiry levels on GBP/USD lie at 1.3190-1.3200 (725m) and 1.3225 (1.1Bn), and these may have an effect on the pair.

However, given the market is currently trading quite far below expiry, option writers trying to manipulate the market back towards the levels have a lot of ground to cover.

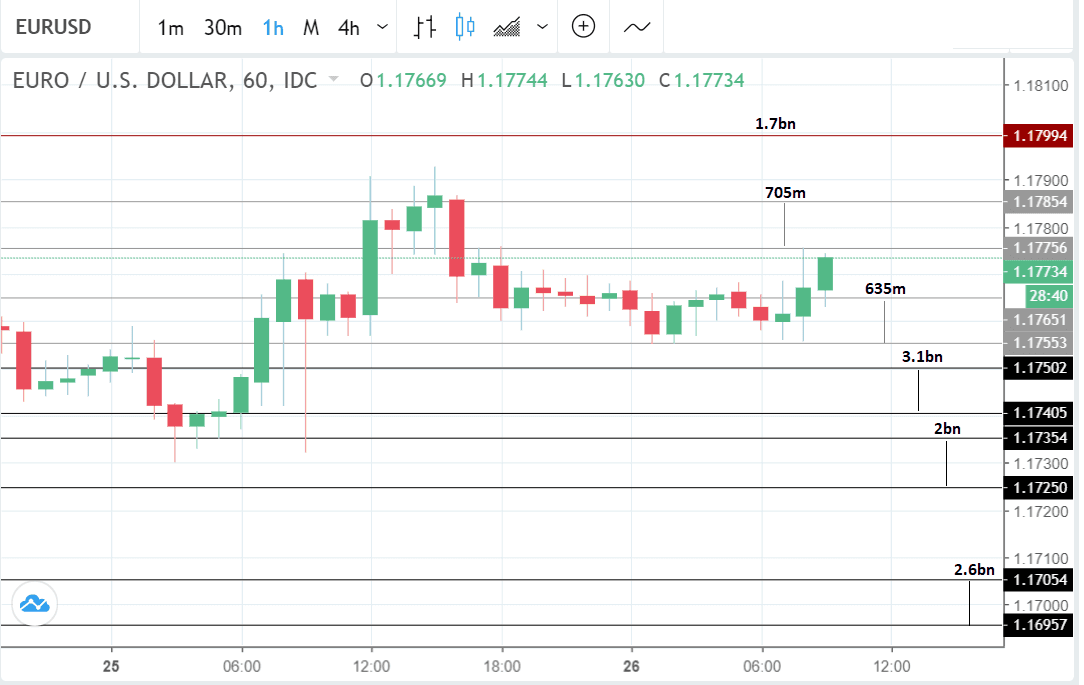

EUR/USD

On EUR/USD there are several major levels all with big expiry volumes.

The pair is currently pushing against the expiry level between 1.1775-85 and this could start to have a stronger pinning effect over time.

An extremely large expiry level composed of 3bn worth of expiries at 1.1740-50, which could have a downwards pull.

