The Pound-Dollar Rate Might Have Just Registered a Crucial Reversal

- Time to exit shorts on GBP/USD say Commerzbank

- Lloyds say recent price action suggestive of a base forming

- Past 24 hours saw GBP/USD record 3rd biggest one-hour rise of 2018

Image © Massimo Usai, Adobe Stock

The US Dollar is an under-performer on global foreign exchange markets ahead of the weekend as global investor sentiment - which is ultimately the main driver of the Dollar at present - settled following a tumultuous week.

The Dollar tends to do well against the likes of the Euro, Pound and an host of other currencies when investors are selling stocks and seeking out 'safe-haven' currencies.

A lull in China-US trade tariff rhetoric is being cited as one reason for the improved sentiment.

"The US Dollar Index retreated from 11-month high as investors took profit following the weaker than expected Philadelphia Fed business outlook," says Terence Wu at OCBC Bank. "Markets will further assess whether the looming US-China trade war starts to weigh on US manufacturing outlook. With the return of growth divergence story, the currency pair is likely to be sensitive to any growth related data."

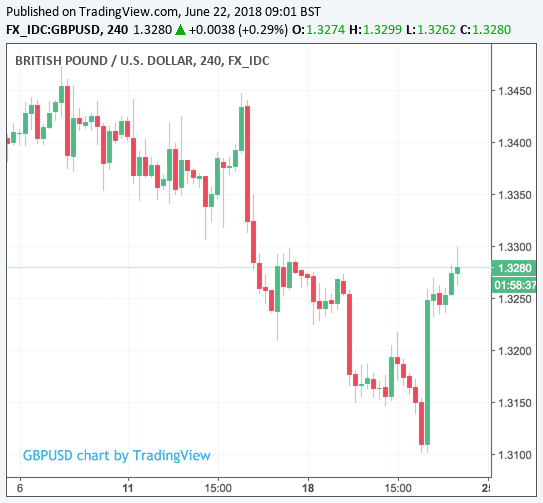

The Pound-to-Dollar exchange rate is quoted at 1.3287, having hit fresh 7-month lows at 1.3102 in mid-week trade. A strong recovery has been noted over the past 24 hours that includes GBP/USD record its 3rd biggest one-hour rise of 2018, the largest since February 14, came on the back of an unexpectedly 'hawkish' Bank of England policy decision on June 21.

"The impulsive reversal from 1.3120 is the kind of price action we are looking for to signal a base developing," says Robin Wilkin, a strategist with Lloyds Bank. "Ideally, we are looking for a move back towards the 1.38-1.40 region, which should define the top of a medium-term range."

"A rally through 1.3420 and 1.3500 would add conviction to that view," adds Wilkin.

However, the analyst cautions that if this rally is in just a temporary correction in a broader and established downtrend then that is the risk area for failure and a turn back through 1.3110/00 support.

"GBP/USD charted a key day reversal yesterday. When we couple this with the TD perfected set up on the weekly chart it is time to exit short positions," says analyst Karen Jones with Comerzbank.

"The market was approaching strong support offered by the 1.3040 October 2017 low, and the 50% retracement at 1.2918 and looks to have reversed just ahead of here. The Elliott wave count is suggesting scope for a correction into the 1.3345/1.3470 band," adds Jones.

Signs of a potential reversal are not restricted to the GBP/USD exchange rate we are told with the pattern being evident in the EUR/USD and the wide Dollar index (DXY).

The US Dollar index - a broad measure of overall Dollar performance against a basket of currencies - is said to have experienced "a significant turnaround" argues Shaun Osborne, a foreign exchange strategist with Scotiabank in Toronto.

"After having made a new high for the current move up Thursday, DXY price action formed a key reversal day signal on the charts (similar price signals were generated in USD trading versus the EUR and GBP), suggesting strongly that the recent rally in the USD has largely run its course for now," says Osborne in a client briefing ahead of the weekend.

Advertisement

Get up to 5% more foreign exchange by using a specialist provider to get closer to the real market rate and avoid the gaping spreads charged by your bank when providing currency. Learn more here.