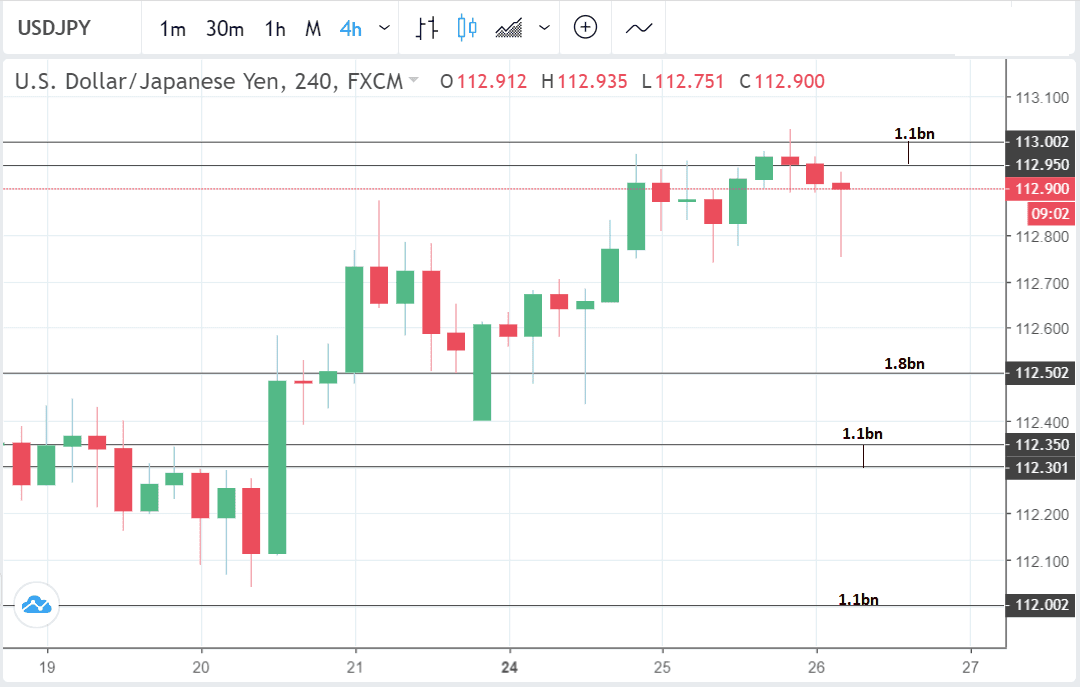

USD/JPY

Dollar-Yen is currently pushing up against a major expiry level between 112.95-113.00 which is likely to act as a kind of ceiling, capping further gains for the pair.

AUD/USD

The Aussie has fallen to a major expiry level at 0.7255-60 composed of 1.1bn of option contracts. The level currently appears to be pinning the exchange rate down and will probably provide a support floor for the exchange rate.

USD/CAD

USD/CAD is trading quite far above its major expiry level and could be vulnerable to the opposite effect to pinning, or 'gamma explosion', suggesting a potential for more upside.

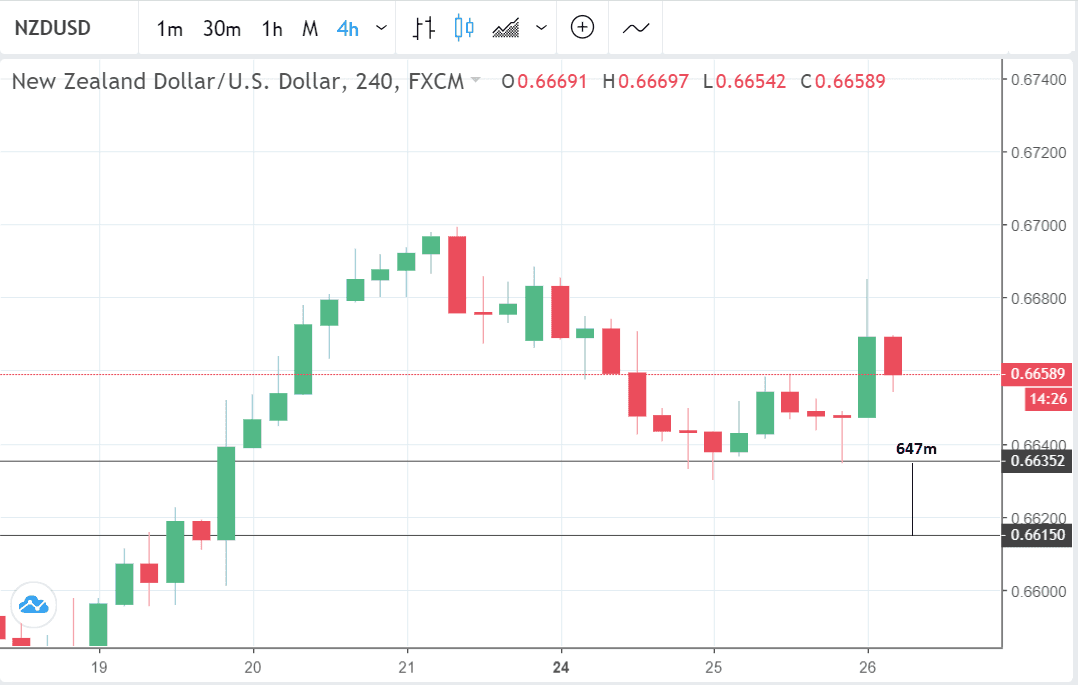

NZD/USD

NZD/USD fell and touched its expiry level at 0.6615-35 (647m) yesterday evening before rallying up to the recent 0.6685 highs. Since then the pair has fallen back down to the current price of 0.6659 - possibly as a result of pinning. It is possible it could remain trapped near the expiry zone as writers attempt to push the rate down.

Option Expiries of 600bn or over on Wednesday, September 26, data courtesy of Reuters:

- EUR/USD: 1.1695-1.1705 (2.6BLN), 1.1725-35 (2BLN), 1.1740-50 (3.1BLN), 1.1755-65 (636M), 1.1775-85 (705M), 1.1800 (1.7BLN)

- GBP/USD: 1.3190-1.3200 (725M), 1.3225 (1.1BLN)

- AUD/USD: 0.7250-55 (1.1BL), 0.7350-60 (850M)

- NZD/USD: 0.6615-35 (647M),

- USD/CAD: 1.2860-75 (835M),

- USD/JPY: 112.0 (1.1BL), 112.30-35 (1.1BL), 112.50 (1.8BL), 112.95-113.00 (1.1BL)

Advertisement

Lock in Sterling's current levels ahead of potential declines: Get up to 5% more foreign exchange for international payments by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here